Trading Thoughts Blog

Permanent link for What is the Harmonized Classification System and Why is it Important? on April 9, 2024

What is the Harmonized Classification System (HS)?

The Harmonized Classification System is a globally recognized way to identify goods being imported and exported by assigning a standardized classification. The HS classification is used for declaring goods at the time of export in export declarations and for the purpose of filing customs entries at the time of import in the country of destination. The HS classification is used to determine duty rates and collect duties, taxes, and fees for imported products.

The Harmonized System (HS) is something every importing and export company will need to understand so proper HS classifications can be assigned to their products. Companies need to take great care in assigning HS classification and understand the compliance risks associated with their HS classification decisions. Exporters and importers alike have a legal responsibility to properly claim and classify goods/products.

The Harmonized Classification System Breakdown

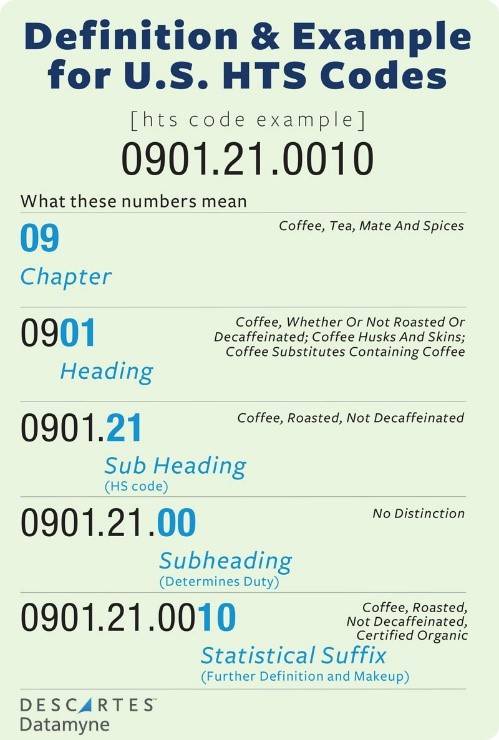

The Harmonized System (HS) is a very structured classification system made up of sections, chapters, notes, headings, and subheadings.

The United States has two published versions of the Harmonized System (HS). For imports, the U.S. publishes the Harmonized Tariff Schedule (HTS) of the U.S. for the HS classification of imported products and the assignment of duty rates. For exports, the U.S. publishes Schedule B for export HS classifications and the collection of statistical data.

The Harmonized System (HS) is broken down into 22 sections which act as groupings of similar chapters.

There are 97 chapters of products that are organized from least manufactured to more manufactured and logically group classifications by make or by use. The first two digits of each HS classification are the chapter number. Within each chapter, the Harmonized System (HS) provides a four-digit heading with the primary legal definition of what is to be included in that heading. Those headings are further broken down into six-digit subheadings. The heading and subheading legal definitions are universal and all countries agree to use the same legal definitions.

While the globally recognized headings and subheadings remain

constant, each country can further break down the subheadings with

country-specific suffixes. In the U.S. two digits (digit 7 and 8) are

added as the duty rate suffix and two digits (digits 9 and 10) are

added as a statistical suffix – making the U.S. classification a

10-digit number.

See the photo above for an example using Coffee.

Why is HS Classification Important for Your Business?

First of all, for importers, the HTS classification determines the duty rates and the duties paid at the time of import so it has immediate revenue implications. Non-compliance can result in fines, penalties, and the back payment of additional duties owed.

Paying duties is a non-negotiable, so proper classification can reduce your compliance risk in the short and long run. The result will never be good when using the wrong classification. If your misclassification caused you to overpay in duties, you won’t receive a refund. If you are underpaid in duties, you are required to pay the difference, and customs will decide if you will need to pay interest, and whether or not fines and penalties will be imposed.

For exporting, HS classification is used in:

- Export documentation (ex. Commercial Invoice)

- Export Declaration

- Import customs entry in a country of destination

For importing, HS classification is used in:

- Customs and Border Protection (CBP) for customs clearance and entry

All in all, use the HS classification to your advantage. Generate proper classifications and importing and exporting will be smooth sailing.

Are You Interested in Learning More?

GVSU's Van Andel Global Trade Center offers a yearly Fundamentals of Harmonized System (HS) Classification Training. Check out our Events page to register for this upcoming event!

---

About the Contributor

Jenna Hoover worked as a student assistant for GVSU’s Van Andel Global Trade Center. At GVSU she studied Finance and Supply Chain Management within the Seidman College of Business. You can find her visiting local coffee shops or checking in on her Roth IRA. In her free time, she enjoys walking her dog, Gertrude, and hanging out with friends along the beautiful beaches of West Michigan.

Originally published 4/8/2022 - Updated 4/9/2024

Categories:

Export

Harmonized Tariff Classification

Import

Posted

on

Permanent link for What is the Harmonized Classification System and Why is it Important? on April 9, 2024.

Permanent link for The United States Mexico Canada Agreement (USMCA): Discovering North American Trade Opportunities in the Modern Era on October 16, 2023

In the ever-evolving landscape of global trade, staying informed about free trade agreements is essential for businesses looking to expand their international operations and seize new opportunities. One such significant agreement that has reshaped North American trade dynamics is the United States-Mexico-Canada Agreement (USMCA). For business professionals engaged in trade activities with Canada and Mexico, understanding the rules and provisions related to the USMCA is paramount. In this blog, we'll delve into four key provisions included in the 2020 update to the USMCA and the implications for North American commerce.

Modernizing Trade for the Digital Age

The USMCA, often dubbed NAFTA 2.0, was designed to adapt to the digital economy that has evolved since the original agreement took effect in 1994. The accord places a strong emphasis on digital trade, data protection, and e-commerce, creating a favorable environment for companies operating in these domains. Business professionals can capitalize on the increased digital trade provisions to expand their online presence, engage in cross-border e-commerce, and tap into a wider consumer base.

Navigating Rules of Origin and Market Access

Understanding the intricate rules of origin within the USMCA is vital for organizations seeking to maximize the benefits of the agreement. The new rules lay out specific criteria pertaining to Tariff Shift and Regional Value Content (RVC) rules, that products must meet to qualify for preferential tariff treatment. Preferential tariff treatment provides improved market access, allowing U.S. businesses to continue trade with Mexico and Canada with reduced tariffs and barriers. Meeting the standards of the USMCA allows businesses to maximize the benefits and succeed in their North American trade initiatives.

New Automotive Rules to Fostering Regional Growth and Fair Trade

The USMCA also brought about substantial changes in automotive rules within the region. One key alteration was the increase in the regional value content (RVC) requirements, mandating a higher percentage of vehicle components to be sourced from the region while eliminating loopholes used to undermine RVC thresholds. This shift aimed to incentivize the use of North American materials and labor, promoting economic growth and job creation within the member countries. Additionally, the USMCA implemented rules promoting higher wages for auto workers, seeking to level the playing field and discourage outsourcing of production to lower-wage countries. These changes signify a reformed approach to automotive trade, emphasizing regional cooperation and fairness in the industry.

Strengthened Labor and Environmental Standards

Unlike its predecessor, the USMCA places more robust labor and environmental standards at the forefront of the agreement. This shift resonates with the growing global focus on sustainable and responsible business practices. For organizations participating in global trade, this means aligning business operations with these elevated standards to ensure compliance and create a more equitable work environment for all. Moreover, these standards can present opportunities for collaboration and innovation in sustainable technologies and practices.

Learn More about the USMCA

In conclusion, the USMCA has significantly modernized the North American trade landscape, offering both challenges and opportunities for businesses engaged in North American commerce. For organizations involved in trade with Canada and Mexico, it's crucial to know the rules of USMCA to make informed decisions that align with your company's growth objectives.

To delve even deeper into the nuances of the USMCA and maximize the benefits of trade with Canada and Mexico, we encourage you to attend our upcoming training session: The Basics of USMCA . Industry experts, Jean-Marc Clement, Principal at Clement Trade Law, and Mark Bleckley, Associate Director at GVSU’s Van Andel Global Trade Center will provide comprehensive insights into the applicable rules, equipping you and your business with the knowledge needed to leverage its advantages effectively. Generously sponsored by Clement Trade Law and Supply Chain Solutions you don't want to miss this opportunity to enhance your expertise and expand your knowledge of the USMCA!

Learn more about the upcoming Basics of USMCA training here

Categories:

Export

FTAs

Import

USMCA

Posted

by

Katherine Dreyer

on

Permanent link for The United States Mexico Canada Agreement (USMCA): Discovering North American Trade Opportunities in the Modern Era on October 16, 2023.

Permanent link for U.S. Extends Section 301 Tariff Exclusions: What You Need to Know on September 7, 2023

In a recent announcement on September 6, 2023, the Office of U.S. Trade Representative Katherine Tai revealed that the expiration date for the Section 301 tariff exclusions has been extended. Originally set to expire on September 30, 2023, these exclusions will now remain in effect until December 31, 2023, as reported by Reuters. This decision impacts a wide range of Chinese imports. Here, we break down the key details you should be aware of regarding these tariff exclusions.

Impact on Imports

The continuation of these tariff exclusions impacts a total of 352 Chinese imports and 77 categories related to COVID-19 are affected. The categories encompass an extensive range of products, including industrial components like pumps and electric motors, automotive parts, chemicals, vacuum cleaners, and critical medical supplies such as face masks, gloves, and sanitizing wipes.

Understanding Section 301

To comprehend the context of these tariff exclusions, it's essential to understand the legal framework behind them. These exclusions are rooted in Section 301 of the Trade Act of 1974. This legislative provision empowers the President of the United States to impose tariffs on imports from countries engaging in unfair trade practices. The Office of the United States Trade Representative (USTR) is tasked with the authority to conduct investigations and take necessary actions to protect U.S. rights under various trade agreements, as outlined by the Congressional Research Service.

Origins of the China 301 Tariffs

The origins of these tariffs can be traced back to actions taken in 2018 and 2019 when former U.S. President Donald Trump imposed tariffs on a wide array of imports from China, totaling around $370 billion. These tariffs were implemented following a comprehensive Section 301 investigation. The investigation revealed that China was involved in the misappropriation of U.S. intellectual property and was pressuring U.S. companies into transferring sensitive technology.

These findings prompted the U.S. government to take action to address trade imbalances and unfair trade practices with China. (Source: White & Case)

In conclusion, the extension of the Section 301 tariff exclusions underscores the ongoing efforts of the United States to rectify trade imbalances and address unfair practices, particularly with China. Stay tuned for updates as the situation evolves.

Categories:

China

Export

Import

Sanctions

Posted

by

Katherine Dreyer

on

Permanent link for U.S. Extends Section 301 Tariff Exclusions: What You Need to Know on September 7, 2023.

Permanent link for Big Changes Are Coming: Huge Drop in the Monthly U.S. Trade Deficit on June 15, 2022

by Natalie Bremmer

Big news rocked the trading world recently with the announcement of the monthly goods and services trading deficit dropping a staggering 19.1% for the United States.

April 2022’s numbers were just released on June 7th, 2022 stating that the $107.7 billion trade deficit from March 2022 had dropped by $20.6 billion down to $87.1 billion in April 2022.

More specifically, U.S. April exports were $252.6 billion, roughly $8.5 billion more than March, and about a 3.5% increase between those two months. U.S. April imports were $339.7 billion, which is a $12.1 billion or 3.4% decrease from the previous month of March.

Year-To-Date

Though April was a great month, in the big picture the United States is still feeling the effects of the Covid-19 pandemic. Between April 2021 and April 2022, the goods and services deficit increased by 41.1% totaling $107.9 billion. This is essentially due to exports increasing by 18.8%, coming in at $151.3 billion, and imports simultaneously increasing by 24.3%, totaling $259.2 billion within this timeframe.

Three Month Trends

On a more positive note, the U.S. three-month trade deficit average is starting to look a lot more promising. Between February 2022 and April 2022, the average goods and services deficit fell by $0.3 billion, down to a total of $94.3 billion. During this time period, U.S. exports increased by $8.3 billion for a total of $242.2 billion, and imports increased by a marginal $8.0 billion totaling $337.4 billion.

Monthly Export Trends

In April 2022, the U.S. export of goods increased by a substantial $6.1 billion to a total of $176.1 billion. The largest portions of this increase came from industrial supplies as well as food and animal feed, accounting for about $4.5 billion combined. Another large portion of the increase was due to the export of capital goods– namely civilian aircraft.

During the same month, the U.S. export of goods also increased by roughly $2.4 billion, totaling at $76.5 billion. The main categories that caused this increase were travel and transport which increased by $1.5 and $0.3 billion respectively.

Monthly Import Trends

In April 2022, U.S. imports of goods actually decreased in comparison to the prior month by $13.0 billion, with a sum of $283.8 billion for the month.

Some of the largest contributors to this decrease were consumer goods, industrial supplies, and capital goods which all decreased by $6.3, $5.4, and $2.6 billion respectively. However, U.S. imports of automotive vehicles rose by roughly $1.4 billion.

Alternatively, the import of services during the same month increased by $0.9 billion compared to the month prior, capping out at $55.9 billion. The largest contributors to this increase were travel, with a $0.6 billion dollar increase, and other business services at $0.2 billion.

For the full report, you can find the U.S. Census post here.

Keep up with VAGTC’s Trading Thoughts Blog for additional updates covering the trade deficit information released in July.

—------------------

Natalie Bremmer is a Student Assistant at GVSU’s Van Andel Global Trade Center . She is a Junior currently pursuing undergraduate degrees in Finance and Human Resource Management at Grand Valley State University. She enjoys lifting weights, getting lost in a good video game, spending time with friends, and going on long hikes.

Categories:

Export

Import

Posted

on

Permanent link for Big Changes Are Coming: Huge Drop in the Monthly U.S. Trade Deficit on June 15, 2022.

Permanent link for Harmonized System Updates Your Company Needs to Know on October 27, 2021

The 7th edition of the Harmonized System (HS) nomenclature will enter into force on January 1, 2022.

Why is this important to your business?

The Harmonized System (HS) nomenclature allows for goods to uniformly be imported and exported to/from countries around the globe, 211 economies participate in this system. The Harmonized System allows for customs tariffs international trade statistics to be tracked and reported as goods flow throughout the global supply chain.

The 7th edition of the HS will include 351 amendments to the current system according to the World Customs Organization.

Some of the major changes include classifications that deal with advancing technology, health & safety equipment, and society protections.

Advancing Technology

Technological advances are occurring daily. Thus, current heading classifications and provisions are not able to properly track new technology that is being created and traded around the world. Updated 2022 HS provisions and classifications will include e-waste, tobacco products, drones, smartphones, and other multifunctional devices.

Health & Safety Equipment

Recent years have highlighted the need for a quicker and more streamlined way to deploy tools that help diagnose and treat infectious diseases. Classification for these tools has been simplified and provisions have been put into place in the 7th edition for supporting medical research occurring on a global scale.

Protecting Society from Dual-Use Goods

The World Customs Organization has increased its efforts to combat world terrorism. Subheadings within the HS have been created for dual-use goods that could potentially be converted to an unauthorized use product such as an explosive device.

Conventions & Clarifications

A number of goods controlled by global Conventions such as chemicals controlled under the Chemical Weapons Convention and the Rotterdam Convention to name a few, have also been updated and reflect clarifications of verbiage to ease the process in classifying products correctly.

Van Andel Global Trade Center recommends companies review the United States HS for 2022 and be ready for any changes that may be implemented on January 1, 2022, that could impact the products your business buys and sells globally. Communicate 2022 changes to suppliers, export customers, dealers/distributors, customs brokers, and international freight forwarders. In some cases, it may be beneficial to obtain binding rulings from Customs to ensure there are no issues/delays moving goods around the world.

Categories:

Export

Harmonized Tariff Classification

Import

Posted

on

Permanent link for Harmonized System Updates Your Company Needs to Know on October 27, 2021.

[1674581513].jpg)