Tariff Dashboard

Welcome to your resource for navigating the evolving landscape of U.S. tariffs in 2026. As trade policies shift rapidly, especially concerning key partners like China, Canada, and Mexico, staying updated is crucial for businesses and consumers. Our platform offers current updates on tariff implementations, reductions, and exemptions, providing clear insights into how these changes impact various industries. Whether you're seeking timelines, analysis of recent trade agreements, or guidance on compliance, our goal is to equip you with the knowledge needed to make informed decisions for your business in this dynamic trade environment.

Have Questions? Our team is here to help you navigate the complexities of today’s trade environment. If you have questions or need further assistance, please don’t hesitate to contact GVSU's Van Andel Global Trade Center team at [email protected] or 616-331-6811. We’re ready to support your international business goals.

Disclaimer: The information provided on this webpage is for informational purposes only and is intended to help businesses and individuals stay informed about recent developments in U.S. trade policy. This content does not constitute legal advice, nor should it be relied upon as such. For legal guidance specific to your business or situation, please consult a qualified trade attorney or compliance professional.

2025/2026 Tariff Actions – Summary Timeline

2026

February 2026

- **Feb 27: Current U.S. Tariff Rates

- 10% temporary tariff on imports from most countries

- Implemented under Section 122 of the Trade Act of 1974

- Intended to last up to 150 days

- The administration has indicated a goal of raising it to 15% in the near term

- Feb 20: De Minimis Duty-Free Treatment Suspension Extended

- The White House announced the continuation of the suspension of duty-free de minimis treatment for imports entering the United States.

- Shipments that would normally qualify for the $800 de minimis threshold may now be subject to applicable duties, taxes, and customs procedures.

- The policy is intended to prevent tariff evasion and improve enforcement of U.S. trade measures, particularly for low-value shipments entering through e-commerce channels.

- Importers and businesses relying on small parcel shipments should expect additional compliance requirements and potential cost impacts.

- Feb 20: Supreme Court Limits Presidential Tariff Authority Under IEEPA

- Many tariffs implemented during the second Trump administration may lack legal foundation

- The fate of an estimated $90 billion in collected tariffs remains uncertain

- Importers could pursue litigation seeking recovery of previously paid duties

- Existing trade deals negotiated under those tariff authorities may face renewed scrutiny

- Feb 6: U.S. Modifies Tariffs Related to Russian Threats

- The White House announced a change to U.S. trade duties originally imposed to counter threats from the Russian government.

- India committed to stop importing Russian oil and deepen defense cooperation with the U.S.

- As a result, the additional 25% tariff on Indian imports has been eliminated, effective February 7, 2026.

January 2026

- Jan 29: Executive Order Establishes New Tariff Authority Related to Cuba

-

The President issued an Executive Order declaring a national emergency related to actions by the Government of Cuba.

-

The order authorizes the U.S. to impose additional ad valorem tariffs on imports from countries that directly or indirectly supply oil to Cuba.

-

Tariff determinations will be made by the Departments of Commerce and State, based on findings related to oil shipments or support.

-

2025

December 2025

- Dec 31: U.S. Delays Tariff Increases on Imported Timber and Lumber Products

- This proclamation amends a prior Section 232 action on timber, lumber, and related wood product imports. It delays scheduled tariff increases until January 1, 2027, while keeping current tariffs in place. The extension allows additional time for the United States to continue trade negotiations with foreign partners to address national security concerns related to wood product imports.

- This proclamation amends a prior Section 232 action on timber, lumber, and related wood product imports. It delays scheduled tariff increases until January 1, 2027, while keeping current tariffs in place. The extension allows additional time for the United States to continue trade negotiations with foreign partners to address national security concerns related to wood product imports.

November 2025

- Nov 20: U.S. Modifies Tariffs on Imports from Brazil

-

The Administration has adjusted the scope of the 40% additional tariff imposed on certain Brazilian goods under Executive Order 14323.

-

Following recent U.S.–Brazil discussions, specific agricultural products are now removed from the tariff list.

-

The change applies to goods entered or withdrawn from warehouse on or after November 13, 2025.

-

- Nov 14: Modifying The Scope of the Reciprocal Tariff with Respect to Certain Agricultural Products

-

The White House has revised its reciprocal tariff program to exempt over 200 agricultural products—including coffee, tea, tropical fruit, cocoa, and spices—from additional duties. Effective November 13, 2025, these changes aim to stabilize food supply chains, reduce costs for importers and consumers, and align U.S. tariff policy with ongoing trade negotiations. This marks a significant narrowing of the tariff program introduced earlier this year under Executive Order 14257.

-

- Nov 4: U.S. Modifies Tariff Policy Under New Trade Arrangement with China

- An Executive Order was signed, adjusting reciprocal tariff rates in line with a new U.S.–China trade arrangement. Under the deal, China will suspend export controls on critical minerals, ease retaliation against U.S. semiconductor firms, and boost purchases of U.S. agricultural products such as soybeans and sorghum.

- In exchange, the United States will continue suspending heightened tariffs on Chinese imports until November 10, 2026. The Administration will monitor China’s compliance and may reimpose tariffs if commitments are not met.

Harmonized Tariff Schedule

Worldwide, product-specific tariffs

|

Product |

Status |

Ad Valorem Tariff Rate |

|---|---|---|

|

Aluminum & Aluminum Derivatives |

Implemented (effective Mar. 12, 2025) Increase Implemented (effective Jun. 4, 2025) U.S.-UK Economic Prosperity Deal (EPD) signed May 8, 2025. |

25% UK-origin products 200% Russian-origin products 50% All other countries 0% if smelt/cast in the U.S. |

|

Automobiles and Auto Parts |

Implemented (effective Apr. 3, 2025) - Automobiles Implemented (effective May 3, 2025) - Auto Parts |

25% on passenger vehicles, light trucks, and their parts 10% total on autos/parts from the UK 15% total on autos/parts from the EU, Japan, and South Korea |

|

Copper & Copper Derivative Products |

Implemented (August 1, 2025) |

50% on semi-finished copper products and intensive copper derivative products |

|

Timber, Lumber, and their Derivatives |

Implemented (October 14, 2025) |

10% softwood timber and lumber 25% upholstered wooden furniture for all countries (except UK, EU, Japan, South Korea) 10% on upholstered wooden furniture for UK 15% on upholstered wooden furniture for EU, Japan, and South Korea |

|

Steel & Steel Derivatives |

Implemented (effective Mar. 12, 2025) Increase Implemented (effective Jun. 4, 2025) U.S.-UK Economic Prosperity Deal (EPD) signed May 8, 2025. |

25% UK-origin products 50% All other countries 0% If melted/poured in the U.S. |

|

Medium and Heavy-Duty Vehicles |

Implemented (effective Nov. 1, 2025) |

25% MHDVs and their parts 10% Buses |

Universal Tariff

- **Feb 27: Current U.S. Tariff Rates

- 10% temporary tariff on imports from most countries

- Implemented under Section 122 of the Trade Act of 1974

- Intended to last up to 150 days

- The administration has indicated a goal of raising it to 15% in the near term

Main Exceptions Section 122 Tariffs

- USMCA-Qualified Goods

- Goods that qualify as originating under the United States-Mexico-Canada Agreement (USMCA) are exempt.

- This primarily applies to qualifying imports from Canada and Mexico.

- Goods Already Subject to Section 232 Tariffs

- Products already covered by Section 232 national-security tariffs are generally exempt from the Section 122 surcharge (to avoid tariff stacking).

- Examples include products like steel and aluminum.

- If Section 232 applies only to part of the value, the Section 122 tariff may apply to the remaining portion.

- Products Listed in Annex II of the Proclamation

- Critical minerals, Energy products and natural resources, Agricultural products, Pharmaceuticals and pharmaceutical ingredients, Certain electronics and IT products

- Certain HTS Chapter 98 Entries

- Many Chapter 98 special classification provisions remain exempt (e.g., U.S. goods returned, certain government or temporary imports), though some repair/processing provisions still have duties applied to the foreign value.

- “Goods in Transit” Exception

- Imports were exempt if:

- Loaded onto a vessel and in transit to the U.S. before 12:01 a.m. ET on Feb 24, 2026, and

- Entered for consumption before 12:01 a.m. ET on Feb 28, 2026.

- Imports were exempt if:

Country Specific Tariffs

|

Country |

Status |

Ad Valorem |

|---|---|---|

|

Afghanistan |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Algeria |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

30% |

|

Bangladesh |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

20% |

|

Bolivia |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Bosnia and Herzegovina |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

30% |

|

Botswana |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Brazil |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

40% |

|

Brunei |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

25% |

|

Cambodia |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

19% |

|

Cameroon |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Canada |

United States Implemented (effective Mar. 4, 2025; adjusted Mar. 6, 2025)

Canadian Countermeasures Announced: Effective Apr. 9, 2025: |

0% Goods entered duty-free under the USMCA, (effective Mar. 7, 2025) 10% Energy or energy resources 10% Potash that is not entered duty-free under the USMCA, (effective Mar. 7, 2025) 35% All other products except energy and potash |

|

Chad |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

China |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025)

Chinese Tariff Countermeasures Announced: |

10% on all goods 20% total, including Hong Kong- origin goods

|

|

Costa Rica |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Côte d’Ivoire |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Cuba |

Reciprocal tariff exemption: imports not subject to reciprocal tariffs at this time |

|

|

Ecuador |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

10% |

|

EU |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025)

EU Tariff Countermeasures Announced: |

0% Goods with Column 1 Duty Rate > 15%

|

|

France |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Germany |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Ghana |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Guatemala |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

10% |

|

Guyana |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Iceland |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

India |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

25% Exemptions for certain products, including agricultural products |

|

Indonesia |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

19% |

|

Iraq |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

35% |

|

Ireland |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Israel |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Italy |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Japan |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Jordan |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Kazakhstan |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

25% |

|

Laos |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

40% |

|

Libya |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

30% |

|

Liechtenstein |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Madagascar |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Malaysia |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

19% |

|

Mexico |

Implemented (effective Mar.4, 2025; adjusted Mar. 5, 2025) |

0% Goods entered duty free under the USMCA, effective Mar. 7, 2025 ENDED - 25% All other products except automobiles and automobile parts subject to Section 232 tariffs |

|

Moldova |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

25% |

|

Mozambique |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Myanmar (Burma) |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

40% |

|

Nauru |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Namibia |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

New Zealand |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Nicaragua |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

18% 0% for goods that are originating under CAFTA-DR |

|

Nigeria |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

North Korea |

Reciprocal tariff exemption: imports not subject to reciprocal tariffs at this time |

|

|

Norway |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Pakistan |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

19% |

|

Papua New Guinea |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Philippines |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

19% |

|

Serbia |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

35% |

|

South Africa |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

30% |

|

South Korea |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

0% for all products with a Column 1 Duty Rate ≥ 15% 15% minus Column 1 Duty Rate for all products with a Column 1 Duty Rate < 15% |

|

Spain |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Sri Lanka |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

20% |

|

Switzerland |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

39% |

|

Syria |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

41% |

|

Taiwan |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

20% |

|

Thailand |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

19% |

|

Trinidad and Tobago |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Tunisia |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

25% |

|

Turkey |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Uganda |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

United Kingdom |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

10% |

|

Venezuela |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

|

Vietnam |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

20% |

|

Zimbabwe |

ENDED- Reciprocal tariff: Implemented Aug. 7 (announced July 31, 2025) |

15% |

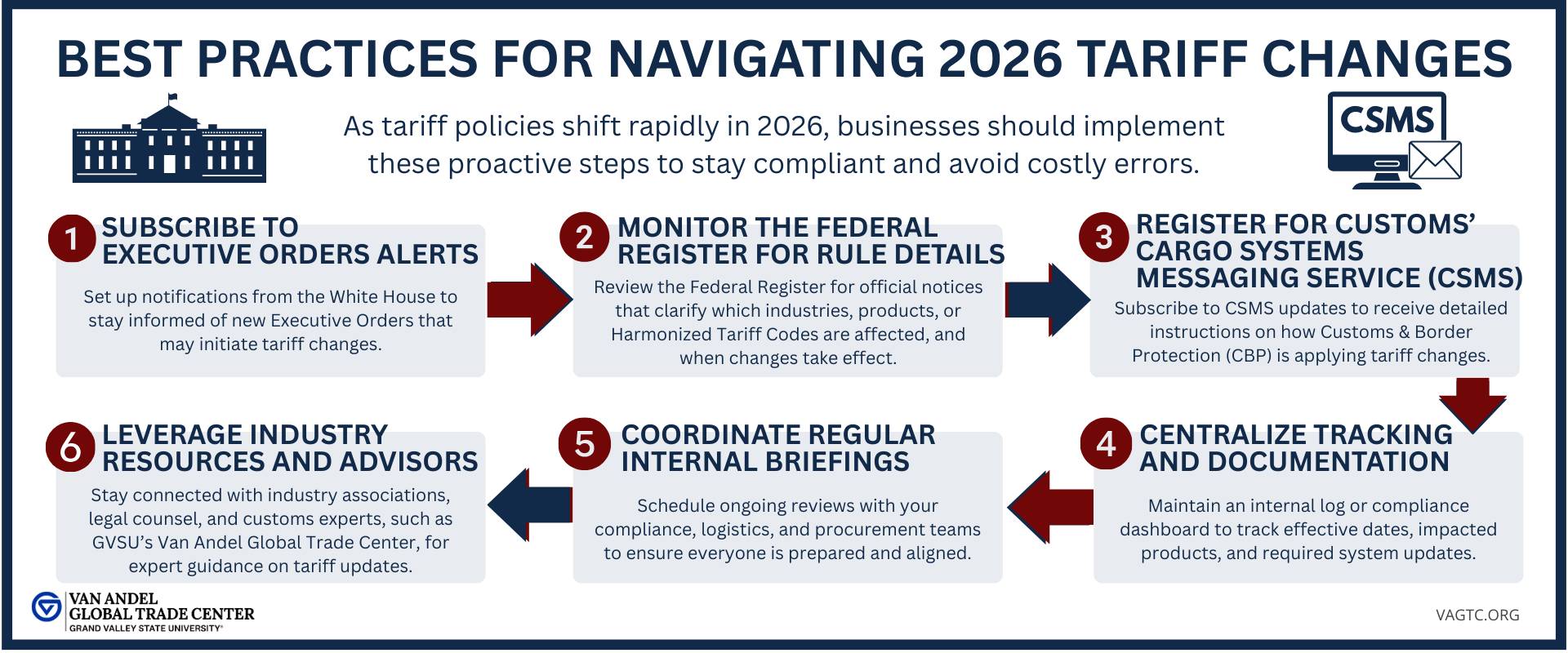

Additional Resources for Tariff Monitoring

This page was created and is updated with the useful resources below.

- Executive Orders - Presidential Actions from the White House

- The Federal Register

- Cargo Systems Messaging Service (CSMS) Webpage

- New Tariff Requirements for 2025 - CBP (PDF)

- Reciprocal Import Tariffs Webpage from Sandler, Travis & Rosenberg, P.A. (ST&R)

- Trump 2.0 tariff tracker Webpage from ReedSmith

- Office of the United States Trade Representative Website

- Tariff Overview- Posted February 2026

Disclaimer: The content provided on this webpage is for informational purposes only and does not constitute legal or professional advice. For guidance specific to your organization, please consult a licensed trade compliance expert or legal advisor.