Trading Thoughts Blog

Permanent link for What is the Harmonized Classification System and Why is it Important? on April 9, 2024

What is the Harmonized Classification System (HS)?

The Harmonized Classification System is a globally recognized way to identify goods being imported and exported by assigning a standardized classification. The HS classification is used for declaring goods at the time of export in export declarations and for the purpose of filing customs entries at the time of import in the country of destination. The HS classification is used to determine duty rates and collect duties, taxes, and fees for imported products.

The Harmonized System (HS) is something every importing and export company will need to understand so proper HS classifications can be assigned to their products. Companies need to take great care in assigning HS classification and understand the compliance risks associated with their HS classification decisions. Exporters and importers alike have a legal responsibility to properly claim and classify goods/products.

The Harmonized Classification System Breakdown

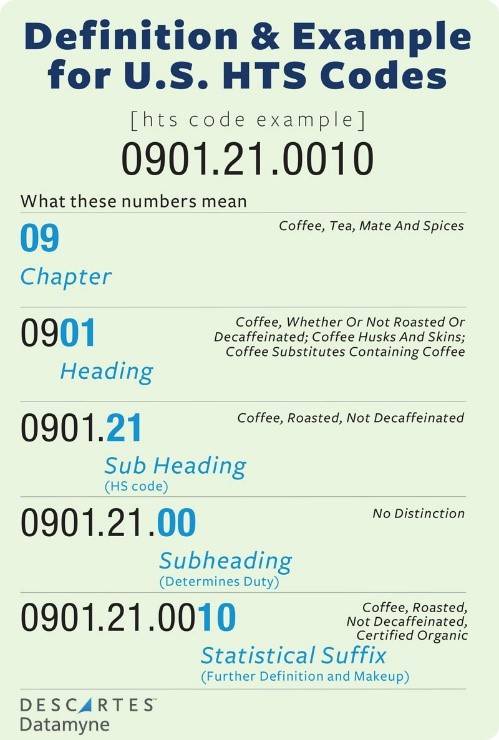

The Harmonized System (HS) is a very structured classification system made up of sections, chapters, notes, headings, and subheadings.

The United States has two published versions of the Harmonized System (HS). For imports, the U.S. publishes the Harmonized Tariff Schedule (HTS) of the U.S. for the HS classification of imported products and the assignment of duty rates. For exports, the U.S. publishes Schedule B for export HS classifications and the collection of statistical data.

The Harmonized System (HS) is broken down into 22 sections which act as groupings of similar chapters.

There are 97 chapters of products that are organized from least manufactured to more manufactured and logically group classifications by make or by use. The first two digits of each HS classification are the chapter number. Within each chapter, the Harmonized System (HS) provides a four-digit heading with the primary legal definition of what is to be included in that heading. Those headings are further broken down into six-digit subheadings. The heading and subheading legal definitions are universal and all countries agree to use the same legal definitions.

While the globally recognized headings and subheadings remain

constant, each country can further break down the subheadings with

country-specific suffixes. In the U.S. two digits (digit 7 and 8) are

added as the duty rate suffix and two digits (digits 9 and 10) are

added as a statistical suffix – making the U.S. classification a

10-digit number.

See the photo above for an example using Coffee.

Why is HS Classification Important for Your Business?

First of all, for importers, the HTS classification determines the duty rates and the duties paid at the time of import so it has immediate revenue implications. Non-compliance can result in fines, penalties, and the back payment of additional duties owed.

Paying duties is a non-negotiable, so proper classification can reduce your compliance risk in the short and long run. The result will never be good when using the wrong classification. If your misclassification caused you to overpay in duties, you won’t receive a refund. If you are underpaid in duties, you are required to pay the difference, and customs will decide if you will need to pay interest, and whether or not fines and penalties will be imposed.

For exporting, HS classification is used in:

- Export documentation (ex. Commercial Invoice)

- Export Declaration

- Import customs entry in a country of destination

For importing, HS classification is used in:

- Customs and Border Protection (CBP) for customs clearance and entry

All in all, use the HS classification to your advantage. Generate proper classifications and importing and exporting will be smooth sailing.

Are You Interested in Learning More?

GVSU's Van Andel Global Trade Center offers a yearly Fundamentals of Harmonized System (HS) Classification Training. Check out our Events page to register for this upcoming event!

---

About the Contributor

Jenna Hoover worked as a student assistant for GVSU’s Van Andel Global Trade Center. At GVSU she studied Finance and Supply Chain Management within the Seidman College of Business. You can find her visiting local coffee shops or checking in on her Roth IRA. In her free time, she enjoys walking her dog, Gertrude, and hanging out with friends along the beautiful beaches of West Michigan.

Originally published 4/8/2022 - Updated 4/9/2024

Categories:

Export

Harmonized Tariff Classification

Import

Posted

on

Permanent link for What is the Harmonized Classification System and Why is it Important? on April 9, 2024.

Permanent link for GVSU to host 25th symposium for area automotive suppliers on February 26, 2024

FOR IMMEDIATE RELEASE

February 26, 2024

Contact: GVSU University Communications

[email protected]

(616) 331-2221

GRAND RAPIDS, Mich. — Navigating industry difficulties and challenges will be the main topic of the 25th Michigan Automotive Suppliers Symposium, hosted by Grand Valley State University’s Van Andel Global Trade Center.

The symposium, with the theme of “Momentum Matters,” will be held at the DeVos Center, Loosemore Auditorium, on the Pew Grand Rapids Campus on Thursday, March 7, from 8:00 a.m.-noon.

"The annual symposium offers the chance to hear crucial insights as businesses realign with the constantly changing fast-paced automotive sector,” said Sonja Johnson, executive director, of the Van Andel Global Trade Center. “Listen to industry experts and how they are maintaining momentum as they navigate challenges in the requirements to meet government standards, and customer needs while juggling a complex supply chain and how recent issues such as labor strikes have impacted the auto industry.”

Speakers include two GVSU alumni. Alejandra Lorenzo, who works for Stellantis North America as a supplier diversity program manager, graduated in 2014. Lorenzo is an expert in supplier diversity, risk management, project management, pre-production and international launches. Lorenzo will give the keynote presentation, “Supplier Diversity: Direct and Tangible Benefits to Create a Stronger, More Resilient Supply Chain.”

GVSU graduate Mike Wall will present “The Road Ahead: Navigating the Winding Roads of the Auto Industry,” as an industry outlook. Wall earned a bachelor’s degree in finance and now has over 20 years of expertise. As executive director of automotive analysis at S&P Global Mobility, Wall will provide an in-depth analysis of vehicle markets and technology trends.

Other sessions include a fireside chat with Munro & Associates; and a Tier 1 Supplier Panel with representatives from Pridgeon and Clay, Inc.; ADAC Automotive; Lacks Enterprises; and Warner Norcross + Judd LLP.

Each year since 1999 the Van Andel Global Trade Center has hosted more than 25 international business events in Michigan and worked with a broad variety of community partners & corporate sponsors to provide the international business community with the business training and international resources it needs to succeed on the global stage.

For more information on this event, visit the Van Andel Global Trade Center website.

####

Categories:

Automotive

Posted

on

Permanent link for GVSU to host 25th symposium for area automotive suppliers on February 26, 2024.

Permanent link for Three Key Considerations for Successful International Expansion on February 8, 2024

It seems like all over the internet there are guides giving advice on specific locations or countries. Some of their advice can range from very specific to extremely broad, making it all the more confusing as to what advice might carry over into a different country. But what advice do all these guides have in common?

Here are some general rules to apply when expanding your business to any country:

1. Understand the Market

Market research is absolutely vital when trying to reach a certain segment. When expanding internationally, this step is crucial. Markets vary widely by country and region, market research for a specific area/region is highly recommended.

Some things to consider while putting together market research:

- Local currencies

- Potential client base in your market segment

- Number of local competitors currently in your target segment

- Foreign competitors in the desired market segment

If performing business from your home country and shipping to a foreign country, ask yourself: Do they take my currency? Could I take their local currency? What kind of people am I trying to sell my product to? What type of people need my product? Which companies in that market are already selling a product similar to what I am trying to sell? Is that market oversaturated?

Asking and answering these types of questions can help verify that your business can become successful in your next venture.

2. Know the Regional Politics

On the outside, a venture might seem extremely viable, but if the political climate is not advantageous then everything can stop in its tracks. If governmental entities are unwelcoming to foreigners or certain types of businesses, then adjustments should be made accordingly.

Things to look out for regarding regional politics include:

- Recently passed legislation regarding the business sector your company is attempting to enter

- Any tariffs or exceptional high duties

- Past and present tensions between the country of origin and the country your business is attempting to expand to

Has the country you’re operating from been at odds with the country you are trying to perform business with recently? Have the respective governments responded by putting tariffs and other restrictions on each other? Such actions would make trying to get your product within that country extremely expensive and could potentially ruin the competitive advantage you once held over your foreign competitors.

Additionally, if the country residents are highly involved in these politics, they might boycott your product anyway. It is important to consider this a highly relevant factor when attempting to expand internationally.

3. Study the Culture

The culture difference can be a make-or-break point when introducing a new business within a foreign culture. Certain topics might be considered more taboo, other countries may hold more conservative values, and different countries might have almost no boundaries at all.

Here are some techniques to get an accurate grasp of a country’s culture:

- Analyze Their Media - If a country’s media broadcasts highly controversial or offensive content, business in this country may not be good for business. Media analysis can also often give you an idea of what’s popular with your demographic and help you advertise abroad.

- Look at Their Laws - Some countries might ban certain demographics from certain activities by the letter of their law. In that case, it would not be wise to release a product that would make those demographics legally vulnerable or unsafe.

- Know Their History - Countries historically go through phases, yet many aspects of their culture remain constant over time. It’s important to understand major historical movements that have happened within your target country, how they affected or changed the culture, and whether are not some of those impacts are still lasting today. Additionally, it is vital to identify ongoing movements and build that into your brand identity for marketing within that country.

Also, understand that cultures within countries can also vary by region as well, so the more specific an analysis is to the target area the better. It is vital to know if your product or service would transition well within a country’s culture to gauge how successful it has the potential to be. For example, avoid selling products that go against a religious belief held by the majority or confront a cultural taboo in the country you are looking to do business in. It is vital to identify whether your product has a “fit” within the culture you are trying to sell to.

With all three of these major factors in mind, you are now ready to successfully expand your business abroad and find yourself a market with the perfect fit for your product or service and the Van Andel Global Trade Center (VAGTC) can help! Whether you are a company just starting to consider global expansion or have been at it for a few years, VAGTC can help you go global or expand into new markets. With funding opportunities available for small and medium-sized businesses from the Michigan Economic Development Corporation (MEDC) through the Michigan State Trade Expansion Program (STEP), there is no better time than now to start or expand your export operations!

For more specialized information on expanding your business internationally and getting connected to the MEDC and STEP, schedule a consultation with the Van Andel Global Trade Center to answer any questions and get connected.

--------------------------------

ABOUT THE CONTRIBUTOR

Natalie Bremmer is a Student Assistant at GVSU’s Van Andel Global Trade Center . She is a Senior currently pursuing an undergraduate degree in Finance, Human Resource Management, and General Management at Grand Valley State University. She enjoys lifting weights, getting lost in a good video game, spending time with friends, and going on long hikes.

Edited by Parker Mackey, a student assistant at the Van Andel Global Trade Center.

Original publish date 5/18/2023 - Updated 2/8/2024

Categories:

Export

Posted

on

Permanent link for Three Key Considerations for Successful International Expansion on February 8, 2024.

Permanent link for Reaching Global Markets: A Small Business Guide to Funding Exports on February 8, 2024

How can small businesses grow their customer base and increase profitability? Export!

When local markets are facing tough times or simply not bringing in enough revenue, the next step in expanding a small business and increasing revenue is to start exporting goods to access new global markets.

Common Concerns about Exporting

Exporting, however, may seem quite daunting and expensive to the inexperienced individual. Fortunately, there are several financial resources, mentors, and consultants available for small businesses to utilize to create an export strategy and set up export operations unique to their business needs.

Setting up and maintaining export operations does require an investment of both time and money, but with 95% of the world’s consumers outside of the U.S., it has the potential to turn into a profitable investment. If traditional bank financing doesn’t fit your business needs, there are different types of loan programs that help in setting up and/or maintaining export plans and provide alternatives to traditional loan options to fund export endeavors.

Export Programs

Programs funded through the U.S. Small Business Association (SBA) that small businesses should be aware of include:

- SBA State Trade Expansion Program (STEP)

- SBA International Trade Loan Program

- SBA Export Working Capital Program

- SBA Export Express Loan Program

SBA loans are provided through banks, but SBA guarantees a substantial portion of the loan – up to 90% – making it more likely to get accepted than a traditional, non-SBA-backed loan.

State Trade Expansion Program (STEP)

One of the most easily accessible financial assistance options available for exporting is the STEP program.

The State Trade Expansion Program (STEP) is a completely different category than the other loan program since technically it’s not a loan at all. Though the money given to the state government is awarded by SBA, it is ultimately the individual state’s economic development department that distributes these funds– no repayment is required.

State-level STEP assistance helps small businesses:

- Learn how to export

- Participate in foreign trade missions and trade shows

- Obtain services to support foreign market entry

- Develop websites to attract foreign buyers

- Design international marketing products or campaigns

Roughly 46 of the 50 states were awarded STEP funds, including Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Georgie, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Michigan, Maryland, Massachusetts, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Puerto Rico, Rhode Island, South Carolina, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming.

Michigan’s STEP program, MI-STEP, administered by the Michigan Economic Development Corporation, offers export assistance that covers up to 50% of export-eligible expenses. For more information on MI-STEP, check out our blog article Michigan Small Businesses Are Missing Out on Free Money: Why You Should Take Advantage of MI-STEP .

Coverage rates and total assistance varies by state, check your state’s STEP policy for exact export assistance information.

International Trade Loan Program

The most expansive of these would be the International Trade Loan Program. Companies can be approved to borrow a maximum of $5 million through this program with a processing time of roughly 5 - 10 business days.

These loans are available to help small businesses enter international markets and compete with businesses already present in the market. It works by combining fixed assets, working capital financing, and debt refinancing for the maximum amount of assistance.

Export Working Capital Program

The Export Working Capital Program is similar to the International Trade Loan Program in that there is a $5 million maximum borrowing limit and 5 - 10 day processing time, but the purpose is slightly different.

People applying for this loan already have a finalized sale or export contract in hand and just need the extra funds to seal the deal. This venture is ultimately a bit less risky than going into a market blind – like the prior program – which makes the approval process easier.

Export Express Loan Program

The Export Express Loan Program allows small businesses to get loans accepted within 36 hours with the trade-off of only being able to borrow $500,000 or less.

The reason turnaround time is so quick is that Export Express lenders can directly underwrite a loan without SBA prior approval.

Meet Your Export Mentors

For businesses interested in learning how to export their goods and explore funding opportunities and resources available for this endeavor, GVSU’s Van Andel Global Trade Center along with state and federal partners from the Michigan Economic Development Corporation (MEDC), Michigan West Coast Chamber of Commerce, U.S. Department of Commerce - Grand Rapids, Michigan Small Business Development Center, Export-Import Bank of the United States, Networks Northwest, U.S. Small Business Association (SBA), and more, are offering four opportunities to join us for our New to Export Workshops throughout the state of Michigan in 2024, visit our event page for dates and details!

—------------------

Natalie Bremmer is a Student Assistant at GVSU’s Van Andel Global Trade Center . She is a Junior currently pursuing a Bachelor in Business Administration degree in Finance, Human Resource Management, and General Management at Grand Valley State University. She enjoys lifting weights, getting lost in a good video game, spending time with friends, and going on long hikes.

Originally published 12/14/2022 - Updated 2/8/2024

Categories:

Export

MEDC

Posted

on

Permanent link for Reaching Global Markets: A Small Business Guide to Funding Exports on February 8, 2024.

Permanent link for The United States Mexico Canada Agreement (USMCA): Discovering North American Trade Opportunities in the Modern Era on October 16, 2023

In the ever-evolving landscape of global trade, staying informed about free trade agreements is essential for businesses looking to expand their international operations and seize new opportunities. One such significant agreement that has reshaped North American trade dynamics is the United States-Mexico-Canada Agreement (USMCA). For business professionals engaged in trade activities with Canada and Mexico, understanding the rules and provisions related to the USMCA is paramount. In this blog, we'll delve into four key provisions included in the 2020 update to the USMCA and the implications for North American commerce.

Modernizing Trade for the Digital Age

The USMCA, often dubbed NAFTA 2.0, was designed to adapt to the digital economy that has evolved since the original agreement took effect in 1994. The accord places a strong emphasis on digital trade, data protection, and e-commerce, creating a favorable environment for companies operating in these domains. Business professionals can capitalize on the increased digital trade provisions to expand their online presence, engage in cross-border e-commerce, and tap into a wider consumer base.

Navigating Rules of Origin and Market Access

Understanding the intricate rules of origin within the USMCA is vital for organizations seeking to maximize the benefits of the agreement. The new rules lay out specific criteria pertaining to Tariff Shift and Regional Value Content (RVC) rules, that products must meet to qualify for preferential tariff treatment. Preferential tariff treatment provides improved market access, allowing U.S. businesses to continue trade with Mexico and Canada with reduced tariffs and barriers. Meeting the standards of the USMCA allows businesses to maximize the benefits and succeed in their North American trade initiatives.

New Automotive Rules to Fostering Regional Growth and Fair Trade

The USMCA also brought about substantial changes in automotive rules within the region. One key alteration was the increase in the regional value content (RVC) requirements, mandating a higher percentage of vehicle components to be sourced from the region while eliminating loopholes used to undermine RVC thresholds. This shift aimed to incentivize the use of North American materials and labor, promoting economic growth and job creation within the member countries. Additionally, the USMCA implemented rules promoting higher wages for auto workers, seeking to level the playing field and discourage outsourcing of production to lower-wage countries. These changes signify a reformed approach to automotive trade, emphasizing regional cooperation and fairness in the industry.

Strengthened Labor and Environmental Standards

Unlike its predecessor, the USMCA places more robust labor and environmental standards at the forefront of the agreement. This shift resonates with the growing global focus on sustainable and responsible business practices. For organizations participating in global trade, this means aligning business operations with these elevated standards to ensure compliance and create a more equitable work environment for all. Moreover, these standards can present opportunities for collaboration and innovation in sustainable technologies and practices.

Learn More about the USMCA

In conclusion, the USMCA has significantly modernized the North American trade landscape, offering both challenges and opportunities for businesses engaged in North American commerce. For organizations involved in trade with Canada and Mexico, it's crucial to know the rules of USMCA to make informed decisions that align with your company's growth objectives.

To delve even deeper into the nuances of the USMCA and maximize the benefits of trade with Canada and Mexico, we encourage you to attend our upcoming training session: The Basics of USMCA . Industry experts, Jean-Marc Clement, Principal at Clement Trade Law, and Mark Bleckley, Associate Director at GVSU’s Van Andel Global Trade Center will provide comprehensive insights into the applicable rules, equipping you and your business with the knowledge needed to leverage its advantages effectively. Generously sponsored by Clement Trade Law and Supply Chain Solutions you don't want to miss this opportunity to enhance your expertise and expand your knowledge of the USMCA!

Learn more about the upcoming Basics of USMCA training here

Categories:

Export

FTAs

Import

USMCA

Posted

by

Katherine Dreyer

on

Permanent link for The United States Mexico Canada Agreement (USMCA): Discovering North American Trade Opportunities in the Modern Era on October 16, 2023.

Permanent link for U.S. Extends Section 301 Tariff Exclusions: What You Need to Know on September 7, 2023

In a recent announcement on September 6, 2023, the Office of U.S. Trade Representative Katherine Tai revealed that the expiration date for the Section 301 tariff exclusions has been extended. Originally set to expire on September 30, 2023, these exclusions will now remain in effect until December 31, 2023, as reported by Reuters. This decision impacts a wide range of Chinese imports. Here, we break down the key details you should be aware of regarding these tariff exclusions.

Impact on Imports

The continuation of these tariff exclusions impacts a total of 352 Chinese imports and 77 categories related to COVID-19 are affected. The categories encompass an extensive range of products, including industrial components like pumps and electric motors, automotive parts, chemicals, vacuum cleaners, and critical medical supplies such as face masks, gloves, and sanitizing wipes.

Understanding Section 301

To comprehend the context of these tariff exclusions, it's essential to understand the legal framework behind them. These exclusions are rooted in Section 301 of the Trade Act of 1974. This legislative provision empowers the President of the United States to impose tariffs on imports from countries engaging in unfair trade practices. The Office of the United States Trade Representative (USTR) is tasked with the authority to conduct investigations and take necessary actions to protect U.S. rights under various trade agreements, as outlined by the Congressional Research Service.

Origins of the China 301 Tariffs

The origins of these tariffs can be traced back to actions taken in 2018 and 2019 when former U.S. President Donald Trump imposed tariffs on a wide array of imports from China, totaling around $370 billion. These tariffs were implemented following a comprehensive Section 301 investigation. The investigation revealed that China was involved in the misappropriation of U.S. intellectual property and was pressuring U.S. companies into transferring sensitive technology.

These findings prompted the U.S. government to take action to address trade imbalances and unfair trade practices with China. (Source: White & Case)

In conclusion, the extension of the Section 301 tariff exclusions underscores the ongoing efforts of the United States to rectify trade imbalances and address unfair practices, particularly with China. Stay tuned for updates as the situation evolves.

Categories:

China

Export

Import

Sanctions

Posted

by

Katherine Dreyer

on

Permanent link for U.S. Extends Section 301 Tariff Exclusions: What You Need to Know on September 7, 2023.

Permanent link for What Is Country of Origin? The Ever-Changing Puzzle of Definitions on June 20, 2023

Country of origin is one of the more confusing concepts to master in conducting international trade or even applying to U.S. domestic business activities. There are three crucial pieces of data that must be managed for compliance purposes in international trade - customs value, Harmonized System (HS) classification, and country of origin. Customs value which determines the amount of duty and taxes to be paid on imported goods is based on a global standard known as the "Valuation Agreement", a treaty administered by the World Trade Organization. HS classification is a standardized system for the classification of goods adopted by almost every country in the world. Country of origin, conversely, is subject to no global standard. There are many authorities and governing bodies (called jurisdictions) that are crafting specific rules of origin which meet the specific objectives and purposes of that jurisdiction.

Before making country of origin too complicated or confusing, there is a universally accepted basic concept of country of origin which should be the default definition until some entity decides to redefine it. In international trade, "country of origin" refers to the country where a product was grown, produced, or manufactured. For raw materials and commodities, this means it wholly originated in a country. For manufactured goods, the country of origin is typically determined by the place where the product underwent its last substantial transformation, meaning the point at which it was transformed into a new and distinct article from the raw material or components used in the production of the goods. This general definition of country of origin should be the default definition in international trade, both import and export, until some authority re-defines it.

Here are the most common jurisdictions (primarily in the United States) of country-of-origin definition to be aware of. These authorities have established specific definitions of "country of origin" for various purposes:

- Importing into the United States: U.S. Customs and Border Protection (CBP) is responsible for enforcing trade regulations at U.S. ports of entry. The CBP uses a specific set of rules to determine the country of origin for imported goods, known as the "Marking of Country of Origin of Imported Merchandise" regulations, utilized for declaration requirements on all U.S. customs entries and the country of origin marking of goods. These regulations define the country of origin as the product’s country of last substantial transformation, following the basic default definition for country of origin.

- Exporting from the United States: When U.S. exporters are completing export documents and export declarations for international shipments, they should still declare the country of origin, as required on the export commercial invoice and export declaration, utilizing the same basic default definition of country of origin – the country it was manufactured in or substantially transformed in – until another jurisdiction of country of origin supersedes that definition. Technically, every country of destination is a different jurisdiction that can define country of origin for their purposes. Still, U.S. exporters should stick to the general definition unless instructed otherwise by their foreign customers.

- United States-Mexico-Canada Agreement (USMCA): The USMCA is a free trade agreement between the United States, Mexico, and Canada. The USMCA includes specific rules of origin that determine whether a product qualifies for preferential tariff treatment under the agreement. The specific rules of origin written into the agreement require the use of tariff shift and regional value content as the defining rules determining qualification as an originating good from the parties to the agreement.

- All other U.S., and most other international free trade agreements: Each FTA agreement will have specific rules of origin written in the same manner as the USMCA agreement.

- Federal Trade Commission (FTC): The FTC issues its own set of country-of-origin rules for the use of “Made in the USA" in the United States. U.S. manufacturers are not required to mark or identify U.S.-made products on product labels are in advertising material, but if they do, it must meet a strict set of FTC rules. If a U.S. business makes a claim of “Made in the U.S.” the FTC considers the statement to be an unqualified claim or origin and sets the standard that it must be “all or substantially all” made in the U.S. – loosely quantified as 80% or more. If not, then a qualified claim is required. Qualified claims must include phrases like "Made in the USA with imported parts" or “Assembled in the U.S. with U.S. and foreign components”. The FTC's objective is to ensure that consumers are not misled about the domestic and foreign content of the products they purchase.

- U.S. Department of Agriculture (USDA): The USDA has specific regulations regarding the labeling of agricultural products, including country of origin labeling (COOL) requirements. Under these regulations, certain food products must be labeled with their country of origin, including beef, pork, lamb, chicken, and goat meat, as well as perishable agricultural commodities such as fruits and vegetables.

- Buy American Act: The Buy American Act is a federal law that requires that certain federal government purchases of goods and materials be made from domestic sources unless an exception applies. Under the Buy American Act, a product is considered to be of domestic origin if it is manufactured in the United States, and at least 50% of the cost of the components of the product is attributable to materials mined, produced, or manufactured in the United States.

- Michigan State Trade Expansion Program (STEP): The Michigan STEP program is a state-run program that provides grants to small businesses in Michigan to help them expand their exports. The program includes specific rules regarding the country of origin of the exported products. To be eligible for the program, a product must be manufactured in Michigan and at least 51% of the value of the product must be attributable to materials and labor costs in Michigan.

Mastering the intricate concept of country of origin in international trade, as well as its application to U.S. domestic business activities, can be a perplexing endeavor. The definition of country of origin lacks a universal consensus, allowing jurisdictions to mold it to their specific objectives. However, before succumbing to overwhelming complexity, it is crucial to recognize the universally accepted basic concept of country of origin—a default definition that refers to the country where a product was grown, produced, or manufactured. This general definition should serve as a starting point in international trade until an authoritative entity redefines it. By familiarizing ourselves with the various jurisdictions and governing bodies involved, such as U.S. Customs and Border Protection, the United States-Mexico-Canada Agreement (USMCA), and the Federal Trade Commission, we can navigate the labyrinthine landscape of country of origin with confidence and compliance. Whether importing or exporting, it is vital to adhere to the prevailing definitions while remaining open to the ever-evolving dynamics of international trade.

Are you interested in learning more about Country of Origin? Since 1999, GVSU's Van Andel Global Trade Center (VAGTC) has been helping Michigan businesses succeed globally through import and export training and consulting. Whether you are thinking about opening a new market, figuring out customs compliance and international regulations, or looking for overseas suppliers to complement your global supply chain, Van Andel Global Trade Center can help. Contact us today!

---

About the Contributor:

Mark Bleckley is the Associate Director at GVSU’s Van Andel Global Trade Center. He is a licensed customs broker and has been involved in global trade for over 30 years. He has managed all aspects of import and export operations, including transportation and logistics, customs clearance, export documentation, recordkeeping, compliance and management of Harmonized Tariff Schedule and country of origin determination and management, as well as, analyzing free trade agreements for maximum benefit.

Categories:

Country of Origin

Posted

on

Permanent link for What Is Country of Origin? The Ever-Changing Puzzle of Definitions on June 20, 2023.

Permanent link for Gains & Guidance in Germany on May 8, 2023

Germany has one of the most successful economies in the world, ranking fourth globally in GDP. This is largely due to its reliable infrastructure and workforce, as well as its positive social and legal climate. Germany has a wealth of scientific and technological research with firm practical applications.

Efficient transportation networks and high nationwide competence in English make Germany an accessible location to foster business partnerships. In addition, impressive import-export statistics state that Germany is “the second largest importer and third largest exporter of consumer oriented agricultural products worldwide, and by far the most important European market for foreign producers.”

However, there are a few hurdles foreign companies may face. Because Germany has such a successful economy and leads most of Europe in trade, it reserves the right to be choosy with whom forms meaningful partnerships. This means that companies must go through long bureaucratic processes when setting up shop in the country. However, these “drawbacks” simply mean that the chance to trade with German companies should be regarded as a high accomplishment.

German business etiquette is more formal than other trade relationships may be. Success in the business world of Germany relies on these key components:

- Punctuality: German partners expect punctuality, including setting meetings well ahead and arriving on time and prepared.

- Formality: Foreign partners are expected to maintain a high level of formality, including using titles and steering clear of controversial or personal topics. Partners should allow the German party to initiate more casual conversations. Additionally, while many German people are proficient in English, it’s considered a thoughtful gesture to translate documents into German.

- Detail: German business partners appreciate organization. According to Wolters Kluwer, “The German mindset values detail, order, and structure. Expect to examine each aspect of a project in detail with your contacts.”

Interested in learning more? Join us on May 24th for a virtual Business Travelers Series session on Navigating Germany! We will cover how-tos and best practices for doing business in the German market, as well as, how to maneuver through cultural nuances business professionals often face while working with or traveling to Germany. This event is generously sponsored by The Gerald R.Ford International Airport and Michigan Economic Development Corporation (MEDC).

---

About the Contributor

Parker Mackey is a Student Assistant at GVSU’s Van Andel Global Trade Center . They are a 2nd-year junior pursuing a Bachelor of Fine Arts in Studio Arts, emphasis painting. They also work for GVSU’s History Department, transcribing for the Library of Congress’s Veterans History Project . They enjoy painting, hiking, and listening to folk punk.

Categories:

Culture

Germany

Posted

on

Permanent link for Gains & Guidance in Germany on May 8, 2023.

Permanent link for Updates on Forced Labor Provisions in 2023 on April 17, 2023

Forced labor has been a huge issue that U.S. Customs and other government agencies have been attempting to crack down on as of late 2021, the majority of 2022, and continued efforts going into 2023.

By the Congressional Research Service definition, forced labor is considered to be “all work or service which is exacted from any person under the menace of any penalty for its nonperformance and for which the worker does not offer himself voluntarily.”

Introduction to Section 307

Section 307 under the Tariff Act of 1930 prohibits the importation of any products that were created using forced labor.

Here is how Section 307 was put into effect:

- Receipt of allegation or self-initiation

- CBP Commissioner initiated CBP an investigation.

- CBP Commissioner issues a Withhold Release Order (WRO)

- Importer may export merchandise or contest the WRO

- Any final readings are published in the Federal Register

- CBP seizes non exported merchandise and commences forfeiture proceedings

Reporting Standards

With these actions in mind, reports that are made to the Commissioner of U.S. Customs and Border Protection (CBP) cannot be unwarranted; there are certain standards for reporting that must be met.

These standards include “any individual that has reason to believe that any class of merchandise that is being, or is likely to be, imported into the United States is being produced by Forced Labor” have a valid argument to file a claim. In accordance with 19 CFR 12.42, Port Directors and other Principal Customs Officers are mandated reporters and if someone not in this role has concerns, they may share with the Port Director or online.

Investigation Standards

Investigations regarding these reports under Section 307 also have a set of standards laid out.

These include statements regarding how an investigation is initiated “as appears warranted by the amount and reliability of the submitted information” and a Commissioner of CBP must find that the information “reasonably but not conclusively indicates that imports may be the product of forced labor” to release a WRO to the related items.

Contesting a WRO

If a company has the unfortunate luck of receiving a WRO, not all is lost– it is possible to contest a WRO with a set of procedures that were posted by the Congressional Research Service.

Here are the general guidelines for contesting a WRO:

- Importer has three months to contest the WRO

- The importer must demonstrate that “every reasonable effort” was made to show the source and type of labor used to produce an item and its parts.

- If WRO is not successfully contested or is not exported from the US, CBP will seize and destroy the afflicted items

- CBP will then publish the date, type of merchandise, manufacturer,

and status of WRO

- However, CBP will not post specific detentions, re-exportations, exclusions, or seizures

Forced Labor Enforcement Advancements

Though Section 307 has been around for a number of years now, advancements in the area of forced labor enforcement have increased as of recently.

During January 2022, U.S. Trade Representative (USTR) announced the development of “first-ever focused trade strategy to combat forced labor.”

This plan entails a series of partnerships of government organizations with non-government organizations (NGO’s) and civil society organizations (CSO’s).

More specifically, the Department of Homeland Security (DCS), with the aid of the NGO’s and CSO’s, will also launch supply chain criminal investigations– the first ever of its kind. The main purpose of these criminal investigations is to help identify and shut down human trafficking efforts, charge those who are directly responsible, and protect the victims of these acts.

External Applications - Combating Illegal Fishing

Surprisingly, a big sector with ongoing forced labor issues has been the live fishing industry.

A new presidential directive has led to search and investigation of fishery supply chains that are suspected of using forced labor and contributing to human trafficking in response to this growing issue.

As permitted by the new directive U.S. Customs & Border Protection are instructed to:

- Investigate fishing vessels and operators suspected to be harvesting seafood with forced labor and issue a withhold release orders (WRO)

- Share evidence with allies and partners to encourage parallel customs enforcement actions.

- Investigate prospective civil penalties cases against importers connected to previously issued fishing vessel WROs.

This is quite a daunting task for the CBP to do alone, so they have enlisted the help of external agencies to leverage existing and emerging technologies to detect IUU fishing and prevent or deter illegal seafood imports from entering the U.S. market as well as consider the use of countervailing duties, Section 301 tariffs, import declarations, Pelly Amendment certifications, and due diligence requirements to counter forced labor in the sea food supply chain.

The Office of the U.S. Trade Representative (USTR) has also been tasked with combating this specific issue. According to ST&R, it has been requested that USTR “engage with free trade agreement partners, preference program beneficiaries, and others to address forced labor and other abusive labor practices in fishing.” In addition, they have also been asked to “collaborate with Canada and Mexico to prohibit imports of goods, including seafood, produced in whole or in part by forced labor.”

External Applications - Uyghur Forced Labor Prevention Act

The Uyghur Forced Labor Prevention Act (UFLPA) was signed into law on December 23, 2021 by President Biden after a major issue of mass amounts of forced labor had become prevalent in the Xinjiang Uyghur Autonomous Region of the People’s Republic of China.

Under this act, the importation of any items, mined, manufactured, etc. fully or in part in the Xinjiang Uyghur Autonomous Region of the People’s Republic of China is prohibited under Section 307 of the Tariff Act of 1930 and said goods are not allowed entry into the U.S.

Even with this Act, there are some very slim exceptions. If a manufacturer is attempting to import items from this region, those goods can only enter the United States if the Commissioner of U.S. Customs and Border Protection (CBP) concludes that the importer complied with specific conditions and had clear evidence that the imported items were not created in part or fully by forced labor.

The UFLPA also required the integration of the Forced Labor Enforcement Task Force. It is currently headed by the Secretary of Homeland Security and works in conjunction with Secretary of Commerce and Director of National Intelligence where they send a report to Congress regarding their strategy to support the CBP’s enforcement of Section 307 of the Tariff Act of 1930 regarding items, produced with forced labor, imported from People’s Republic of China.

This Act created a lot of significant changes, so the CBP has created an importer guidance resource for assistance with the implementation of the UFLPA rebuttable presumption that went into effect June 21, 2022.

To learn more about forced labor provisions and how these new processes might affect your company, contact the Van Andel Global Trade Center today !

------------------

ABOUT THE CONTRIBUTOR

Natalie Bremmer is a Student Assistant at GVSU’s Van Andel Global Trade Center . She is a Junior currently pursuing a Bachelors in Business Administration undergraduate degree in Finance, Human Resource Management, and General Management at Grand Valley State University. She enjoys lifting weights, getting lost in a good video game, spending time with friends, and going on long hikes.

Categories:

Forced Labor Provisions

Posted

on

Permanent link for Updates on Forced Labor Provisions in 2023 on April 17, 2023.

Permanent link for Doing Business in Australia: Culture, Mentality, and Etiquette on January 5, 2023

Original post from August 2019

Updated January 2023

The Commonwealth of Australia, the world’s smallest continent and largest island, is a diverse country with vast iconic natural wonders like the Great Barrier Reef and the Outback, and heavily concentrated cities such as Sydney and Melbourne. Being a newly established country in 1901, it was easy for the country to develop its own cultural personality. Although the culture can be described as Western with indigenous influences, foreigners may be surprised by the quirks and personal touches that Australians have made over time to the standards of their Western lifestyle.

A significant contributor to Western culture is the multinational and famed sport of rugby. Although Australia is well-known for being very much involved in competing internationally in rugby, they are famous for playing their own version as well, Australian football. Australian football can be described as a mixture of rugby, soccer, and American football, with an oval-shaped field and goalposts that resemble those of American football. To score points, players kick the ball through the set of goalposts that are on either end of the field. One of the most intriguing differences in this sport is that the players can pass to their teammates by kicking the ball or punching it with their palms, but they cannot throw it. Additionally, although Australian football is a contact sport, they do not wear any padding, only a jersey uniform. Australian football is a very entertaining and popular sport to watch. For this reason, it is a notable contributor to the country’s economy. The Australian Football League (AFL) reported revenue of AUD$480 million in 2015.

Economically, Australia is revered as the wealthiest (per adult) country in the world, with a decently low poverty rate of 13.2% as of 2018. The United States plays a particularly important role in the economy of Australia, being that it remains their largest two-way trading partner in goods and services. This is a result of the Australian-United States Free Trade Agreement (AUSFTA) that was established in 2005. The passing of this agreement has since increased the trade flow by 91%.

As a result of AUSFTA, there is no surprise that American businesses seek to further strengthen the trade relationship between the two countries. Business opportunities in Australia are of wide variety and significance. However, the quirky culture can often be intimidating for business persons from other countries. There are three key aspects to understand that will enhance a business trip to Australia by providing a deeper appreciation of the country: the business culture, mentality, and etiquette.

Australian Business Culture

Meetings in Australia can seem different from those typically held in the United States. To start, they are considerably more laid back. It is typical for Australian business persons to use colorful language (curse words) in meetings, as well as, crack jokes to lighten the mood. Additionally, it is common to be addressed by only your first name, and it is expected that you do the same. Even though it may not seem like it, Australians do take these business affairs seriously. Therefore, it is important to dress the part and be prepared for your meeting. If you are presenting a proposition or sitting as a chairman, it is expected that you be punctual and show up to the meeting a few minutes early. Also, be sure to chat about things like the weather or sports to relax the atmosphere.

Modesty and Understanding

A key factor in the business culture of Australia is modesty. Australians are very modest about their job position; it is very unattractive to them when a foreigner emphasizes their title and the greatness of their business. For this reason, it is recommended to not use an aggressive sales technique to persuade a potential partner, as most of the time it will not work. Avoid overselling your company, or coming off as self-important. It is more persuasive if the facts are laid out for them with a friendly attitude. But even if you do execute your sale in this way, they still may clearly express that they are not interested; Australian business persons are known to be very blunt and honest when considering a business contract. It is important to prepare for a straightforward rejection. Of course, this response will not be rude, but rather, more diplomatic. Nevertheless, it may take longer than expected to receive this response. This is because businesses in Australia value a team environment. The top management of a corporation will most likely consult their subordinates before deciding. No matter your position in the company, Australian businesses are very considerate of everyone’s opinion and expect that it be shared. Patience and understanding are key in these situations.

Business Etiquette in Australia

Gifts are not expected at business interactions but are greatly appreciated when given at the correct time. In Australia, it is commonly understood as bribing when a person brings a gift to a meeting before the close of a deal. If you decide to give a gift, simply have one prepared if a close or agreement arises. This will come off as congratulations and will be admired. Additionally, if invited out to dinner or drinks, do not begin to discuss business unless the counterpart does so. It can be seen as rude, or pushy if a business person attempts to bring a pitch to the table because it can cause stress and create a serious atmosphere.

If you are planning a trip to Australia for business purposes, it is recommended to understand the unique business culture, mentality, and etiquette of the country. A comprehensive education of these elements of their lifestyle will allow more of a relationship and connection to develop between two business persons of different backgrounds. And, if you have some free time in Australia, attempt to catch an Australian football game - you will not be disappointed.

Learn More

Learn more about the country, trade, and culture of Australia by registering for the Business Travelers Series: Navigating Australia on February 15, 2023 from 9am - 10am EST. This virtual event is generously sponsored by The Gerald R. Ford International Airport and Michigan Economic Development Corporation

Interested in Traveling to Australia?

Contact the Michigan Economic Development Corporation today to

learn about

the Michigan and Pennsylvania co-hosted trade

mission to Sydney and Melbourne, Australia with an option to visit

New Zealand.

MI-STEP Funding From MEDC

Did you know that qualifying Michigan companies have the opportunity to receive STEP funds for International Trade Missions and Trade Shows like this one?

To find out if your company is eligible new companies must complete and submit an online intake form here. Existing clients can contact your regional international trade manager. Funds will be approved for specific and measurable export initiatives. Funds for the MI-STEP program are subject to availability. Learn more about the MI-STEP program here.

---

About the Contributor

Mackenzie was an undergraduate student at Grand Valley State University and a student assistant at the Grand Valley State University’s Van Andel Global Trade Center. She majored in International Business and Finance while minoring in Spanish.

Categories:

Culture

Posted

on

Permanent link for Doing Business in Australia: Culture, Mentality, and Etiquette on January 5, 2023.

[1708973432].jpg)

[1674581513].jpg)

[1671477886].jpg)