Innovation Corner

Permanent link for Decision Tools for Entrepreneurs on May 3, 2024

Making smart decisions is crucial for your business's success. In this post, I'll introduce you to easy-to-use tools that can help you make better choices confidently.

-

Decision Trees : Picture a tree with branches showing different choices and their possible outcomes. Decision trees help you see the consequences of each decision. To create one, start by listing your options. Then, map out what might happen for each option. Assign probabilities based on what you know or estimate. This visual aid makes it easier to choose the best path forward.

-

Pareto Analysis : Ever heard of the 80/20 rule? It says that 80% of your results come from 20% of your efforts. Pareto analysis helps you focus on what matters most. List your tasks or problems, then identify which ones have the biggest impact. By tackling these first, you'll maximize your efforts for success.

-

SWOT Analysis : SWOT stands for strengths, weaknesses, opportunities, and threats. This tool helps you understand your business better. Make a list for each category. Your strengths and weaknesses are internal, while opportunities and threats are external. By knowing these, you can plan smarter strategies.

Here's how to use it: List your business's strengths, like unique products or talented team members. Then, jot down weaknesses, such as limited resources or inexperienced staff. Next, identify opportunities in the market, like growing demand for your product. Finally, consider threats, like new competitors or changing regulations. With this insight, you can focus on leveraging strengths, improving weaknesses, seizing opportunities, and mitigating threats.

-

Decision Matrices : Imagine a table with options listed on one side and criteria on the other. Decision matrices help you compare choices objectively. Start by listing your options and criteria. Assign weights to criteria based on importance, then rate each option on how well it meets each criterion. Multiply the ratings by the weights and add them up. The option with the highest score is likely your best choice.

Let's say you're choosing between different suppliers for a critical component. Your criteria might include cost, quality, reliability, and delivery time. Assign weights based on what matters most to your business. Then, rate each supplier on each criterion. Multiply the ratings by the weights and add them up for each supplier. The one with the highest total score is your top pick.

The Eisenhower Matrix is similar to a decision matrix, and can be especially useful for prioritizing your activities.

-

Cost-Benefit Analysis : This tool helps you decide if a choice is worth it financially. List all costs and benefits associated with a decision. Compare them to see if benefits outweigh costs. If they do, it's probably a good move for your business.

Here's how it works: Let's say you're considering investing in new equipment. List all costs, including purchase price, installation, and maintenance. Then, list benefits like increased productivity or reduced downtime. Quantify these benefits in monetary terms if possible. Finally, compare total costs to total benefits. If benefits outweigh costs, the investment is likely to pay off.

-

Expected Monetary Value (EMV): Expected Monetary Value is a statistical technique used to assess the potential value of different outcomes based on their probabilities. By multiplying the probability of each outcome by its associated monetary value and summing the results, entrepreneurs can calculate the expected value of a decision or project. EMV complements the other tools, and works especially well with decision trees and cost-benefit analysis.

To apply EMV, start by identifying the possible outcomes of a decision or project and estimating their probabilities. Then, assign a monetary value to each outcome, representing its potential impact on revenue, cost savings, or other financial metrics. Multiply the probability of each outcome by its monetary value and sum the results to calculate the expected monetary value. This provides entrepreneurs with a quantitative measure of the potential value of different options, helping them prioritize and make informed decisions.

These tools can make decision-making less daunting for business owners and managers. By using decision trees, Pareto analysis, SWOT analysis, decision matrices, and cost-benefit analysis, you can make informed decisions confidently. Remember, successful decision-making also requires critical thinking and creativity. Embrace your journey with confidence!

Categories:

management

Posted

by

Thomas Hopper

on

Permanent link for Decision Tools for Entrepreneurs on May 3, 2024.

Permanent link for Improvise, Adapt, Overcome on April 12, 2024

Entrepreneurs can glean invaluable insights from the Marine Corps Fighting Doctrine's mantra: "Improvise, Adapt, Overcome." In today's dynamic business environment, adaptability is not just beneficial—it's essential. Successful ventures pivot swiftly and innovate to navigate unforeseen challenges.

Improvise

Entrepreneurs often encounter unexpected obstacles that disrupt their plans. As the military adage goes, "No plan survives first contact with the enemy," entrepreneurs must be prepared to deviate from their original strategies. Similar to Marines on the battlefield, they must think creatively, leveraging available resources in unconventional ways to overcome adversity.

Adapt

Adaptability lies at the heart of both military strategy and entrepreneurship. "Slow is smooth, smooth is fast," emphasizing the importance of methodical action even under pressure. In entrepreneurship, staying agile and responsive to changing market dynamics is crucial. Being able to adjust strategies swiftly to new trends and competitive landscapes is key to success.

Overcome

Resilience is paramount in the face of adversity. "Embrace the suck," urging individuals to endure difficult situations without complaint. Entrepreneurs must confront challenges head-on, prioritizing both objectives and the well-being of individuals, as emphasized in "Mission first, people always." By navigating setbacks with determination and grit, entrepreneurs can emerge stronger and more successful.

Conclusion

The Marine Corps mantra illuminates the path to entrepreneurial success. By embracing flexibility, adaptability, and resilience, entrepreneurs can thrive amidst challenges. Channeling the spirit of improvisation, adaptation, and overcoming fosters excellence in entrepreneurship, ensuring ventures not only survive but flourish in the ever-evolving business landscape.

Categories:

entrepreneurship

innovation

management

Posted

by

Thomas Hopper

on

Permanent link for Improvise, Adapt, Overcome on April 12, 2024.

Permanent link for Mastering the Fail-Fast Approach: A Blueprint for Entrepreneurial Success on April 5, 2024

Throughout my career, I've focused on developing cutting-edge technologies and products. One of the most influential figures I've worked with, a brilliant scientist, introduced me to the concept of "fail fast."

Previously, my approach revolved around testing various inventive ideas and assessing their viability. As a team, we aimed to replicate successful outcomes and iterate on new concepts.

While we experienced some successes, we also encountered numerous failures, some of which were avoidable and overshadowed our achievements. Failure can come with significant costs.

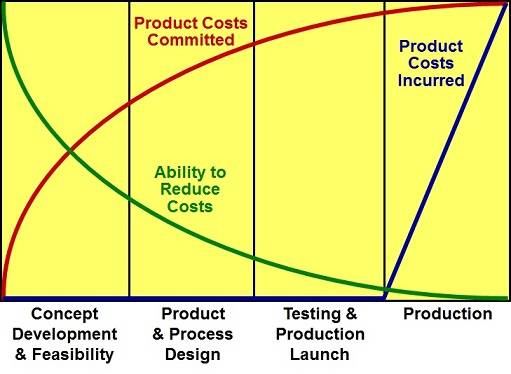

As we progress towards market launch, flexibility decreases, and changes become more expensive. Simultaneously, development expenses escalate, making it crucial to identify and address potential flaws early on to minimize costs.

The fail-fast mindset acknowledges that no idea is perfect and seeks to identify weaknesses swiftly and efficiently. Rather than focusing solely on success, the emphasis is on identifying and mitigating failure points.

To implement this approach, it's essential to define clear hypotheses and develop a comprehensive test plan. For example, testing different website designs through A/B testing to determine their impact on conversion rates.

By embracing the fail-fast approach, entrepreneurs can quickly learn from mistakes and make necessary improvements. Failure becomes an opportunity for growth rather than a setback.

When developing new products or services, the costs spent on development increases, while the flexibility in making changes to the design of the product or service decreases. Image from NPD Solutions.

Categories:

innovation

management

Posted

by

Thomas Hopper

on

Permanent link for Mastering the Fail-Fast Approach: A Blueprint for Entrepreneurial Success on April 5, 2024.

Permanent link for How to Price Your Product: Understanding the Difference Between Price and Cost on March 8, 2024

Understanding Product Pricing: Navigating the Price vs. Cost Conundrum

As entrepreneurs and intrepreneurs venture into the world of product development, they inevitably encounter the question: "How much does it cost?" This seemingly simple query actually warrants a deeper understanding, as it involves distinguishing between price—what the customer pays—and cost—what it takes for you to deliver the product to the customer's hands. Moreover, it's essential to differentiate between current costs and those at scale.

1. Addressing Customer Inquiries: The Price Perspective

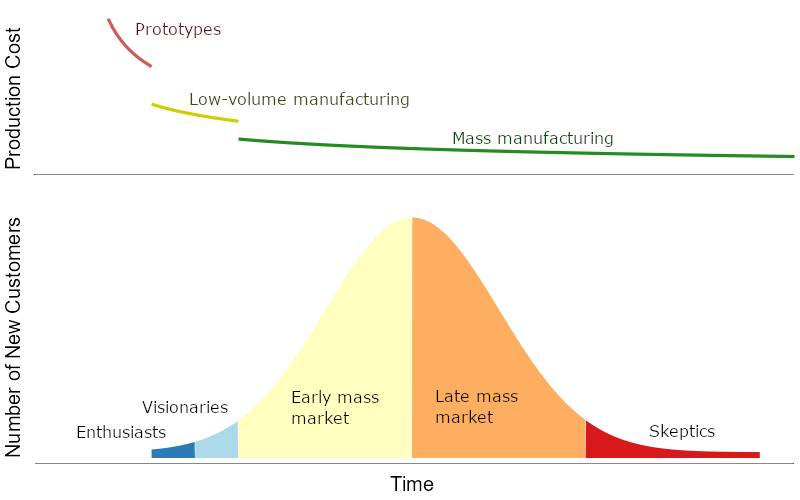

When engaging with potential customers, particularly those eager to make a purchase, their primary concern revolves around the immediate price. For them, the question translates to, "What's the price, right now?" It's imperative to have a response ready to validate the market and encourage sales. Initially, pricing should focus on market testing rather than operational efficiency. Aim for a premium price point to gauge market receptivity, keeping in mind that early pricing need not correlate with actual costs.

2. Meeting Investor and Stakeholder Expectations: The Cost at Volume

Conversations with investors or internal stakeholders typically revolve around the cost at volume. While estimating costs at scale may seem daunting, it's feasible with a strategic approach. Rather than pinpointing exact costs for every component, identify the key cost drivers and approximate their expenses at the highest feasible volume. For instance, if you're envisioning mass production of a smartphone, aim for a volume estimate that aligns with market demand while remaining realistic.

3. Illustrating Cost Dynamics: A Practical Example

Consider the scenario of manufacturing smartphones in China and shipping them to the U.S. west coast. Initially, shipping costs per phone may be significant. However, as volumes increase, economies of scale come into play, driving down the per-unit shipping cost substantially. Such insights allow you to provide stakeholders with informed estimates, demonstrating the potential cost reductions at scale.

4. Embracing the Cost-Volume Relationship

The relationship between cost and volume applies universally across products and services. As your operations scale, variable costs become increasingly dominant, leading to lower per-unit expenses. This dynamic underscores the importance of targeting high-value customer segments early on, prioritizing premium pricing over cost-conscious mass markets.

5. Navigating Market Opportunities

While high-value customer segments are often the initial focus for startups, exceptions exist. Certain market opportunities may lie in cost-conscious segments, where underserved customers seek affordable alternatives. By offering lower-margin substitutes with strategic feature adjustments, startups can carve out a niche and gain market share.

In conclusion, mastering the interplay between price and cost is essential for entrepreneurial success. By understanding customer expectations, investor perspectives, and cost dynamics, startups can navigate pricing challenges effectively, paving the way for sustainable growth and profitability.

Categories:

entrepreneurship

innovation

management

marketing

Posted

by

Thomas Hopper

on

Permanent link for How to Price Your Product: Understanding the Difference Between Price and Cost on March 8, 2024.

Permanent link for Innovation on February 9, 2024

In today's fast-paced business landscape, the key to success often lies in the ability to innovate quickly and bring products to market faster than the competition. For businesses striving for relevance and growth, an efficient innovation process is not just a luxury; it's a necessity. In this blog, we'll explore strategic approaches and practical tips to help you streamline your innovation process and ensure that your product reaches the market swiftly and successfully.

- Start with a Clear Vision

Before embarking on the innovation journey, it's crucial to have a clear vision of what problem your product solves and who your target audience is. Define your value proposition and ensure that it aligns with market needs. A well-defined vision serves as a guiding light, helping your team stay focused and make informed decisions throughout the development process.

- Embrace Agile Methodology

Agile methodology has become synonymous with rapid innovation. By breaking down the development process into smaller, manageable tasks and regularly reassessing priorities, you can adapt to changes swiftly. This iterative approach allows for continuous improvement, reducing the risk of late-stage changes that could delay your time to market.

- Foster a Culture of Innovation

Innovation is not solely the responsibility of the R&D department; it should be ingrained in the entire organizational culture. Encourage cross-functional collaboration, reward creative thinking, and create an environment where employees feel empowered to share their ideas. A culture of innovation promotes a collective mindset that can significantly speed up the product development process.

- Conduct Rapid Prototyping

Waiting until the final stages to test your product can be a costly mistake. Rapid prototyping allows you to gather valuable feedback early in the process, enabling you to make necessary adjustments swiftly. By incorporating user feedback throughout development, you reduce the likelihood of major overhauls later on, saving both time and resources.

- Utilize Technology and Automation

Leverage technology to automate repetitive tasks, streamline workflows, and enhance collaboration. Project management tools, communication platforms, and collaborative software can significantly increase efficiency. Automation not only accelerates processes but also minimizes the risk of human error, ensuring that your product development stays on track.

- Build Strategic Partnerships

Collaborating with external partners can provide access to valuable resources and expertise, accelerating the development process. Whether it's forming strategic alliances, outsourcing specific tasks, or leveraging existing networks, partnerships can help you overcome challenges and bring your product to market faster.

- Prioritize Minimal Viable Product (MVP)

Instead of waiting for a fully polished product, focus on delivering a Minimal Viable Product (MVP) that addresses the core needs of your target audience. Launching an MVP allows you to gather real-world feedback, validate assumptions, and make necessary adjustments before investing in extensive features. This approach not only accelerates time to market but also reduces the risk of building a product that misses the mark.

To borrow from management guru Peter Drucker, businesses have only two core functions, and innovation is one of them. By incorporating these strategies into your innovation process, you can position your business as a dynamic force in your industry, delivering products to market faster and staying ahead of the competition. Remember, the key lies not only in developing groundbreaking ideas but also in executing them swiftly and efficiently. Embrace innovation, foster a culture of agility, and watch your business thrive in the ever-evolving landscape of today's market.

Categories:

entrepreneurship

innovation

management

Posted

by

Thomas Hopper

on

Permanent link for Innovation on February 9, 2024.

Permanent link for Why Startups Fail (and what you can do about it) on January 19, 2024

New product and service launches fail for many reasons. When the company is a startup, it's not just the product or service that fails, but the whole company. If you know what to watch out for, though, you can greatly increase your chances of success.

One of the main reasons that founders give is insufficient funding; that they run out of cash. This is often the last problem that a startup faces before shuttering, but it's almost always a symptom of deeper problems.

There have been multiple studies on this, such as this Harvard study, published in 2021, and CB Insights' separate study, also published in 2021. Both studies found that the top reasons for failure include

- No market need, also described as insufficient customer discovery and demand validation;

- Not having the right team, generally as a result of lacking industry experience;

- Poor planning and execution, usually encountered as either over-optimistic plans or as the adoption of strategies that lead to higher cash burn rates than can be absorbed by available funding.

What can you do to bolster your chances of success

- Study and understand your target customers;

- Clearly define the problem you are solving for them in terms they have expressed;

- Validate demand for a solution;

- Build a founding team with both the right attitudes (the willingness to learn and to work in multiple rolls) and the right experience;

- Know your financials and plan for sustainable both development and growth.

StartupGrind has more good advice.

Categories:

entrepreneurship

management

Posted

by

Thomas Hopper

on

Permanent link for Why Startups Fail (and what you can do about it) on January 19, 2024.

Permanent link for Boost Your Small Business Success on December 15, 2023

Starting a small, bootstrapped business is no small feat, and ensuring consistent quality in your products or services is crucial for long-term success. One effective way to achieve this is by incorporating elements of the ISO 9001 standard into your business processes. ISO 9001 is an internationally recognized quality management standard that can guide you to developing better, more consistent business processes, delivering better and more consistent results to your customers. Here are some practical tips for small business owners to implement key aspects of ISO 9001.

- Understand Customer Needs and Expectations:

ISO 9001 emphasizes a customer-centric approach. Start by clearly understanding your customers' needs and expectations. Engage with them through surveys, feedback forms, and social media to gather valuable insights. Use this information to tailor your products or services to meet their requirements more effectively.

- Establish a Quality Policy:

Define a quality policy that aligns with your business objectives. Clearly communicate this policy to your team and ensure everyone understands their role in maintaining quality. A well-defined quality policy provides a framework for decision-making and helps in consistently delivering high-quality outcomes.

- Implement Documented Processes:

Documenting your processes is a fundamental step in ISO 9001. Create clear, step-by-step procedures for key business activities, such as product development, customer service, and order fulfillment. This documentation serves as a reference for employees and helps maintain consistency, especially as your business grows.

- Set and Monitor Key Performance Indicators (KPIs):

Identify key performance indicators that align with your business goals and customer expectations. Regularly monitor these KPIs to track your business's performance and identify areas for improvement. This data-driven approach will enable you to make informed decisions and continuously enhance your processes.

- Train and Empower Your Team:

Invest in training programs to ensure that your team understands the importance of quality and is equipped with the necessary skills to meet customer expectations. Empower employees to take ownership of their roles and contribute to the overall quality objectives of the business.

- Regularly Conduct Internal Audits:

Internal audits are a proactive way to identify potential issues and ensure compliance with established processes. Regularly review your documented procedures and conduct internal audits to identify areas for improvement. This continuous improvement cycle is integral to the ISO 9001 framework.

- Encourage a Culture of Continuous Improvement:

Foster a culture of continuous improvement within your organization. Encourage employees to suggest improvements and innovations in processes. Implement a feedback loop that allows for the timely review and incorporation of valuable suggestions, leading to a more agile and adaptive business.

Conclusion:

Implementing ISO 9001 principles in your small, bootstrapped business can be a game-changer. By focusing on customer needs, documenting processes, monitoring performance, and fostering a culture of continuous improvement, you can deliver better, more consistent results to your customers. ISO 9001 is not just a certification; it's a mindset that can help your business thrive in a competitive landscape while building a reputation for excellence. Embrace these tips, and watch your small business grow with a commitment to quality.

Categories:

entrepreneurship

management

Posted

by

Thomas Hopper

on

Permanent link for Boost Your Small Business Success on December 15, 2023.

Permanent link for It Takes A Village on November 17, 2023

No entrepreneurs have the experience, know-how, and time to build a concept into a full-fledged business that pays its own way. Most entrepreneurs have expertise either in business management or in the technical aspects of their business concept, but not both.

Most entrepreneurs are trying something new, so it's completely normal and expected that they won't know everything. Still, every entrepreneur should be actively working to close these gaps and improving their chances of success by acquiring a team of the right cofounders, advisors, and mentors.

Cofounders bring complementary skills, with enough overlap in knowledge and working style that you can effectively solve problems together.

Advisors are professionals with enough subject matter expertise or business experience to guide you to the right decisions for your business. They might be experienced at raising funds, or at sales, or have deep technical knowledge needed to develop a product or service. They are definitely there to advise you in an area of your business that they know better than you do. They might work for free, but compensation is fairly common, and may be in the form of cash or stock.

Mentors have "been there and done that." Though they may have worked on a different product or even in a slightly different industry, they already know the path you're walking and are familiar with the potential pitfalls. You will typically have only one mentor at a time, and the relationship should be fairly long-term. Mentors should have more experience and knowledge than you do in your industry, or at least in your stage of growth as an entrepreneur. More importantly, they should be someone you like enough for them to function as a role model.

The importance of cofounders, mentors, and advisors really cannot be overstated; they frequently make the difference between success and failure.

Categories:

entrepreneurship

management

Posted

by

Thomas Hopper

on

Permanent link for It Takes A Village on November 17, 2023.

Permanent link for The 3 Simple Rules for Successful Businesses on September 21, 2023

You'll find volumes of advice on what business strategy to follow. Almost all of it is either based on anecdote or very tactical, and should be taken it with a healthy dose of skepticism. Sure, some business owners succeed, for a time, by trusting their guts. And yes, you should definitely keep abreast of your competition.

Michael Raynor took it a step further. He and his team studied twenty-five thousand businesses and found three simple rules that the successful companies followed:

- Better before cheaper—in other words, compete on differentiators other than price.

- Revenue before cost—that is, prioritize increasing revenue over reducing costs.

- There are no other rules—so change anything you must to follow Rules 1 and 2.

There's a proviso here, though, and unsurprisingly rule 0 is: do what the data says. Prioritize making data-driven decisions.

I'll let Raynor himself explain these rules in the video below.

Categories:

entrepreneurship

management

Posted

by

Thomas Hopper

on

Permanent link for The 3 Simple Rules for Successful Businesses on September 21, 2023.

Permanent link for Automating your business on June 23, 2023

In today's fast-paced business landscape, organizations strive for efficiency, consistency, and scalability. Standardizing and automating business processes is a strategic approach that empowers companies to optimize their operations, improve productivity, and drive sustainable growth. By establishing clear guidelines and harnessing the power of automation, businesses can reduce errors, enhance customer satisfaction, and unlock new opportunities.

An important guideline: don't automate too early. Processes that have been automated rarely get improved, and improvements to automated processes tend to focus on making them cost less to perform rather than increasing product (or service) quality and top-line revenues.

Common areas to look for opportunities to automate:

- Operations management: To keep track of the who, what, and when of your business, automate the entire logistical part of the process.

- Project management: To avoid emails, information files, or to-do lists getting lost in miscommunication, use project or task management software.

- Customer support: To save your support team from the hassle of responding to hundreds or thousands of complaints about an issue, use customer support software to automate some replies.

- Social media management: To free up precious time, use social media automation tools to schedule your posts throughout the day, week, or month depending on your preference.

To automate, follow these basic steps:

- Systematize your processes Before any standardization or automation can take place, it is essential to gain a comprehensive understanding of existing processes. Begin by mapping out each major process in your business, identifying inputs, outputs, decision points, suppliers to the process, and customers of the process. Flowcharts, swimlane charts, SIPOC diagrams, or turtle diagrams all work well for this. Start with whichever one works for you. Document your processes in a centralized repository, ensuring easy access for all stakeholders.

- Identify repetitive activities Not all activities can be automated; sometimes, you need human creativity or decision-making. Look for sequences of steps in the process that are repetitive and don't require creative or critical thinking.

- Automate repetitive activities Leverage automation tools and technologies such as robotic process automation (RPA), workflow management systems, and artificial intelligence (AI) to automate repetitive tasks, data entry, and decision-making processes. This not only reduces human error but also frees up valuable time and resources, enabling employees to focus on higher-value activities.

- Monitor, Measure, and Optimize Once the automated processes are deployed, monitoring their performance is crucial. Establish key performance indicators (KPIs) to measure the effectiveness and efficiency of the automated processes. Leverage analytics and reporting tools to gather data and gain actionable insights. Regularly review the KPIs, identify bottlenecks or areas for improvement, and make necessary adjustments. Continuous monitoring and optimization are essential to achieving long-term success.

- Train and Engage Employees While automation can streamline processes, it is important to remember that it complements human efforts rather than replacing them entirely. Invest in training programs to equip employees with the necessary skills to adapt to automated workflows. Encourage a culture of collaboration and innovation, where employees feel empowered to provide feedback and suggest process enhancements. By fostering employee engagement, organizations can maximize the benefits of standardized and automated processes.

For small businesses looking for cost-effective business process automation solutions, there are several reliable options available. These tools offer a range of features to streamline processes and enhance productivity:

-

Zapier: a popular automation platform that connects different applications, enabling seamless data flow and task automation. It offers a user-friendly interface and supports integration with over 2,000 apps, making it versatile for various business needs.

-

Trello: a visual project management tool that uses the Lean whiteboard metaphor of boards, lists, and cards to organize tasks and workflows. It provides automation features, such as automatic card creation and due date reminders, simplifying task management for small teams.

-

HubSpot CRM: a free customer relationship management system that automates sales and marketing processes. It helps businesses track customer interactions, manage leads, and automate email campaigns.

-

Google Workspace: Google Workspace offers a suite of cloud-based productivity tools, including Gmail, Google Drive, Google Docs, and Google Sheets. These applications can be integrated and automated using Google Apps Script, allowing small businesses to streamline communication, collaboration, and document management.

-

Social Pilot: social media automation tool built for businesses of all sizes, from small to enterprise-sized. With this versatile tool, expect to enjoy a ton of features such as social media scheduling, calendar management, robust analytics, client management, and more.

-

Tidio: An easily accessible live chat widget makes your business available 24/7, while AI-powered chatbots engage your customers in real-time.

Standardizing and automating business processes is a strategic imperative in today's competitive landscape. By mapping, documenting, and standardizing processes, organizations can achieve consistency and efficiency. The integration of cost-effective automation tools enables busy, understaffed small businesses to optimize their operations, reduce manual effort, and enhance productivity.

Categories:

management

Posted

by

Thomas Hopper

on

Permanent link for Automating your business on June 23, 2023.