Innovation Corner

Permanent link for Failure Breeds Success on April 21, 2023

Startup failures and pivots can lead to success. Innovation—like starting a company—is fundamentally a learning process, so sometimes we have to fail in order to get better at succeeding. In fact, research shows that learning is optimal when decisions are successful about 85% of the time and fail about 15% of the time. At least, for certain types of learning.

It might be just coincidence, then, or it might be a good sign that we're good at learning as a society, that according to the Small Business Administration around 20% of small businesses fail in the first year. Startup failures provide valuable lessons to entrepreneurs, helping them learn from their mistakes and increase their chances of success in their next venture. In some cases, a startup failure can lead to a pivot that results in a more successful business model. Instagram, for example, started as a check-in app called Burbn but became one of the most popular photo-sharing social media platforms after pivoting. Similarly, Slack started as an internal tool for video game developer Tiny Speck. The company eventually pivoted to focus on Slack and rebranded as Slack Technologies.

Entrepreneurs who embrace failure as a learning opportunity, learn from their mistakes, and pivot when necessary can increase their chances of building a successful business. Some venture capitalists recognize the value of failure so strongly that they incorporate it into their investment strategy.

While failure is hard to accept, sometimes it's better than succeeding. Embrace your failures and just learn from them.

Categories:

entrepreneurship

Posted

by

Thomas Hopper

on

Permanent link for Failure Breeds Success on April 21, 2023.

Permanent link for Product Cost Modeling, Target Markets, and Pricing on April 14, 2023

Entrepreneurs and intrepreneurs developing new products are inevitably asked "how much does it cost?"

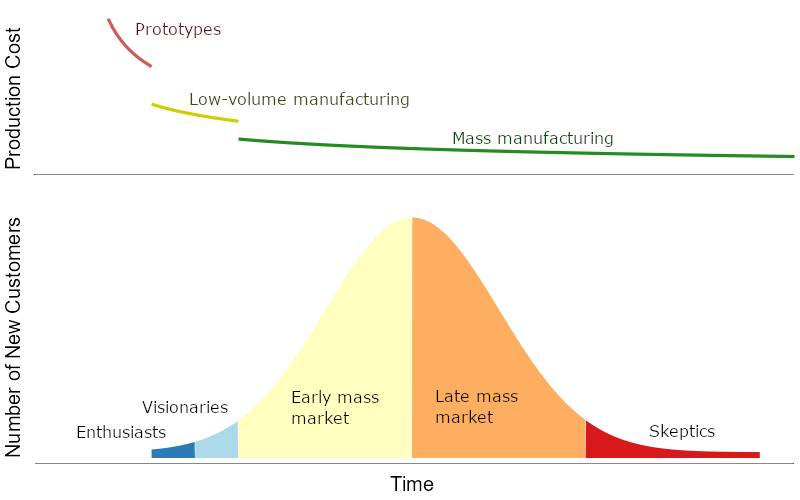

To answer this, we need to distinguish between price—how much the customer pays—and cost—how much it costs you to put it in the customer's hands. We also need to distinguish between how much it costs right now and how much it will cost at volume.

If you're talking to potential customers, who are interested in buying, they really mean "what's the price, right now?" You'll need an answer for them, because you want them to buy. You need that market validation. So what's the right price? Ideally, it's a premium price point, but early price points should have no relation to actual costs. You're testing the market; not your operational efficiency.

If you're talking to potential investors or internal stakeholders, they usually want to know about the cost at volume. Volume is a bit tricky. You cannot possibly obtain an accurate cost estimate to produce a product design that doesn't exist yet in volumes you can only guess at, and at a manufacturing site that you haven't selected. But that's o.k.! You don't need to know the exact costs of every component; you only need to know which components of production drive the bulk of your cost, and roughly what those components cost at volume. What we're really looking for is just a fair estimate, at the highest volume that makes sense. If you're developing the next whiz-bang smartphone, where the total market is running around 1.5 billion units per year, you don't want to estimate volumes of 10 billion units per year. But around a hundred million a year could be the basis of a perfectly reasonable volume cost estimate.

Let's try an example of part of your operation. Suppose you're manufacturing your next-gen smartphone in China and shipping to the U.S. west coast once a month. Your product is small and you can fit 500 units to a pallet. Shipping rates for that pallet will probably run you around $1,000 (mid-2022 prices), or $2 per phone. When sales grow enough to utilize an entire 40-foot shipping container, you'll spend $10,000 but ship 20 pallets, or 10,000 units, lowering the cost per phone to $1. If you could reach volumes of around 120 million phones per month, you can buy the capacity of an entire container ship, which a google search or a phone call to a major shipper tells you will cost around $100,000 per day. With shipping times of around two weeks, you'd spend about $1.4 million per month to ship those parts, but the cost per part would be just 1 penny. When an investor or stakeholder asks you "how much will it cost," your answer should not be "$1,000 for a pallet of 500 phones;" your answer should be "we estimate 1 cent per phone at volume."

If your investors instead want to know how much it costs today, you'll of course tell them that at today's very low volumes, shipping costs about $2 each to port; just $500 per month.

One startup manufacturer I'm familiar with had a product where the bulk of the cost came from labor and certain metals in the product. That manufacturer's answer to "how much does it cost" assumed production would (someday) be someplace where labor was cheap and that volumes would be sufficient to buy an entire mine's-worth of metal production—this resulted in the lowest potential costs. In the present day, their actual costs were many times higher, with production in the United States where it was easier to manager during scale-up and with lower volume metals purchases.

This cost-volume relationship holds for just about every product or service that a business provides. The more you do, the more your costs are dominated by variable costs rather than fixed costs, and cheaper the variable costs get per unit.

For this reason, early-stage startups should (almost*) never be trying to sell into cost-conscious mass markets. You should be looking for the high-value customer segments, those who are willing to pay a premium price for a premium product or service. As your volumes increase, you can work on reducing costs and then reducing price while holding your margins (or letting margins slip while raking in large revenues, the way oil companies do). We'll cover this more in a future blog post.

* almost never: there are some great market opportunities in cost-conscious markets, where customers are under-served or not served and cannot afford current offerings. Startups can offer a lower-margin substitute with fewer features at lower prices, staving off competition from established companies while gaining market share. Examples include the early personal computer market, transistor radios, and shared mobility (e.g. Uber). Harvard Business Review offers some additional insight.

Categories:

innovation

management

Posted

by

Thomas Hopper

on

Permanent link for Product Cost Modeling, Target Markets, and Pricing on April 14, 2023.

Permanent link for How to grow sales on April 7, 2023

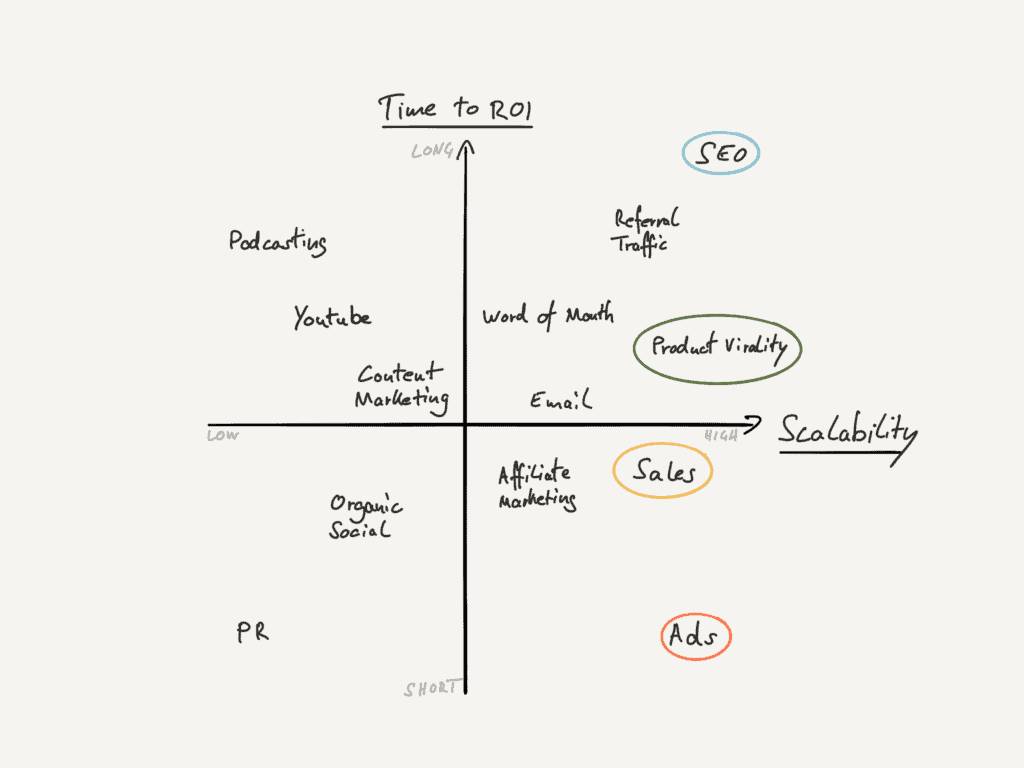

Entrepreneurs often start out strong with a few hard-won sales, but rather than seeing the growth they expect, their sales often stall.

What strategies will work to grow sales? You have to understand your product and your markets, and improve your customer acquisition channels. You want channels that

- offer a high ROI,

- fit within your resource constraints,

- are already connected to your target customers,

- are suitable for the types of relationships you want to build (in particular: your customer's average customer lifetime value), and

- are scalable.

Kevin Indig compares some of the possible channels and identifies which work and which don't. His channels are:

- Ads

- Affiliate Marketing

- Content Marketing

- Organic Social

- Podcasting

- PR

- Product Virality

- Referral Traffic

- Sales

- SEO

- Word of Mouth

- Youtube

He argues that only ads, product virality, sales, and SEO are scalable. His article is thought-provoking and worth your time.

Categories:

management

sales

Posted

by

Thomas Hopper

on

Permanent link for How to grow sales on April 7, 2023.

Permanent link for A Model for Improving Your Business on March 31, 2023

Many businesses think of their biggest competitive advantage as being the "secret sauce" in their product or service. Established businesses often focus on their "core strengths," which invariably revolve around their main capital investments and maintaining a healthy ROA. In practice, though, a company's real competitive advantage is their ability to consistently adapt and improve how they do business.

Startups, as temporary organizations dedicated to the search for a repeatable and sustainable business model, do this constant improvement almost instinctively; there is no "right" way to do things, so entrepreneurs are always looking for some way to do things. One of the key steps in transitioning from startup mode to normal business mode is setting up the organization to continue to learn, adapt, and improve.

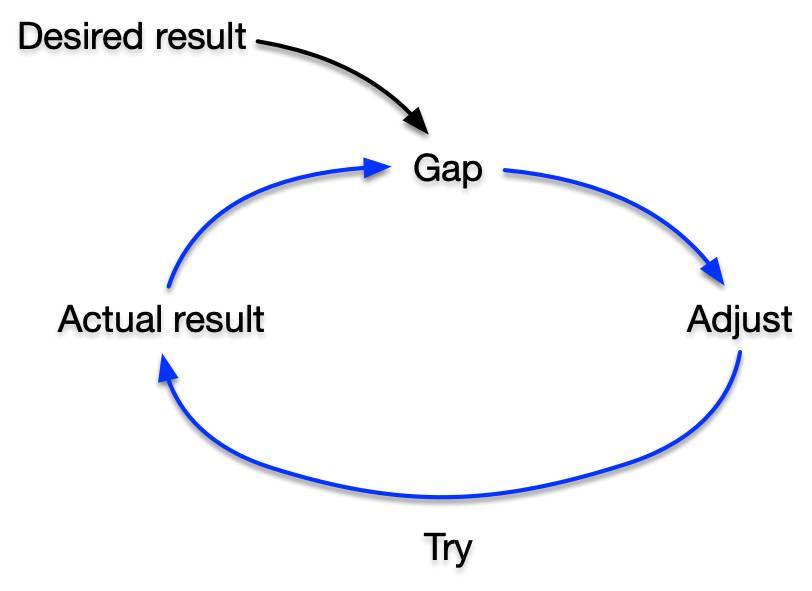

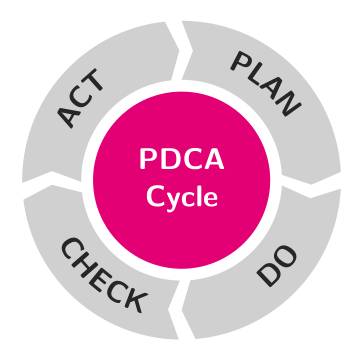

This is accomplished in four steps:

- Set up processes and tools that everyone can follow, then

- Make sure people follows the processes,

- Compare the results to what was expected and understand the causes for any deviation from expectations, and

- Finally, update the processes and tools.

Repeat this constantly, everywhere and at every level of the organization. Do whatever it takes to speed up this cycle of improvement. Most importantly, empower employees to perform this within their areas of responsibility by providing a process and tools to implement this change. The result will be better-quality products and services, at higher revenue, and at lower cost.

The simplest model to implement continuous improvement is the Plan, Do, Study, Act (PDSA) cycle developed by quality guru W. Edwards Deming.

PDSA

Plan: Plan a test or a change that is intended to improve your business.

Do: Follow the plan

Study: Study the results, asking "what went right?" and "what went wrong?" Identify any discrepancies from expectations and understand why they happened.

Act: Act on what was learned in the previous steps, updating your understanding or adopting the change, and initiating the next planning phase.

ISO 9001

While the main advantage to this process lies in institutionalizing the learning and improvement process that is naturally performed on an ad hoc basis in startups, business selling to other businesses will find an additional benefit. Many businesses require their vendors to be registered to the ISO-9001 quality management system standard, or one of the related industry-specific standards such as QS-9000, TL-9000, or AS-9100. Each of these standards requires companies to have processes in place for continuous improvement, and PDSA lays a solid groundwork for such processes.

Categories:

entrepreneurship

Posted

by

Thomas Hopper

on

Permanent link for A Model for Improving Your Business on March 31, 2023.

Permanent link for How can I Conduct Market Research? on March 24, 2023

Market research is a crucial step in starting your business. By understanding your target customers, your competitors, and the current market landscape, you can ensure better market adoption and higher value.

Here are a few specific ways you can conduct market research:

Surveys: Surveys are an easy way to gather information from a large number of people quickly and inexpensively. You can use a tool like Google Forms or SurveyMonkey to create and distribute a survey to gather insights about your target audience, their needs, and their preferences. Be careful, though, how you write questions to avoid leading your respondents to give you the answers you like rather than solid data.

Focus groups: A focus group is a small, representative group of people who are brought together to discuss and provide feedback on a particular topic or product. You can use a focus group to gather in-depth insights and opinions about your business or product. Small Business Trends offers some more in-depth advice on How to Conduct a Focus Group.

Industry data analysis: There are many sources of industry data that can help you understand trends and patterns in your market. This can include data from trade associations, government agencies, or market research firms. The SBA provides links to some great databases and other tools for market research and competitive analysis.

Customer interviews: Conducting in-depth interviews with current or potential customers can provide valuable insights into their needs, motivations, and decision-making processes. You can use these interviews to gather specific feedback and ideas for improving your products or marketing efforts. More detailed advice can be found in the article Customer Discovery Interviews: A Secret of Successful Startups.

Competitor analysis: Analyzing your competitors can help you understand their strengths and weaknesses, and identify areas where you can differentiate your business. This can include things like reviewing their website and social media accounts, analyzing their product offerings, and gathering customer feedback about their products or services. Here are 5 Outstanding Competitor Analysis Tools for Startups.

Your regional Small Business Development Center will probably be able to help you conduct market research free of charge, and many local libraries provide access to demographic databases that can be used to gauge market size or build potential customer lists, like the Gale Business Demographics Now database and ReferenceGuru's AtoZ Databases.

Categories:

entrepreneurship

management

marketing

Posted

by

Thomas Hopper

on

Permanent link for How can I Conduct Market Research? on March 24, 2023.

Permanent link for What Is Your Market Potential? on March 17, 2023

Entrepreneurs often struggle to figure out their revenue potential. I frequently see entrepreneurs greatly overestimate their market.

If you're selling a new inventory management solution into grocery stores, your total addressable market (TAM) is not the $810 billion grocery store market; your TAM is what grocery stores spend on inventory management solutions.

Your serviceable addressable market (SAM) is also not "every grocery store," but only the spending on inventory management solutions by those grocery stores where you have a real shot at making a sale based on your business model.

Your actual revenue potential, however, is only a fraction of that market; your serviceable obtainable market (SOM) is fraction of sales you expect to actually achieve based. This will grow with time and as your resources grow, and it's best to estimate it bottom-up.

Techcrunch has some great advice and insight: Nice try, startup, but that's not your serviceable obtainable market (SOM)

Categories:

entrepreneurship

Posted

by

Thomas Hopper

on

Permanent link for What Is Your Market Potential? on March 17, 2023.

Permanent link for What customers need on March 10, 2023

When products are successful in the marketplace, it's never because they were clever or the most technically brilliant implementation, but about how well your solution solves a problem that customers have with existing solutions. When I work with clients, I push them to identify what pains their future customers are complaining about with current products or services, and what gains customers are actively wishing for.

Customer pains are what annoy a customer before, during, or after they get a job done with an existing solution. When customers regularly struggle to use a product, or complain about how it works, how it makes them feel, or how it makes them look, then you have a customer pain that you differentiate your product around.

In contrast, a gain saves a customer time, money, or effort. When customers regularly say they'd like more of something, or for better of some product or service, or that it's easier to use, they're calling out for a new solution with those specific gains.

How do you find out what customers want?

The best approach is to go to the places where customers buy or use the existing products or services, and just watch and listen. Take notes.

Another approach, though less reliable, is to simply sit down with some prospective customers, either one at a time or in small groups, and ask them about their experience. Be careful not to lead them in any direction, but definitely encourage them to talk about what's missing and what doesn't work well.

Reading through many customer reviews of similar—or substitute—products or services can also provide some useful insights, but recognize that reviews are biased toward the extremes. Don't assume that what you read in reviews represents the opinions of the majority of potential customers.

The video below offers some further insight into finding out what customers really need.

Categories:

entrepreneurship

innovation

Posted

by

Thomas Hopper

on

Permanent link for What customers need on March 10, 2023.

Permanent link for You Can Develop Grit on March 3, 2023

A key to entrepreneurial success is grit: passion and sustained persistence applied toward long-term achievement.

It's easy to talk about grit as something you have or don't. Successful entrepreneurs have grit; the rest of us don't. But this false. Anyone can develop grit.

Dr. Carol Dweck, PhD in psychology, has studied people's ability to learn and adapt to challenging circumstances. She describes two basic mindsets: the fixed mindset and the growth mindset. Her research shows that people with a growth mindset tend to perform better than those with a fixed mindset, and she's shown that people with a fixed mindset can develop a growth mindset.

People with a fixed mindset tend to see intelligence as static or fixed; people with a growth mindset tend to view intelligence as a characteristic that can be developed.

Growth mindsets enable entrepreneurs to move into new fields, fosters grit, makes it easier to iterate on your product or service, and keeps you from stagnating. Harvard Business Review has a nice run-down on why entrepreneurs need a growth mindset.

How can you develop a growth mindset?

- Learn to recognize your fixed mindset voice. When you say things like "I'm not good at..." or "I always...," you're probably using a fixed mindset. Work to notice this voice, think about examples that counter the fixed mindset, and substitute conditional statements like "sometimes I..." or "In these situations, I often..."

- Work on being comfortable being vulnerable, and seek honest feedback. Critical feedback is not telling you who or what you are; you're just hearing about weaknesses or oversights that you can improve upon.

- Invest your sense of self-worth and your self-esteem in your values and basic human worth rather than in what you produce or your income.

Categories:

entrepreneurship

Posted

by

Thomas Hopper

on

Permanent link for You Can Develop Grit on March 3, 2023.

Permanent link for The Three Rules for Businesses Strategy on February 17, 2023

You'll find volumes of advice on what business strategy to follow. Almost all of it is based on anecdote. Take it with a healthy dose of skepticism. However, Michael Raynor actually studied twenty-five thousand businesses and found three simple rules that the successful companies followed:

- Better before cheaper—in other words, compete on differentiators other than price.

- Revenue before cost—that is, prioritize increasing revenue over reducing costs.

- There are no other rules—so change anything you must to follow Rules 1 and 2.

There's a proviso here, though, and unsurprisingly rule 0 is: do what the data says. Prioritize making data-driven decisions.

I'll let Raynor explain these rules.

Categories:

management

Posted

by

Thomas Hopper

on

Permanent link for The Three Rules for Businesses Strategy on February 17, 2023.

Permanent link for What to Outsource on February 3, 2023

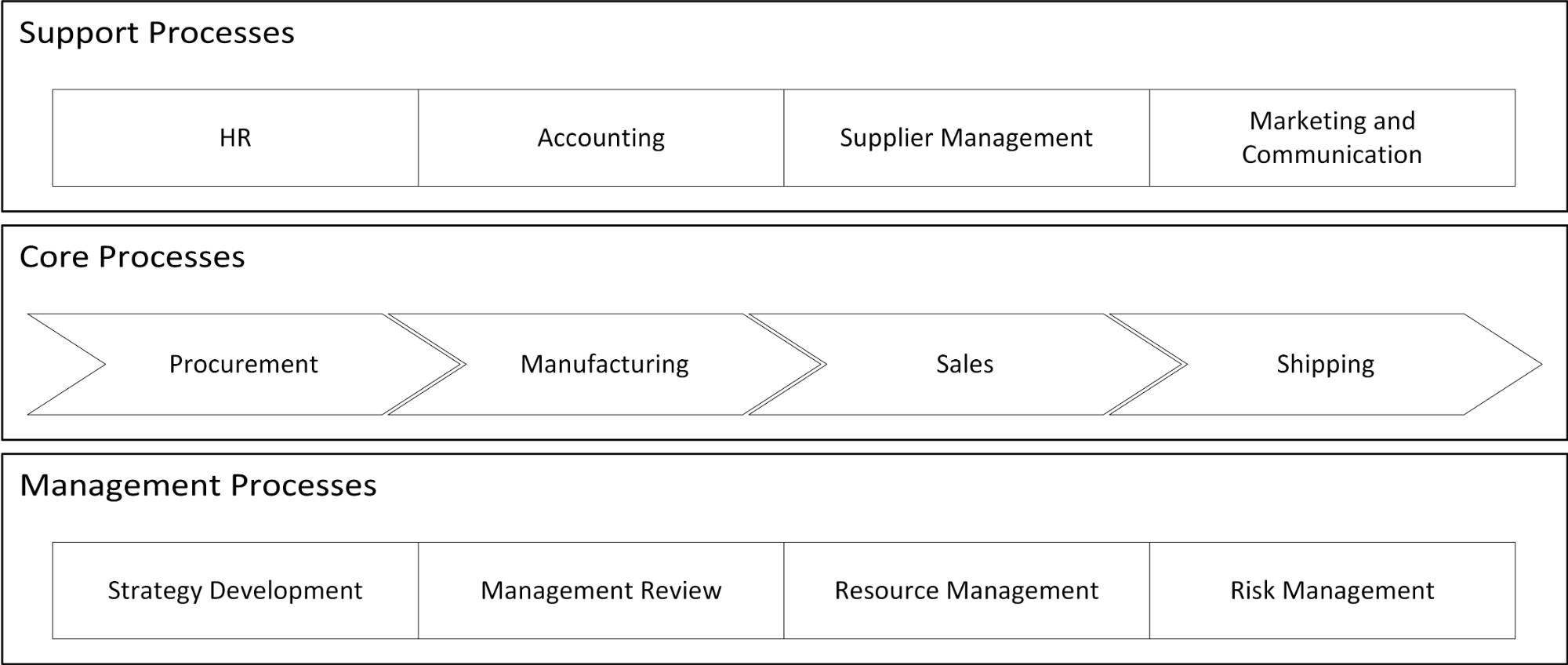

Entrepreneurs get in the habit of doing it all in their business, but as the business grows, they need to add staff to handle the growing workload. Being fully engaged in all aspects of a business, it can be hard to decide what to outsource. How do you decide what to outsource?

- Outsource repetitive processes that do not require deep knowledge about the business and need a fast response rate. The best processes are those that the startup's owners or employees already know well; they can be effectively managed with minimal effort. This might include front-line customer support, certain aspects of social media marketing, or the manufacturing and shipment of merchandise that is not a part of your main product or service.

- Outsource processes that require deep knowledge and that are outside of the core processes of the business. This would normally include many legal and human resources functions.

- Outsource capital-intensive operations, but have a plan to closely monitor the quality and cost-effectiveness of output. These are almost always core processes, and could include manufacturing.

It can be helpful when deciding what and how to outsource, to think about whether or not a process is a core process of your business. If your business cannot run for any length of time without performing a process, that process is probably a core process. If you could get away with delaying a process for a while, it's not a core process. If your business uses KPIs, your core processes usually be associated with a KPI. It's usually best to keep core processes in-sourced and under your direct control, and look at other processes for outsourcing.

Categories:

management

outsourcing

Posted

by

Thomas Hopper

on

Permanent link for What to Outsource on February 3, 2023.