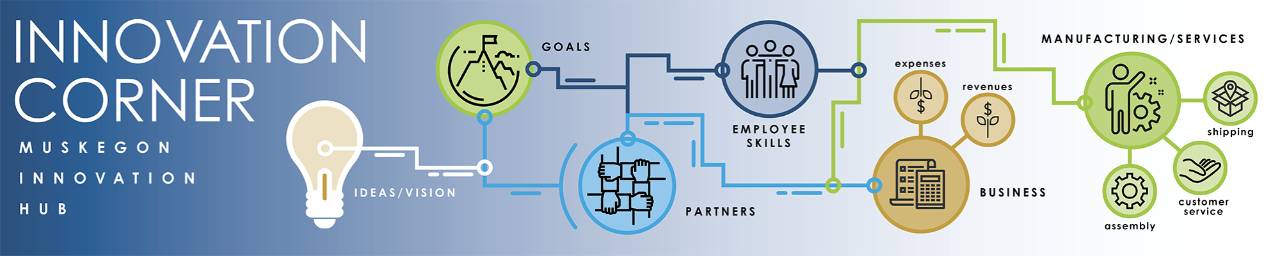

Innovation Corner

Permanent link for Ways to Fund a Startup on June 16, 2023

There are many ways that entrepreneurs can raise money for their startup, including:

-

Bootstrapping:

This involves using personal savings, credit cards, sales revenue,

and other financial resources to fund the business.

- Self-funding

- Commitment to major customer

- Crowdfunding: Raise small amounts of money from a large number of people, typically through an online platform. Crowdfunding is not only a potential source of non-dilutive capital, but is a great way to cheaply validate your business idea, and has become the most popular means of funding new businesses.

- Angel investors: These are individuals who invest their own money in exchange for ownership equity in the company.

- Venture capital: This is funding provided by firms or funds to startups in exchange for ownership equity. In Michigan, the Michigan Venture Capital Association is a great resource for connecting with both Angels and VCs.

- Bank loans: loans provided by banks or other financial institutions to businesses. Usually they'll require a business plan, a business bank account, and some collateral.

- Incubators and accelerators: These organizations provide funding, mentorship, and other resources to help startups grow. Famous examples are Y Combinator and Tech Stars.

- Government grants: These are funds provided by government agencies to support the development of new technologies or businesses. Usually they are available for businesses in specific industries that the government is interested in strengthening and growing.

- Partnering or licensing: This involves partnering with another company or licensing your technology to them in exchange for funding. Often one partner provides critical intellectual property or contacts while the other partner provides funding.

I'll cover each of these in more detail in future blog posts.

Categories:

entrepreneurship

funding

management

Posted

by

Thomas Hopper

on

Permanent link for Ways to Fund a Startup on June 16, 2023.

Permanent link for Predicting Your Business' Break-even Point on June 9, 2023

The break-even point is an important financial target that every founder should understand. It is the point at which your total revenue equals your total expenses, and you start making a profit. In other words, it's the point where you break even. If you sell less than your break-even point, you'll lose money, while if you sell more, you should be turning a profit.

To calculate the break-even point, you need to know two things: your fixed costs and your variable costs. Fixed costs are expenses that don't change, such as rent or salaries, while variable costs are expenses that vary with your sales volume, such as production costs or commissions.

Once you have identified your fixed and variable costs, you can use the following formula to calculate your break-even point:

Break-even point = fixed costs / (price - variable cost per unit)

For example, if your fixed costs are $50,000, and your variable cost per unit is $10, and you sell your product for $30 per unit, your break-even point would be:

Break-even point = $50,000 / ($30 - $10) = 2,500 units

This means that you need to sell 2,500 units of your product to cover your fixed and variable costs and break even.

Knowing your break-even point is critical because it can help you make informed decisions about pricing, production volume, and marketing expenses. By understanding how many units you need to sell to break even, you can set sales targets and adjust your strategy to achieve profitability.

FindLaw has a great breakdown of how to do a break-even analysis before you start your business.

Categories:

entrepreneurship

funding

management

Posted

by

Thomas Hopper

on

Permanent link for Predicting Your Business' Break-even Point on June 9, 2023.

Permanent link for Planning for Cash Flow on June 2, 2023

Cash flow is another important financial metric that founders should understand when determining how much money their startup needs. It refers to the amount of cash that flows in and out of your business during a specific period, usually a month. Positive cash flow is how businesses pay their bills, so predicting your cash flow is crucial to ensuring that your business will be viable.

Cash flows are normally presented on a cash flow statement, and a good financial projections template will have one that automatically fills in for you from your projections of revenues and expenses.

To calculate your cash flow, you need to know the inflows and outflows of cash for a given period. Inflows of cash can include sales revenue, loans, or investments, while outflows of cash can include expenses like salaries, rent, and utilities.

You can calculate your cash flow for each planning period (typically a month, a quarter, or a year) using the following formula:

Net cash flow = sum of inflows of cash - sum of outflows of cash

For example, let's say that your startup received $50,000 in sales revenue and $20,000 in loans during the month, and your expenses, including salaries, rent, and utilities, totaled $60,000. Your cash flow for the month would be:

Cash flow = ($50,000 + $20,000) - $60,000 = $10,000

A positive cash flow means that you have more cash coming in than going out during the period. This is what you want; it makes it possible for you to pay the bills. On the other hand, a negative cash flow means that you have more cash going out than coming in, which will lead to using debt (e.g. credit cards) to pay bills and might ultimately have to file for chapter 11 bankruptcy in the business. When your cash flow prediction is negative, you should go back to your assumptions about pricing and what is needed to achieve desired sales. You'll need to find ways to either increase revenue or decrease costs.

Trovata offers a lot more detail on how to predict cash flow before starting your business, and why it's important.

Categories:

entrepreneurship

funding

management

Posted

by

Thomas Hopper

on

Permanent link for Planning for Cash Flow on June 2, 2023.

Permanent link for Estimating Operating Expenses on May 26, 2023

Operating expenses are the second of three major sources of financial expenses in your business. Operating expenses are the ongoing costs of running your business, regardless of whether any product is sold.

To estimate your operating expenses, start by making a list of the items and expenses you will need to run your business. Then, research the cost of each item and expense to arrive at an accurate estimate. Be sure to include any recurring expenses, such as monthly rent or utility bills.

Here are some common types and categories of operating expenses that you should consider when estimating your startup costs:

-

Rent: This includes the cost of leasing or renting office space or a storefront.

-

Utilities: This includes the cost of electricity, water, gas, and other utilities needed to operate your business.

-

Salaries and wages: This includes the cost of paying your employees, including payroll taxes and benefits.

-

Marketing and advertising: This includes the cost of promoting your business, including social media ads, print ads, sponsored content, and travel to trade shows or key customers.

-

Supplies and inventory: This includes the cost of purchasing materials and supplies needed to provide your products or services.

-

Insurance: This includes the cost of insuring your business against liability, property damage, and other risks.

-

Professional fees: This includes the cost of legal and accounting services.

When estimating your operating expenses, be sure to include all related costs, such as taxes, shipping fees, and other related expenses. It's also important to consider any seasonal fluctuations in your expenses, such as higher heating bills in the winter.

Once you have estimated your operating expenses, you can use this information to determine your cash flow needs and create a budget for your business. You should aim to have enough capital to cover at least six months of operating expenses, and ideally a year or more.

Categories:

entrepreneurship

funding

management

Posted

by

Thomas Hopper

on

Permanent link for Estimating Operating Expenses on May 26, 2023.

Permanent link for Estimating COGS on May 19, 2023

In planning for and tracking the cost of doing business, we often find that it's useful to divide the costs into two categories: fixed costs and variable costs.

Variable costs are the costs that increase with number of units sold. If sell twice as much, our variable costs roughly double. For example, if you were making a single iPhone, you would have to spend money for one screen and one battery pack. If you made two iPhones, you would need to spend twice as much to have two screens and two battery packs. Screens and battery packs are part of your variable costs.

A major component of variable costs is your costs of goods sold, or COGS.

Estimating COGS will help you understand your business' financial variability, guide you in pricing strategy, and provide a basis for establishing investor confidence.

COGS for Product-based Businesses

For product-based businesses, COGS are sometimes referred to as the production costs, and are expenses that are directly related to the production and distribution of your product. These costs can include raw materials, labor, shipping, and packaging. Understanding your production costs is crucial to determine how much money your startup needs to operate and become profitable.

Calculating actual COGS is pretty straight-forward:

COGS = Beginning Inventory + Purchases − Ending Inventory

(formatted equation)

For entrepreneurs looking to start a business, this takes a bit more work. To estimate your future production costs, you need to add up all the direct costs involved in producing your product. These can include:

-

Raw materials: the cost of materials that go into your product, such as components or ingredients.

-

Labor: the cost of the workforce involved in manufacturing or assembling your product. May sometimes include the portion of sales labor directly attributable to selling each unit of a product.

-

Shipping and handling: the cost of transporting your product to your customers or warehouses.

-

Packaging: the cost of materials used to package your product, such as boxes or bags.

Once you have calculated your production costs, you can use them to determine the price of your product and the minimum amount of revenue you need to generate to cover your costs.

For example, if your production costs for a unit of your product are $20, and you want to have a gross profit margin of 30%, you would need to price your product at:

Price = COGS / (1 - Profit margin)

(formatted equation)

Price = $20 / (1 - 0.30) = $28.57

This means that you would need to sell your product for $28.57 to cover your COGS and earn a 30% profit margin.

Knowing your production costs is essential because it can help you make informed decisions about pricing, product design, and manufacturing processes. By understanding your costs, you can optimize your production processes and pricing strategy to maximize profits and grow your startup.

COGS for service-based businesses

While the costs of goods sold (COGS) are typically associated with manufacturing businesses, service-based businesses also have costs that are directly related to providing their services. These costs can include wages, supplies, and overhead expenses, among others. Understanding your service-based COGS is crucial to determine how much money your startup needs to operate and become profitable.

To calculate your service-based COGS, you need to identify all the direct costs associated with providing your services. These can include:

-

Wages: the cost of paying your employees who provide the services.

-

Supplies: the cost of any materials or supplies used to provide the services, such as software or cleaning supplies.

-

Travel expenses: if your business requires travel to provide services, such as a consulting or delivery service, then you need to account for expenses like gas, car rentals, or airfare.

-

Overhead expenses: these are the costs of running your business that are not directly related to providing services, such as rent, utilities, and insurance.

As with production-based COGS, once you have identified your service-based COGS, you can use them to determine the price of your services and the minimum amount of revenue you need to generate to cover your costs.

Categories:

entrepreneurship

funding

management

Posted

by

Thomas Hopper

on

Permanent link for Estimating COGS on May 19, 2023.

Permanent link for Estimating Startup Costs on May 12, 2023

As a founder, determining your startup costs can be both a daunting task and critical to your success. Startup costs include all the expenses you will incur to get your business up and running, including fixed assets, operational expenses, marketing and advertising, legal and professional fees, and more. Accurately estimating your startup costs is essential to ensure that you have enough capital to launch your business and keep it running until it becomes profitable.

To determine your startup costs, you should start by making a comprehensive list of all the items and expenses you will need to launch your business. Here are some common categories of expenses you should consider:

-

Fixed assets: These are the physical assets you will need to operate your business, such as real estate, computers, furniture, equipment, and vehicles. The value of fixed assets should be depreciated over each item's useful life and, where applicable, that depreciated value deducted from your tax burden.

-

Operational expenses: These are the ongoing costs of running your business, such as rent, utilities, insurance, and salaries. These expenses are deducted as you incur them.

-

Marketing and advertising: These are the expenses associated with promoting your business, such as social media ads, print ads, and sponsored content. These expenses can be deducted in the year they are incurred.

-

Legal and professional fees: These are the expenses associated with setting up your business, such as legal fees, accounting fees, and consulting fees. These expenses can be deducted in the year they are incurred.

For each item above, estimate your cost, being sure to include all taxes, shipping costs, and other related expenses. If you are unsure about the cost of an item or expense, research it and make the best-educated guess that you can. It's not important to have perfect estimates, but to have estimates that you can plan around.

After you have estimated your startup costs, you can then determine how much initial financing you will need to launch your business. Additional financing may be needed to cover post-startup operation of your business, until you're earning more cash than you're spending.

SCORE offers a nice financial projections template to help you get started.

Categories:

entrepreneurship

funding

management

Posted

by

Thomas Hopper

on

Permanent link for Estimating Startup Costs on May 12, 2023.

Permanent link for Founders get this wrong on May 5, 2023

Starting a new business venture can be an exciting but challenging experience. Entrepreneurs are constantly looking for money to run their businesses, and most feel the pain of not having enough money.

I find myself frequently advising entrepreneurs to test their business ideas early and often—to fail fast—and one of the earliest and easiest ways to test a new idea is to prepare a plan with detailed financial projections. It's a cheap way to figure out what you need to start your business, and what you'll need to keep it running. In this and several following blog posts, we will explore how founders can determine how much money their startup needs to achieve success.

1. Conduct Market Research

The first step in determining how much money a startup needs is to conduct thorough market research, as we've explored in past blog posts. Understanding the market, competitors, and customer behavior will help you estimate the costs associated with acquiring customers, launching products or services, and running your business. Market research can also help you determine how much revenue you can expect to generate in the first year of operations.

2. Determine Startup Costs

Once you have conducted market research, you can start determining the costs associated with launching your business. These startup costs are what you will spend before you start selling and delivering your product or service. Startup costs can include expenses such as legal fees, permits, licenses, rent, equipment, supplies, inventory, and marketing expenses. They can also include capital expenses like real estate, manufacturing equipment, furniture, and computers.

3. Estimate Costs of Goods Sold

Costs of goods sold (COGS), sometimes known as production costs, are expenses that are directly related to the production or creation of your product. These costs can include raw materials, labor, shipping, and packaging, and will scale directly with your sales volume. When you sell twice as many items, your total COGS will be twice as much.

While the COGS are typically associated with manufacturing businesses, service-based businesses also have costs that are directly related to providing their services. These costs can include wages, supplies, and travel expenses directly associated with delivering a service.

4. Estimate Other Operating Costs

In addition to startup costs and COGS, you need to estimate the ongoing operating costs associated with running your business. Operating costs can include salaries, wages, benefits, rent, utilities, insurance, taxes, advertising and marketing, and maintenance costs. These costs will vary depending on the type of business you are starting and the location, and they do not typically scale with the amount of goods sold.

5. Calculate Cash Flow

Cash flow is the amount of money that flows in and out of your business each month. Understanding your cash flow is essential to determine how much money you need to have enough cash on hand to cover expenses and pay bills.

6. Determine Break-Even Point

The break-even point is the point at which your revenue covers your expenses. The break-even point will tell you how much revenue you need to generate to cover your costs.

7. Finish the Financial Plan

Once you have estimated your startup costs, operating costs, cash flow, and break-even point, you nearly have a complete financial plan for your startup. Add projected income (a.k.a. profit and loss) statements to calculate profit margins and balance sheets for the first year of operations, and you're done! A detailed financial plan can help you make informed decisions about how to allocate resources and manage cash flow.

So what do founders get wrong? Too often, when they make their ask for investment--whether from angels or VCs, or at a pitch competition, or just for a bank loan--they haven't done the work above to know how much they need and when they need to spend it. Haje Jan Kamps has some additional insights for you.

Categories:

entrepreneurship

funding

management

Posted

by

Thomas Hopper

on

Permanent link for Founders get this wrong on May 5, 2023.