Trading Thoughts Blog

Permanent link for What is the Harmonized Classification System and Why is it Important? on April 9, 2024

What is the Harmonized Classification System (HS)?

The Harmonized Classification System is a globally recognized way to identify goods being imported and exported by assigning a standardized classification. The HS classification is used for declaring goods at the time of export in export declarations and for the purpose of filing customs entries at the time of import in the country of destination. The HS classification is used to determine duty rates and collect duties, taxes, and fees for imported products.

The Harmonized System (HS) is something every importing and export company will need to understand so proper HS classifications can be assigned to their products. Companies need to take great care in assigning HS classification and understand the compliance risks associated with their HS classification decisions. Exporters and importers alike have a legal responsibility to properly claim and classify goods/products.

The Harmonized Classification System Breakdown

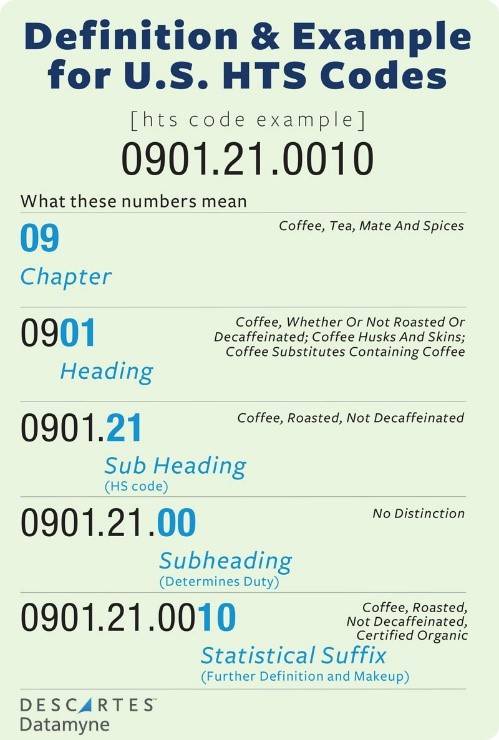

The Harmonized System (HS) is a very structured classification system made up of sections, chapters, notes, headings, and subheadings.

The United States has two published versions of the Harmonized System (HS). For imports, the U.S. publishes the Harmonized Tariff Schedule (HTS) of the U.S. for the HS classification of imported products and the assignment of duty rates. For exports, the U.S. publishes Schedule B for export HS classifications and the collection of statistical data.

The Harmonized System (HS) is broken down into 22 sections which act as groupings of similar chapters.

There are 97 chapters of products that are organized from least manufactured to more manufactured and logically group classifications by make or by use. The first two digits of each HS classification are the chapter number. Within each chapter, the Harmonized System (HS) provides a four-digit heading with the primary legal definition of what is to be included in that heading. Those headings are further broken down into six-digit subheadings. The heading and subheading legal definitions are universal and all countries agree to use the same legal definitions.

While the globally recognized headings and subheadings remain

constant, each country can further break down the subheadings with

country-specific suffixes. In the U.S. two digits (digit 7 and 8) are

added as the duty rate suffix and two digits (digits 9 and 10) are

added as a statistical suffix – making the U.S. classification a

10-digit number.

See the photo above for an example using Coffee.

Why is HS Classification Important for Your Business?

First of all, for importers, the HTS classification determines the duty rates and the duties paid at the time of import so it has immediate revenue implications. Non-compliance can result in fines, penalties, and the back payment of additional duties owed.

Paying duties is a non-negotiable, so proper classification can reduce your compliance risk in the short and long run. The result will never be good when using the wrong classification. If your misclassification caused you to overpay in duties, you won’t receive a refund. If you are underpaid in duties, you are required to pay the difference, and customs will decide if you will need to pay interest, and whether or not fines and penalties will be imposed.

For exporting, HS classification is used in:

- Export documentation (ex. Commercial Invoice)

- Export Declaration

- Import customs entry in a country of destination

For importing, HS classification is used in:

- Customs and Border Protection (CBP) for customs clearance and entry

All in all, use the HS classification to your advantage. Generate proper classifications and importing and exporting will be smooth sailing.

Are You Interested in Learning More?

GVSU's Van Andel Global Trade Center offers a yearly Fundamentals of Harmonized System (HS) Classification Training. Check out our Events page to register for this upcoming event!

---

About the Contributor

Jenna Hoover worked as a student assistant for GVSU’s Van Andel Global Trade Center. At GVSU she studied Finance and Supply Chain Management within the Seidman College of Business. You can find her visiting local coffee shops or checking in on her Roth IRA. In her free time, she enjoys walking her dog, Gertrude, and hanging out with friends along the beautiful beaches of West Michigan.

Originally published 4/8/2022 - Updated 4/9/2024

Categories:

Export

Harmonized Tariff Classification

Import

Posted

on

Permanent link for What is the Harmonized Classification System and Why is it Important? on April 9, 2024.

Permanent link for Harmonized System Updates Your Company Needs to Know on October 27, 2021

The 7th edition of the Harmonized System (HS) nomenclature will enter into force on January 1, 2022.

Why is this important to your business?

The Harmonized System (HS) nomenclature allows for goods to uniformly be imported and exported to/from countries around the globe, 211 economies participate in this system. The Harmonized System allows for customs tariffs international trade statistics to be tracked and reported as goods flow throughout the global supply chain.

The 7th edition of the HS will include 351 amendments to the current system according to the World Customs Organization.

Some of the major changes include classifications that deal with advancing technology, health & safety equipment, and society protections.

Advancing Technology

Technological advances are occurring daily. Thus, current heading classifications and provisions are not able to properly track new technology that is being created and traded around the world. Updated 2022 HS provisions and classifications will include e-waste, tobacco products, drones, smartphones, and other multifunctional devices.

Health & Safety Equipment

Recent years have highlighted the need for a quicker and more streamlined way to deploy tools that help diagnose and treat infectious diseases. Classification for these tools has been simplified and provisions have been put into place in the 7th edition for supporting medical research occurring on a global scale.

Protecting Society from Dual-Use Goods

The World Customs Organization has increased its efforts to combat world terrorism. Subheadings within the HS have been created for dual-use goods that could potentially be converted to an unauthorized use product such as an explosive device.

Conventions & Clarifications

A number of goods controlled by global Conventions such as chemicals controlled under the Chemical Weapons Convention and the Rotterdam Convention to name a few, have also been updated and reflect clarifications of verbiage to ease the process in classifying products correctly.

Van Andel Global Trade Center recommends companies review the United States HS for 2022 and be ready for any changes that may be implemented on January 1, 2022, that could impact the products your business buys and sells globally. Communicate 2022 changes to suppliers, export customers, dealers/distributors, customs brokers, and international freight forwarders. In some cases, it may be beneficial to obtain binding rulings from Customs to ensure there are no issues/delays moving goods around the world.

Categories:

Export

Harmonized Tariff Classification

Import

Posted

on

Permanent link for Harmonized System Updates Your Company Needs to Know on October 27, 2021.