Trading Thoughts Blog

Permanent link for The New-to-Export Workshop in West Michigan Is an Essential Resource for Small & Medium Businesses on August 19, 2025

Unlocking Global Growth: Why This Workshop Matters

Once a quarter, Grand Valley State University’s Van Andel Global Trade Center (VAGTC)—sponsored by the Michigan Economic Development Corporation—will host a New-to-Export Workshop. For just $15, small and medium-sized businesses (SMEs) can gain critical, foundational export knowledge.

So why should your business attend?

-

A Strategic Launchpad for Exporting

Exporting unlocks new revenue streams, but it also presents real-world challenges: compliance requirements, tariffs, logistics, and global pricing strategies. This workshop delivers practical guidance and proven tools to help businesses overcome these hurdles and take their first—or next—step into international markets. -

Tailored to Michigan’s SMEs

In 2023, 89% of Michigan’s 13,885 exporters were small or medium-sized businesses, contributing nearly 21% of the state’s total goods exports. This workshop is designed specifically with them in mind, offering targeted, actionable insights. -

Backed by Van Andel Global Trade Center’s Experience & Network

Since 1999, VAGTC has hosted over 25+ international trade and compliance events annually across Michigan. Participation in this workshop connects you not only with expert knowledge but also with a robust network of statewide resources to support your export journey long after the event ends.

Global Trade: Challenges & Opportunities for SMEs

Today’s global trade environment is shifting rapidly—but that doesn’t mean small businesses need to be left behind. With U.S. tariffs averaging 18.6%, global growth in merchandise trade forecasted at just 0.9%, and fresh tensions affecting trade with Canada and Mexico, navigating international markets may feel more daunting than ever. (WTO.org , weforum.org)

That’s exactly why the New-to-Export Workshop is so timely. It helps SMEs decode global trade disruptions—turning complex issues like tariff hikes, shifting regulations, and geopolitical uncertainty into clear, manageable strategies. Instead of reacting to change, attendees will learn how to anticipate it, build more resilient export plans, and discover new global opportunities with confidence.

Michigan’s Trade Profile: Strong Foundations & Real Growth Potential

Despite global turbulence, Michigan remains a powerhouse in international trade—and SMEs are at the heart of it.

-

Top Export Destinations & Industry Strength

In 2024, Michigan exported $23.3 billion in goods to Canada alone, making up 38% of the state’s total exports. Other major destinations included Mexico ($17.1B), China ($2.1B), Germany ($1.9B), and Japan ($1.5B)—demonstrating strong demand for Michigan-made products across diverse markets. (ustr.gov) -

Small Businesses, Big Impact

Nearly 90% of Michigan exporters are SMEs, proving that size is no barrier to global reach. These businesses play a central role in sustaining the state’s international trade momentum. -

Driving Jobs and Economic Growth

Exports of manufactured goods supported an estimated 209,000 jobs across Michigan in 2022. Leading the charge is transportation equipment, which alone accounted for $26.6 billion in exports in 2024. Other key sectors include machinery ($5.5B), chemicals ($5.2B), electrical equipment & appliances ($4.5B), and computer & electronic products ($3.2B). These figures highlight not only the state’s industrial strength but also the opportunity for SMEs to plug into global supply chains and drive export-based job creation. (ustr.gov)

Are You Ready to Go Global?

For Michigan’s small and medium-sized businesses, export readiness is no longer optional—it’s essential. Global trade dynamics are changing fast, and those who are prepared will be best positioned to grow.

The upcoming New-to-Export Workshop offers the tools, insights, and network your business needs to move forward. Whether you’re exploring exports for the first time or looking to build a stronger international strategy, this event is your starting point for success.

Don’t miss out—register now and take your Michigan business global with confidence.

Special Thanks to Our Partners

This event is made possible by the collaboration and support of:

Michigan Economic Development Corporation

(MEDC), Michigan Department of Agriculture & Rural

Development, U.S.

Small Business Administration, EXIM Bank, U.S. Department of Commerce - Grand Rapids, Michigan Small

Business Development Center

Categories:

Export

MEDC

New to Export

Tariffs

Posted

on

Permanent link for The New-to-Export Workshop in West Michigan Is an Essential Resource for Small & Medium Businesses on August 19, 2025.

Permanent link for What Michigan Businesses Need to Know About the 2025 Tariff Changes on May 22, 2025

As the global trade landscape continues to shift, 2025 has already brought significant changes that Michigan international businesses—large and small—must carefully navigate. With new tariff measures officially in effect, including reciprocal tariffs and expanded duties on key industry sectors, it's more important than ever to stay informed and proactive.

What Are the New Tariffs?

10% Baseline Reciprocal Tariffs (Effective April 5, 2025)

The United States has implemented a baseline 10% tariff on all

imported goods unless a country-specific rate applies. This reciprocal

tariff policy was introduced to level the playing field with trading

partners who impose higher tariffs and non-tariff barriers on U.S. products.

Country-Specific Tariffs

- China: 30% tariffs on electric vehicles, lithium-ion batteries, solar cells, and critical minerals. Some goods may be subject to 90-day delayed enforcement, creating a short compliance window.

- Canada and Mexico: 25% tariffs on certain steel and aluminum imports despite USMCA Free Trade Agreement provisions. Additional tariffs of 10% apply on other specific Canadian goods.

- European Union: 20% tariffs on certain EU goods, with a 90-day pause period to determine long-term enforcement strategies.

Industry-Specific Tariffs

- Steel and Aluminum: 25% tariffs remain in place under Section 232 national security measures.

- Semiconductors, Medical Supplies, and Wood Products: Ongoing investigations could lead to new tariffs or trade restrictions later in 2025.

Maritime and Transportation Measures

- New fees on Chinese-owned shipping companies and higher inspection fees at U.S. ports are scheduled for implementation later this year, adding logistics cost considerations for importers.

What Does This Mean for Michigan Businesses?

Increased Import Costs - Michigan is home to a wide

range of industries that rely heavily on imported raw materials to

make their finished goods, from automotive components and machinery to

consumer products, to name a few. With the implementation of new and

higher U.S. tariffs, businesses can expect to see a rise in landed

costs, which include the product price, shipping, duties, and customs

fees. This can impact pricing, profit margins, and overall competitiveness.

For example, U.S. manufacturers that source steel, aluminum,

batteries, or electrical components from China or the EU could face

additional costs of 10% to 30% or more. Businesses should consider

conducting a cost analysis to understand how the U.S. tariffs might

affect their bottom line and explore options for mitigating these

increases through supplier negotiations, pricing adjustments, or

consider buying from other U.S. manufacturers.

Supply Chain Adjustments - Rising tariffs may require

Michigan businesses to rethink their sourcing strategies and supply

chain models. Businesses heavily reliant on imports from

tariff-affected countries like China, Canada, or the European Union

may face production delays or increased costs that threaten delivery

timelines and customer satisfaction.

This creates an opportunity to:

- Evaluate alternative suppliers in countries not currently impacted by new tariffs.

- Explore domestic U.S. sourcing or reshoring opportunities to reduce reliance on international supply chains.

- Partner with logistics experts to optimize shipping routes and avoid unexpected costs, such as new maritime fees on Chinese-owned shipping companies scheduled for later this year.

Taking a proactive approach now can help businesses maintain operational continuity and build more resilient supply chains.

Compliance Obligations - As tariffs and trade policies change, staying compliant with U.S. Customs and Border Protection (CBP) requirements is critical. Incorrect tariff classifications, missed duty payments, or failure to comply with new documentation requirements could result in penalties, shipment delays, or reputational damage.

Businesses should:

- Review their current import practices with a licensed customs broker or trade consultant.

- Ensure that product classifications (HTS codes) are accurate and up-to-date.

- Monitor official government updates through resources like the Federal Register, Cargo Systems Messaging Service, and United States Trade Representative to stay ahead of changes.

Regular and ongoing training and updates for supply chain, procurement, and create compliance teams will also help reduce the risk of costly trade mistakes.

Strategic Opportunities

While tariffs present challenges, they also open the door for Michigan businesses to build new competitive advantages. Companies that adapt quickly may be able to:

- Strengthen and build new relationships with domestic/U.S. suppliers and manufacturers, boosting local economies.

- Explore new international markets less affected by tariffs to diversify revenue streams.

- Explore of programs like Duty Drawback, which refunds certain duties paid on imported goods that are later exported.

- Leverage state resources such as the Michigan Economic Development Corporation (MEDC) for supply chain diversification support, export assistance, and market research.

With the right strategies in place, Michigan businesses can turn today’s trade challenges into tomorrow’s growth opportunities.

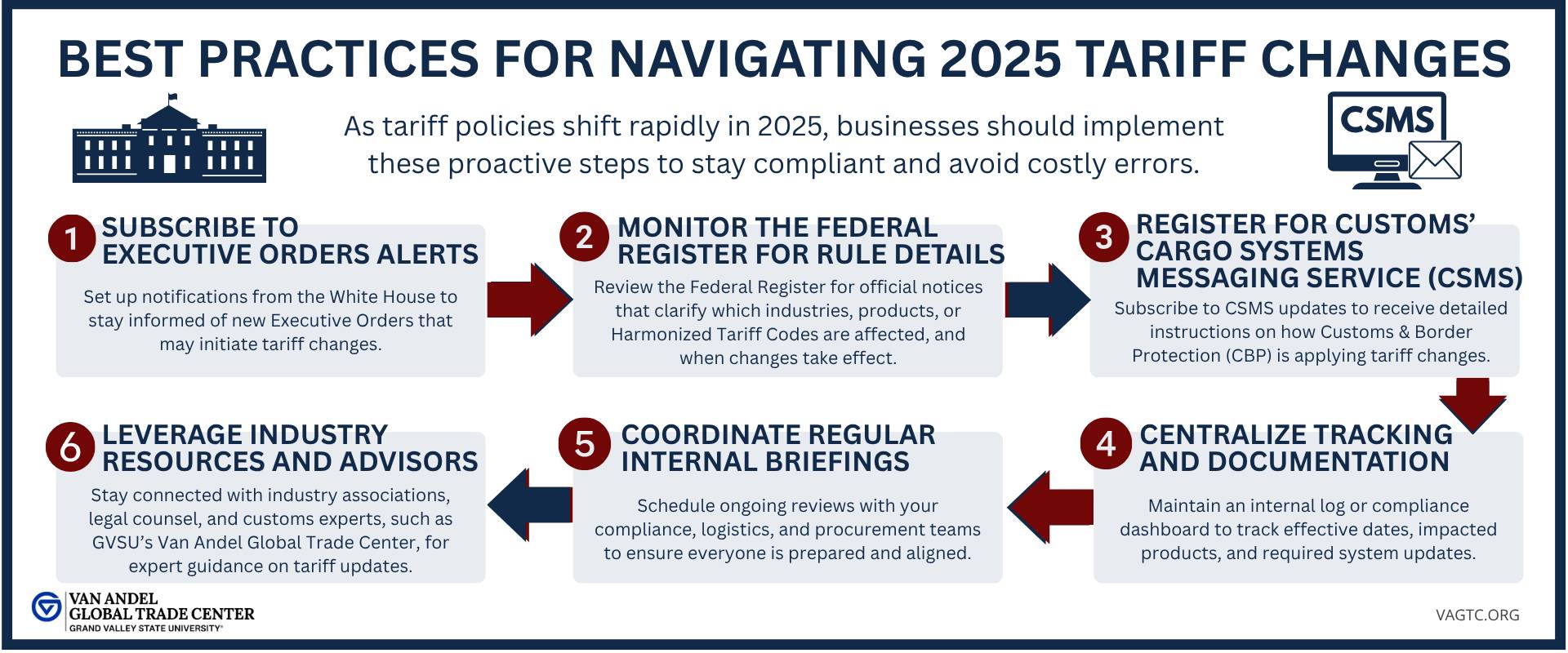

How to Stay Informed and Proactive

Remaining compliant and competitive in today’s trade environment requires diligent monitoring of regulatory developments. Below are trusted resources to help Michigan businesses navigate these changes:

Essential Resources

- Van Andel Global Trade Center Tariff Dashboard - Stay current with summarized updates and expert insights.

- Presidential Executive Orders - White House - Access the latest official executive actions impacting trade policy.

- Federal Register - Review legal notices on tariff changes and trade regulations.

- U.S. Customs Cargo Systems Messaging Service (CSMS) - Sign up for direct updates on import requirements and system changes.

- Office of the U.S. Trade Representative - Stay updated on trade negotiations and enforcement actions.

- Michigan Economic Development Corporation (MEDC) - Explore local support programs, including supply chain assistance and export expansion resources.

Need Help Navigating These Changes?

Grand Valley State University’s Van Andel Global Trade Center is here to support Michigan businesses in navigating the complexities of global trade compliance and international/global market opportunities. From customized consulting to hands-on training, our team is ready to help you strategize and succeed.

Connect with us at gvsu.edu/vagtc for assistance and to explore available resources.

Categories:

Tariffs

Posted

on

Permanent link for What Michigan Businesses Need to Know About the 2025 Tariff Changes on May 22, 2025.

Permanent link for Trump's Newest Tariffs on Canada, Mexico, and China: What It Means for U.S. Trade and Consumers on February 3, 2025

On February 1, 2025, President Donald J. Trump announced the imposition of new tariffs on imports from Canada, Mexico, and China, citing national security concerns related to illegal immigration and drug trafficking. The measures include a 25% tariff on imports from Canada and Mexico, with a reduced 10% tariff specifically on Canadian energy resources, and a 10% tariff on imports from China. - whitehouse.gov

As of February 3, the 25% additional tariffs on Mexico imports have been put on hold for 30 days due to current talks. – Reuters.com

Trade Volume with Canada and Mexico

According to data from the U.S. Census Bureau, in the first ten months of 2024, the United States engaged in substantial trade with both Canada and Mexico. Total trade with Canada amounted to approximately $699.6 billion, with U.S. exports to Canada totaling $322.4 billion and imports from Canada at $377.2 billion. - census.gov

In the first three quarters of 2024, goods and services worth approximately US$600 billion crossed the U.S.-Canada border. When including trade in services, this figure rises to US$683 billion., with nearly US$350 billion in goods and services exported to Canada during this period. This data underscores Canada's position as a key trading partner for the U.S. - economics.td.com

In the first ten months of 2024, according to data from the U.S. Census Bureau, trade with Mexico was even more significant than with Canada, totaling around $776.0 billion. U.S. exports to Mexico were valued at $309.4 billion, while imports from Mexico reached $466.6 billion. - census.gov

Regarding Mexico, in 2023, the U.S. imported goods and services valued at $530 billion and exported $367 billion to Mexico. The machinery and equipment manufacturing sector, which includes automotive and parts, accounted for $193 billion of U.S. imports from Mexico, while electronics manufacturing contributed $119 billion. These two sectors also represented significant portions of U.S. exports to Mexico, totaling $67 billion and $65 billion, respectively. - scotiabank.com

These statistics illustrate the critical importance of Canada and Mexico in U.S. trade dynamics, reflecting the extensive economic ties that have been fostered over the years.

China's Response

In response to the U.S. tariffs, China's Ministry of Commerce condemned the action, announced plans to file a legal case against the U.S. at the World Trade Organization, and stated that China "will take corresponding countermeasures to firmly safeguard its rights and interests." - fmprc.gov.cn

Global Economic Implications

The announcement of these tariffs has led to significant reactions in global markets. Major stock indices have experienced declines, and there is heightened concern about potential disruptions to international trade and economic growth. - theguardian.com

Economists and industry leaders have expressed concerns that the newly imposed tariffs could lead to increased costs for consumers and businesses, potentially contributing to higher inflation and affecting employment in industries reliant on international trade. A model gauging the economic impact of President Trump's tariff plan from EY Chief Economist Greg Daco suggests it would reduce U.S. economic growth by 1.5 percentage points this year, potentially ushering in "stagflation"—high inflation, stagnant economic growth, and elevated unemployment. - reuters.com

Additionally, North American companies are preparing for the effects of these tariffs, which threaten to disrupt numerous industries, including automotive, consumer goods, and energy, leading to increased costs and potential production delays. Industry leaders express concerns over increased costs for consumers and possible supply chain disruptions. The tariffs could harm industries on both sides of the border, affecting auto manufacturing, fuel, and consumer goods sectors. - reuters.com

The tariff situation is consistently evolving. Discussions are ongoing among the involved nations and within the global economic community regarding the potential impacts and future developments related to these trade measures. GVSU’s Van Andel Global Trade Center will continue to post updates as they occur.

Categories:

Automotive

China

Export

Import

Tariffs

Posted

on

Permanent link for Trump's Newest Tariffs on Canada, Mexico, and China: What It Means for U.S. Trade and Consumers on February 3, 2025.

Permanent link for Where are the Customs Entries? A Guide for Import Compliance on January 16, 2025

As trade advisors and consultants, one of the most common questions we hear from small and mid-sized businesses is: “Do we need to worry about Customs compliance?” The short answer? Yes—absolutely.

Often, the realization of the importance of compliance is triggered by a new hire, an internal audit, or as international trade becomes more integrated into day-to-day operations. No matter how the awareness begins, businesses need to understand that compliance risk is a hidden but significant challenge when working with partners outside the U.S.

Uncovering Compliance Risks: The Role of Customs Entries

When we first walk into a business, we don’t know much about its import activity or the processes they have in place. Some companies have oversight mechanisms; others assume everything is running smoothly simply because shipments arrive on time. The truth is, within the first five minutes, we can usually gauge their level of compliance oversight. How? By asking one simple question: “Where are the customs entries?”

Customs Entries Hold the Key

Customs entries are the foundation of any import operation. They reveal critical details such as:

- The number of entries filed over a given period.

- Where the entries are being filed.

- Who is responsible for filing them?

If a company cannot provide these answers, tracking down customs entry data often uncovers previously unknown trade lanes and hidden risks.

The second question we ask is equally telling: “Where are the records?” Responses often include:

- “I’ve never seen the customs entries.”

- “That’s the customs broker’s job.”

- “I assume someone else handles that.”

In many cases, customs entries are sent to Accounts Payable with the broker’s invoice and then filed away—never to be seen again. This lack of oversight can expose the company to significant compliance risks.

The Importance of Oversight and Recordkeeping

Customs entries are official government filings, akin to transactional tax returns. They rely on accurate import documentation—particularly the commercial invoice. Errors in value, classification, or country of origin can lead to costly penalties. While customs brokers file these entries on your behalf, they act as service agents and are not held liable for errors. The responsibility for compliance rests squarely on the importer, as mandated by Customs under the principle of “Reasonable Care.”

To safeguard against these risks, companies must establish robust internal controls, including:

- Reviewing customs entries against commercial invoices and an audited Harmonized Tariff Schedule (HTS) classification list.

- Promptly addressing errors with customs brokers.

- Maintaining a secure record retention system indexed by entry number, date, supplier name, and related documentation.

By implementing these measures, you’ll be well-prepared to answer the pivotal question: “Where are the customs entries?”

Take the First Step Toward Compliance

Ready to build confidence in your importing practices? Join us for Van Andel Global Trade Center’s “Basics of Importing” training. This workshop will provide the foundational knowledge you need to navigate U.S. Customs regulations, manage compliance risks, and import goods effectively and efficiently.

Visit our Upcoming Events page to register and take the next step toward a more informed and compliant import process.

Categories:

Import

Posted

on

Permanent link for Where are the Customs Entries? A Guide for Import Compliance on January 16, 2025.

Permanent link for USMCA Year Four: Analyzing Its Impact on Michigan's Labor Market and Future Trade Prospects on October 11, 2024

by Luke Notorangelo

The United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA on July 1, 2020, aimed to modernize trade between the U.S., Canada, and Mexico, incorporating more flexibility and advanced technological strategies. The article Driving Capital underscores how the USMCA and the Inflation Reduction Act (IRA) have catalyzed job creation and investment in Michigan, especially in the automotive sector’s shift toward sustainability. The Wilson Center's analysis further highlights the USMCA's role in strengthening supply chains and addressing geopolitical challenges. Meanwhile, the Atlantic Council notes that upcoming elections in Mexico and the U.S. could significantly influence the Agreement's future. Collectively, these perspectives reveal the USMCA’s pivotal role in shaping economic resilience and sustainability across North America.

Impact on Michigan’s Labor Market

The USMCA has significantly impacted Michigan's labor market, particularly in the automotive industry, driving job creation and investment in electric vehicle manufacturing. The Agreement's requirement that a substantial portion of automotive content be produced by workers earning at least $16 per hour is a key step in raising wage standards and supporting labor rights. Mechanisms like the Rapid Response Labor Mechanism (RRLM) empower workers to report labor violations, enhancing protections.

However, there are challenges. Some Michigan companies have closed operations in Mexico due to compliance issues, raising concerns about job stability and competition. This underscores the delicate balance Michigan workers face as the automotive sector evolves.

With the IRA encouraging growth in Mexico’s automotive sector, Michigan’s labor market stands at a crossroads—facing both opportunities and uncertainties. The upcoming USMCA review in 2026 will likely shape the future for workers and businesses alike, offering a chance to critique and adjust the Agreement to ensure long-term benefits for North American trade.

Four Years of USMCA: Looking Ahead

Despite global supply chain challenges such as the COVID-19 pandemic, Russia’s invasion of Ukraine, and tensions with China, trade between the USMCA nations has surged by 50%. This growth underscores the strength of the Agreement in managing trade disputes and overcoming supply chain disruptions. Beyond economics, the USMCA reflects a broader shift in globalization, emphasizing sustainability, transparency, and resilience.

As the USMCA reaches its fourth anniversary, it’s clear that while much has been accomplished, unresolved disputes and future challenges remain. Elections in Mexico, the U.S., and Canada could introduce new policies that reshape the trade landscape. Monitoring these developments is essential to maximizing the Agreement’s potential and ensuring a successful 2026 review.

The 2026 USMCA Review: Why It Matters for Michigan Trade

The USMCA includes a unique review process, with a critical evaluation scheduled for July 1, 2026. This review will determine whether the Agreement will be extended for another 16 years or if periodic evaluations will occur. The review will focus on compliance in key areas like telecommunications and labor rights. As political debates intensify, particularly around migration and drug trafficking, Mexico must solidify its position as a reliable partner in North American trade to ensure a successful review.

USMCA in 2024: Notable Considerations

As we mark the fourth anniversary of the USMCA, it's evident that the Agreement is more than just a trade deal—it’s a vital support for Michigan's labor market and a symbol of resilience for North America’s economic future. Growth in the automotive sector and broader trade has positioned the region toward a more sustainable and equitable economy. Yet, upcoming reviews and elections could significantly reshape this framework, making it crucial for businesses, workers, and policymakers to stay engaged. Decisions made now will impact job stability and competition in Michigan, laying the foundation for a stronger North American economy.

Expand Your Knowledge of International Trade

Looking to deepen your understanding of The United States-Mexico-Canada Agreement (USMCA)? Join us at an October, Basics of USMCA training event! Learn valuable insights, expand your network, and discover how the Van Andel Global Trade Center can support your international growth. Register today to secure your spot!

---

About the Contributor

Luke Notorangelo is currently a Marketing and Sales Student Assistant at the Van Andel Global Trade Center. Luke is a senior studying Business Administration with a concentration in Marketing at Grand Valley State University. He enjoys going to the gym, watching a good sports game, spending time with friends, and exploring new noteworthy restaurants in the area.

Categories:

FTAs

Mexico

USMCA

Posted

on

Permanent link for USMCA Year Four: Analyzing Its Impact on Michigan's Labor Market and Future Trade Prospects on October 11, 2024.

Permanent link for East and Gulf coast ports strike, with ILA longshoremen walking off job from New England to Texas, stranding billions in trade on October 2, 2024

By CNBC's Lori Ann LaRocco

Billions in trade came to a screeching halt at U.S. East Coast and Gulf Coast ports after members of the International Longshoremen’s Association, or ILA, began walking off the job after 12:01 a.m. ET on Tuesday.

The ILA is North America’s largest longshoremen’s union, with roughly 50,000 of its 85,000 members making good on the threat to strike at 14 major ports subject to a just-expired master contract with the United States Maritime Alliance, or USMX, and picketing workers beginning to appear at ports. The union and port ownership group failed to reach agreement by midnight on a new contract in a protracted battle over wage increases and use of automation.

In a last-ditch effort on Monday to avert a strike that will cause significant harm to the U.S. economy if it is lengthy — at least hundreds of millions of dollars a day at the largest ports like New York/New Jersey — the USMX offered a nearly 50% wage hike over six years, but that was rejected by the ILA, according to a source close to the negotiations, who was granted anonymity to speak about the private negotiations. The port ownership group said it hoped the offer would lead to a resumption of collective bargaining.

Read the full article here.

------

CNBC This piece of content has been aggregated from an outside website.

Categories:

New Articles

Posted

on

Permanent link for East and Gulf coast ports strike, with ILA longshoremen walking off job from New England to Texas, stranding billions in trade on October 2, 2024.

Permanent link for Gov. Gretchen Whitmer Announces $1.2 Million in Export Assistance Funds Available for Michigan's Small Businesses on October 1, 2024

LANSING, Mich. – Governor Gretchen Whitmer joined the Michigan Economic Development Corporation (MEDC) today to announce Michigan has received the top award of $900,000 from the U.S. Small Business Administration (SBA) State Trade Expansion Program (STEP) for the upcoming fiscal year. The Michigan Strategic Fund is providing an additional $300,000 as the state match to support the Michigan STEP initiative (MI-STEP) and help small businesses grow through increased access to global markets. MEDC’s International Trade program has now facilitated nearly $6 billion in small business export sales development by deploying critical export resources and fostering a statewide network of export support.

This year marks the 13th year of STEP funding from SBA, which has awarded nearly $15 million to the state of Michigan since its inception. With 95% of the world's consumers and two-thirds of all purchasing power located outside of the United States, Michigan’s administration of STEP dollars to small businesses is critical in promoting Michigan’s goods and services worldwide.

Michigan has historically led the nationwide STEP grant program in results of facilitated export sales. While the national return on investment (ROI) remains 40:1 for facilitated sales realized from SBA STEP dollars, Michigan retains #1 status with a reported ROI of 328:1 during STEP program history.

“This year, Michigan has secured a top STEP award from the Biden-Harris administration’s SBA to help small local businesses access the international market and export their high-quality goods,” said Governor Whitmer. “We are focused on connecting our businesses with the international network they need to expand and create jobs in Michigan. We will get it done by bolstering our federal partnerships and shoring up our state-level initiatives including the MEDC’s International Trade program. Together, we will grow our economy and help small businesses thrive right here in Michigan.”

This year’s SBA award will continue to support export development for small- and medium-sized businesses through grants for international sales trips, trade missions, and trade shows. However, no additional activities will be eligible for the FY25 administration of MI-STEP. MI-STEP is designed to spur job creation by empowering small- and medium-sized businesses to export their products, providing reimbursement grants up to $15,000 annually for eligible export-related expenses.

“Increasing the sale of Michigan goods and services to global markets is an important part of taking the state’s ‘Make It in Michigan’ economic development strategy globally. Growing export sales not only fosters increased company revenue and stability but also supports higher incomes for Michiganders by helping Michigan exporters revitalize communities and create greater employment and entrepreneurial options,” said Quentin L. Messer, Jr., CEO of MEDC and President and Chair of the MSF Board. “In fiscal year 2023, federal and state funding for MI-STEP allocated more than $2 million to 254 companies. Michigan small businesses utilizing MEDC’s International Trade resources, including MI-STEP, reported $510 million in new export sales to 127 countries.”

MI-STEP applications are accepted Nov. 1, 2024 through Sept. 15, 2025 for small- and medium-sized businesses pursuing export development. MI-STEP grants are competitive awards and funding is not guaranteed. Companies that may not qualify for MI-STEP or do not receive MI-STEP funding are encouraged to engage with Michigan’s network of international trade resources and service providers offering support for businesses at any point along their international growth journey. These services include B2B matchmaking, qualified and unqualified partner lists, worldwide credit reports, export compliance support, customized market research, and more –available at no cost to Michigan small businesses.

Click below to get details on how to apply for assistance, including MI-STEP eligibility requirements and the application process, or complete the online intake form to start a conversation with an International Trade Manager.

Categories:

MEDC

New Articles

Posted

on

Permanent link for Gov. Gretchen Whitmer Announces $1.2 Million in Export Assistance Funds Available for Michigan's Small Businesses on October 1, 2024.

Permanent link for Things to Consider When Doing Business in Mexico on August 12, 2024

by Natalie Bremmer

When people think of exporting, they often picture sending their products halfway across the globe. Though this mentality is not necessarily wrong, it can oftentimes lead businesses astray from their greatest opportunity– their next-door neighbor, Mexico!

U.S. businesses would be doing themselves a grave disservice by overlooking the exporting opportunities Mexico has to offer. In 2019, the U.S. exported roughly 350,000 units of product to Mexico while simultaneously receiving 200,000 units of product in the same year– a huge opportunity while also being able to decrease shipping costs because of a much shorter travel distance.

However, as with any country, there are social and cultural norms that businesspersons should be aware of before attempting to strike a deal.

Here are the top cultural norms people should be aware of when doing business in Mexico:

Timing

Business hours typically don’t start until 9-10 a.m. at the earliest and sometimes end at 8 p.m. and have a much longer lunch break. With this, you can expect later meeting times as well as more small talk before diving right into the designated topic of the meeting.

Though it’s polite for the guests to arrive on time, it is culturally common for the hosting company to oftentimes be a bit late for meetings.

If you do have meetings over lunch or dinner at a restaurant, expect it to take even longer. Restaurant service in Mexico is usually at a much slower pace than it is in the US. Sit, enjoy the conversation, and do not rush the check.

Formalities

Always dress formally and professionally for the first meeting to make the best impression. In areas with a hotter climate, it is sometimes acceptable to dress more ‘business casual’ as it is usually too hot to wear a full suit.

Business cards are always welcome and are readily exchanged. It is best to have a business card in both English and Spanish (if applicable) for maximum outreach results.

Small gifts with your company’s logo on it are acceptable, but anything larger or of higher value may be considered as a sort of unwanted persuasion.

In addition to this, doing anything that could remotely be considered bribing or promising ‘favors’ is extremely disrespectful and is not tolerated. All final business decisions are made by those in positions of power; negotiating with anyone not in this position will achieve suboptimal results.

Also, it is not polite to perform the first initial business meeting over a meal. Meals are shared among people who are familiar and enjoy each other's company; they are typically not acceptable for people unfamiliar with each other.

Communication

When addressing someone, it is best to use their official title of Mr., Mrs., Ms., Dr. This conveys the upmost respect, tends to have the best social reaction, and is a much quicker way to build relationships.

With the presence of the Covid-19 pandemic, Americans have started to shift toward a preference of online and video call communication, but in Mexico, the preference is still face to face communication as it tends to have a more personal touch.

While communicating in person, body language is also very important to consider. Trying to seem as open and engaged as possible by not closing off your arms and nodding along to the conversation is a great starting point to have the most productive conversations.

Do not feel the need to rush into business right away, though. Business professionals in Mexico prefer to get to know their partners first by engaging in small talk to get a good assessment of their character.

Having some baseline understanding and conversational skills in Spanish is a must-have in this scenario. Your Mexican business partners might find this impressive and realize how serious your offer is, resulting in a better negotiation.

Learn More!

To expand your cultural awareness of the best business practices in Mexico, sign up to attend the Business Travelers Series: Navigating Mexico – Virtual event on August 14, 2024, at 9 am EST, this virtual event is sponsored by the Gerald R. Ford International Airport and the Michigan Economic Development Corporation.

—-------------------------------------------

Natalie Bremmer was a Student Assistant at GVSU’s Van Andel Global Trade Center . She pursued an undergraduate degree in Finance, Human Resource Management, and General Management at Grand Valley State University. She enjoys lifting weights, getting lost in a good video game, spending time with friends, and going on long hikes.

Categories:

Culture

Mexico

The Business Travelers Series

Posted

on

Permanent link for Things to Consider When Doing Business in Mexico on August 12, 2024.

Permanent link for What is the Harmonized Classification System and Why is it Important? on April 9, 2024

What is the Harmonized Classification System (HS)?

The Harmonized Classification System is a globally recognized way to identify goods being imported and exported by assigning a standardized classification. The HS classification is used for declaring goods at the time of export in export declarations and for the purpose of filing customs entries at the time of import in the country of destination. The HS classification is used to determine duty rates and collect duties, taxes, and fees for imported products.

The Harmonized System (HS) is something every importing and export company will need to understand so proper HS classifications can be assigned to their products. Companies need to take great care in assigning HS classification and understand the compliance risks associated with their HS classification decisions. Exporters and importers alike have a legal responsibility to properly claim and classify goods/products.

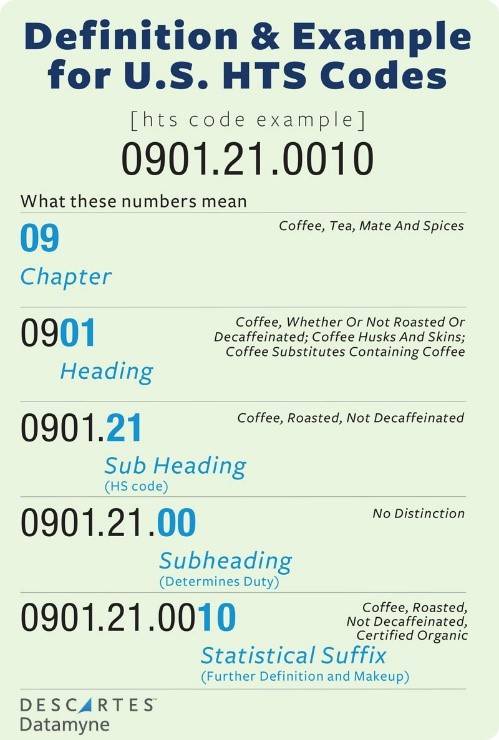

The Harmonized Classification System Breakdown

The Harmonized System (HS) is a very structured classification system made up of sections, chapters, notes, headings, and subheadings.

The United States has two published versions of the Harmonized System (HS). For imports, the U.S. publishes the Harmonized Tariff Schedule (HTS) of the U.S. for the HS classification of imported products and the assignment of duty rates. For exports, the U.S. publishes Schedule B for export HS classifications and the collection of statistical data.

The Harmonized System (HS) is broken down into 22 sections which act as groupings of similar chapters.

There are 97 chapters of products that are organized from least manufactured to more manufactured and logically group classifications by make or by use. The first two digits of each HS classification are the chapter number. Within each chapter, the Harmonized System (HS) provides a four-digit heading with the primary legal definition of what is to be included in that heading. Those headings are further broken down into six-digit subheadings. The heading and subheading legal definitions are universal and all countries agree to use the same legal definitions.

While the globally recognized headings and subheadings remain

constant, each country can further break down the subheadings with

country-specific suffixes. In the U.S. two digits (digit 7 and 8) are

added as the duty rate suffix and two digits (digits 9 and 10) are

added as a statistical suffix – making the U.S. classification a

10-digit number.

See the photo above for an example using Coffee.

Why is HS Classification Important for Your Business?

First of all, for importers, the HTS classification determines the duty rates and the duties paid at the time of import so it has immediate revenue implications. Non-compliance can result in fines, penalties, and the back payment of additional duties owed.

Paying duties is a non-negotiable, so proper classification can reduce your compliance risk in the short and long run. The result will never be good when using the wrong classification. If your misclassification caused you to overpay in duties, you won’t receive a refund. If you are underpaid in duties, you are required to pay the difference, and customs will decide if you will need to pay interest, and whether or not fines and penalties will be imposed.

For exporting, HS classification is used in:

- Export documentation (ex. Commercial Invoice)

- Export Declaration

- Import customs entry in a country of destination

For importing, HS classification is used in:

- Customs and Border Protection (CBP) for customs clearance and entry

All in all, use the HS classification to your advantage. Generate proper classifications and importing and exporting will be smooth sailing.

Are You Interested in Learning More?

GVSU's Van Andel Global Trade Center offers a yearly Fundamentals of Harmonized System (HS) Classification Training. Check out our Events page to register for this upcoming event!

---

About the Contributor

Jenna Hoover worked as a student assistant for GVSU’s Van Andel Global Trade Center. At GVSU she studied Finance and Supply Chain Management within the Seidman College of Business. You can find her visiting local coffee shops or checking in on her Roth IRA. In her free time, she enjoys walking her dog, Gertrude, and hanging out with friends along the beautiful beaches of West Michigan.

Originally published 4/8/2022 - Updated 4/9/2024

Categories:

Export

Harmonized Tariff Classification

Import

Posted

on

Permanent link for What is the Harmonized Classification System and Why is it Important? on April 9, 2024.

Permanent link for GVSU to host 25th symposium for area automotive suppliers on February 26, 2024

FOR IMMEDIATE RELEASE

February 26, 2024

Contact: GVSU University Communications

[email protected]

(616) 331-2221

GRAND RAPIDS, Mich. — Navigating industry difficulties and challenges will be the main topic of the 25th Michigan Automotive Suppliers Symposium, hosted by Grand Valley State University’s Van Andel Global Trade Center.

The symposium, with the theme of “Momentum Matters,” will be held at the DeVos Center, Loosemore Auditorium, on the Pew Grand Rapids Campus on Thursday, March 7, from 8:00 a.m.-noon.

"The annual symposium offers the chance to hear crucial insights as businesses realign with the constantly changing fast-paced automotive sector,” said Sonja Johnson, executive director, of the Van Andel Global Trade Center. “Listen to industry experts and how they are maintaining momentum as they navigate challenges in the requirements to meet government standards, and customer needs while juggling a complex supply chain and how recent issues such as labor strikes have impacted the auto industry.”

Speakers include two GVSU alumni. Alejandra Lorenzo, who works for Stellantis North America as a supplier diversity program manager, graduated in 2014. Lorenzo is an expert in supplier diversity, risk management, project management, pre-production and international launches. Lorenzo will give the keynote presentation, “Supplier Diversity: Direct and Tangible Benefits to Create a Stronger, More Resilient Supply Chain.”

GVSU graduate Mike Wall will present “The Road Ahead: Navigating the Winding Roads of the Auto Industry,” as an industry outlook. Wall earned a bachelor’s degree in finance and now has over 20 years of expertise. As executive director of automotive analysis at S&P Global Mobility, Wall will provide an in-depth analysis of vehicle markets and technology trends.

Other sessions include a fireside chat with Munro & Associates; and a Tier 1 Supplier Panel with representatives from Pridgeon and Clay, Inc.; ADAC Automotive; Lacks Enterprises; and Warner Norcross + Judd LLP.

Each year since 1999 the Van Andel Global Trade Center has hosted more than 25 international business events in Michigan and worked with a broad variety of community partners & corporate sponsors to provide the international business community with the business training and international resources it needs to succeed on the global stage.

For more information on this event, visit the Van Andel Global Trade Center website.

####

Categories:

Automotive

Posted

on

Permanent link for GVSU to host 25th symposium for area automotive suppliers on February 26, 2024.

[1708973268].jpg)