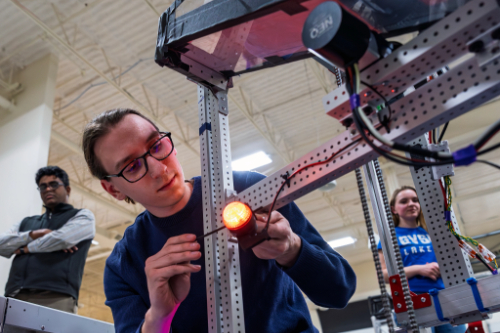

Face to face

Students are required to come to a GVSU campus for face-to-face instruction to complete the program requirements. Instruction is face-to-face (though some courses may be offered online in addition).

Hybrid

Students come to a GVSU campus more than one time a semester for face-to-face instruction, with additional class meetings online. Instruction is online and face-to-face.

Low Residency

Students come to a GVSU campus no more than one time a semester (e.g., one weekend, week, class session, etc.). Instruction is mostly online.

Online

Students are not required to come to any GVSU campus to complete the program requirements. Instruction is fully online.