Innovation Corner

Permanent link for Product Cost Modeling, Target Markets, and Pricing on April 14, 2023

Entrepreneurs and intrepreneurs developing new products are inevitably asked "how much does it cost?"

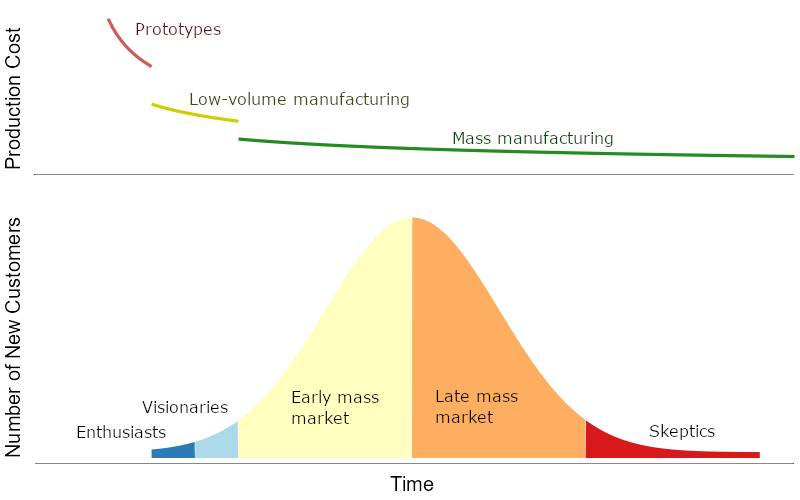

To answer this, we need to distinguish between price—how much the customer pays—and cost—how much it costs you to put it in the customer's hands. We also need to distinguish between how much it costs right now and how much it will cost at volume.

If you're talking to potential customers, who are interested in buying, they really mean "what's the price, right now?" You'll need an answer for them, because you want them to buy. You need that market validation. So what's the right price? Ideally, it's a premium price point, but early price points should have no relation to actual costs. You're testing the market; not your operational efficiency.

If you're talking to potential investors or internal stakeholders, they usually want to know about the cost at volume. Volume is a bit tricky. You cannot possibly obtain an accurate cost estimate to produce a product design that doesn't exist yet in volumes you can only guess at, and at a manufacturing site that you haven't selected. But that's o.k.! You don't need to know the exact costs of every component; you only need to know which components of production drive the bulk of your cost, and roughly what those components cost at volume. What we're really looking for is just a fair estimate, at the highest volume that makes sense. If you're developing the next whiz-bang smartphone, where the total market is running around 1.5 billion units per year, you don't want to estimate volumes of 10 billion units per year. But around a hundred million a year could be the basis of a perfectly reasonable volume cost estimate.

Let's try an example of part of your operation. Suppose you're manufacturing your next-gen smartphone in China and shipping to the U.S. west coast once a month. Your product is small and you can fit 500 units to a pallet. Shipping rates for that pallet will probably run you around $1,000 (mid-2022 prices), or $2 per phone. When sales grow enough to utilize an entire 40-foot shipping container, you'll spend $10,000 but ship 20 pallets, or 10,000 units, lowering the cost per phone to $1. If you could reach volumes of around 120 million phones per month, you can buy the capacity of an entire container ship, which a google search or a phone call to a major shipper tells you will cost around $100,000 per day. With shipping times of around two weeks, you'd spend about $1.4 million per month to ship those parts, but the cost per part would be just 1 penny. When an investor or stakeholder asks you "how much will it cost," your answer should not be "$1,000 for a pallet of 500 phones;" your answer should be "we estimate 1 cent per phone at volume."

If your investors instead want to know how much it costs today, you'll of course tell them that at today's very low volumes, shipping costs about $2 each to port; just $500 per month.

One startup manufacturer I'm familiar with had a product where the bulk of the cost came from labor and certain metals in the product. That manufacturer's answer to "how much does it cost" assumed production would (someday) be someplace where labor was cheap and that volumes would be sufficient to buy an entire mine's-worth of metal production—this resulted in the lowest potential costs. In the present day, their actual costs were many times higher, with production in the United States where it was easier to manager during scale-up and with lower volume metals purchases.

This cost-volume relationship holds for just about every product or service that a business provides. The more you do, the more your costs are dominated by variable costs rather than fixed costs, and cheaper the variable costs get per unit.

For this reason, early-stage startups should (almost*) never be trying to sell into cost-conscious mass markets. You should be looking for the high-value customer segments, those who are willing to pay a premium price for a premium product or service. As your volumes increase, you can work on reducing costs and then reducing price while holding your margins (or letting margins slip while raking in large revenues, the way oil companies do). We'll cover this more in a future blog post.

* almost never: there are some great market opportunities in cost-conscious markets, where customers are under-served or not served and cannot afford current offerings. Startups can offer a lower-margin substitute with fewer features at lower prices, staving off competition from established companies while gaining market share. Examples include the early personal computer market, transistor radios, and shared mobility (e.g. Uber). Harvard Business Review offers some additional insight.

Categories:

innovation

management

Posted

by

Thomas Hopper

on

Permanent link for Product Cost Modeling, Target Markets, and Pricing on April 14, 2023.