Trust Survey

Logo of "The Trustworthiness of Michigan's Largest Publicly-Held Companies: A Public Perception Survey"

A Report from the Koeze Business Ethics Initiative at the Seidman College of Business, GVSU

Authors: Michael DeWilde & Kevin Lehnert

Business, as a social institution that creates products, services, jobs and wealth (and often enough purpose for those who work within it), is necessarily predicated on trust. While there are of course many government-mandated oversights, laws and regulatory practices that act as a check on businesses that would violate the public’s trust, most businesses realize it is in their own self-interest to be trustworthy. Being trustworthy means, at the least, that they are who they say they are, that they stand behind their products and services, that they strive for quality and competency and transparency, keep their promises, and deal fairly with one another, employees, vendors and customers. In the words of the philosopher Robert Solomon, the real currency of business is not money, it is trust. Without money there would be others ways to deal and bargain, barter and trade. But without some degree of trust? Why would – how could - anyone engage at all? This is perhaps not a widely shared perception in our cynical age, but nonetheless remains a foundational truth of how people operate in the commercial world. We have not the time, energy, competencies or resources to verify each and every one of our transactions. We trust that companies are not only looking out for themselves but again, even if only out of self-interest, for us as well. That the food we buy, the clothes, the cars, the toys for our children, the appliances, etc. are not only means to profit for those who provide them (we do not begrudge them their profit for taking the risks they do to manufacture these goods) but also sources of pride, expressions of good faith and mutual dependency. It is one thing to “trust” that a company will churn out a profit, but quite another to trust that that profit is being secured in ways that are fair to employees, consumers, the environment, and so on. While we do not expect altruism from business, we do expect value, and continue to be (rightfully) dismayed when the value propositions are found to be undermined in some way. We want to – need to – trust that businesses recognize their importance not just as producers or providers but as social institutions that help all of us flourish. They, in turn, need to earn our trust by proving themselves over time worthy of our continued patronage and respect.

To get a better sense of how Michigan’s largest publicly-held companies - companies worth billions of dollars and hundreds of thousands of jobs in our state - are doing relative to trustworthiness, the Koeze Business Ethics Initiative at the Seidman College of Business at Grand Valley State University has embarked on a three-year study seeking to answer some fundamental questions: 1) how does the public in Michigan perceive these large companies? 2) what will a “deep-dive” scholarly investigation of these companies practices reveal (i.e., looking at employee relations, corporate governance, vendor relations, risk management, environmental stewardship, etc.)? and 3) what courses of action might these companies currently be on, or take, to improve their trustworthiness?

In this initial report we are disclosing the results of a “Trustworthiness Survey” we administered to 2400 Michigan residents. Respondents represented all demographics in Michigan and from most geographical regions. They were asked to fill out a survey that asked them how familiar they were with representative firms from the top twenty-five, and then to rank the firms, using a Likert Scale, from 1-5 on the following two questions:

- I believe (Top 25 firm X) to be trustworthy 1 2 3 4 5

- I believe (Top 25 firm X) to have integrity 1 2 3 4 5

Along with these three questions (familiarity, trustworthiness, integrity) respondents also answered a series of questions about age, race, income, gender, education, religion and political affiliation.

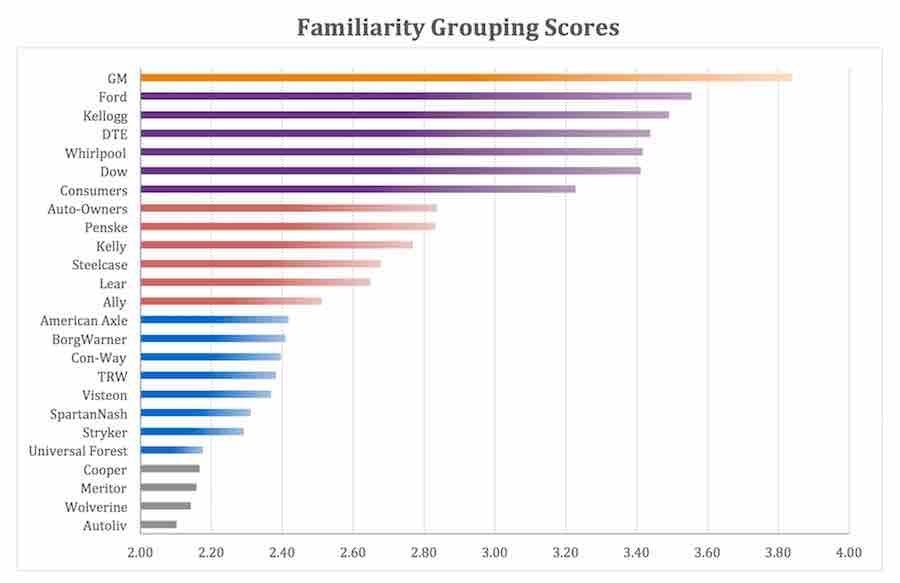

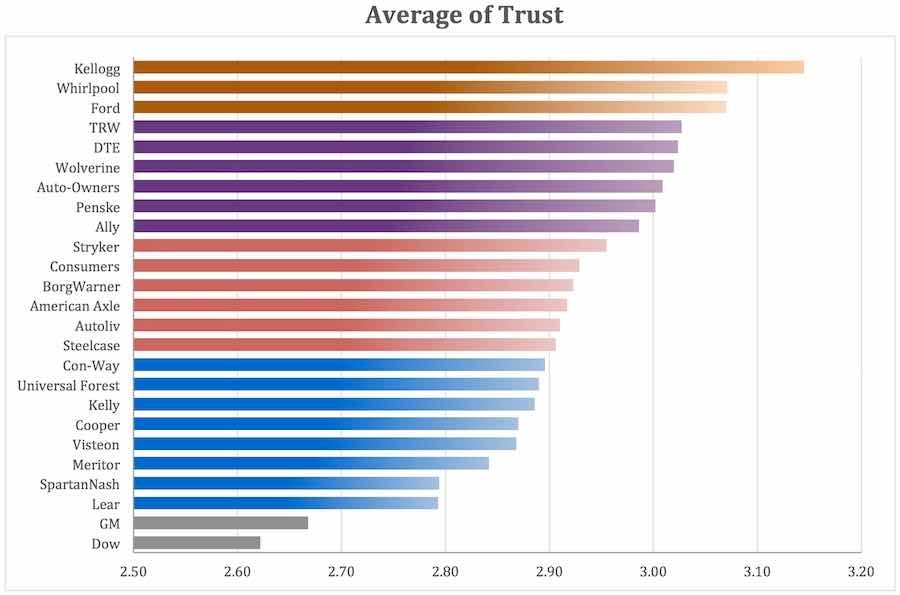

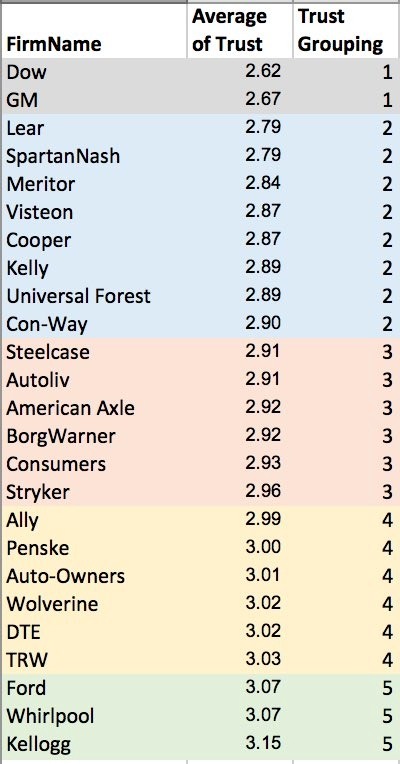

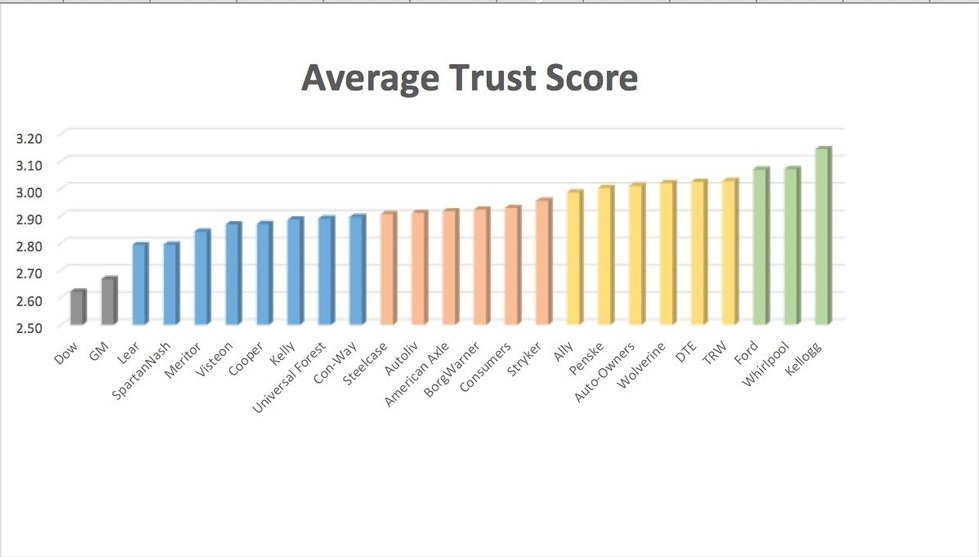

Results from this survey were then collated and familiarity weighted to produce a snapshot of how Michigan’s largest publicly-held firms are perceived by the Michigan public relative to trustworthiness (see graph).

The companies were placed linearly into five color-coded groups as their scores dictated, least trusted to most trusted. The same process was used for familiarity. Separations of groups were based on statistically significant variations.

While lengthy commentary on the results awaits a more in-depth analysis of the companies (the analysis is currently underway), we do take notice of the public’s tendency to place most of the companies in the “3” range. This suggests to us, at least preliminarily, three possible interpretations: 1) that the public is not aware enough of most of the firms to make an informed judgment and so defaults to a middle ground assessment; 2) the public is aware of the firms but not simply does know whether to trust most of them or not; 3) the public is aware and informed and knows to trust these firms exactly to the point expressed on the scale.

This survey is but the first step in the process of us developing a comprehensive Trustworthiness Index. The Index, as mentioned above, will be a “deep dive” look at each of these companies using publicly available databases and, where available, surveys and interviews the companies themselves allow us to conduct. The results of the Trustworthiness Index will be available fall of 2017. General results of the Index will be reported for the public at large through news media and this site. Detailed specifics and analysis of the "deep dive" in the Index will be made available to the companies in question for a fee. CMS has already contracted with us for this analysis of their company.

"We at Consumers Energy strive to hear what others have to say. That’s an important part of building trust with the people we serve and providing them with the confidence that we care about their concerns. We hope that taking part in the Trustworthiness Index will help us better understand how our customers see us and provide us with insights to help us improve our performance." ~ Christina DuVall, Chief Compliance Officer, CMS

For questions please contact Michael DeWilde, the director of the KBEI, at [email protected]

Research Methodology

The purpose of this survey was to investigate how much trust Michigan consumers place in their state-based businesses. Subjects were presented with a survey that randomly asked them about 3 of the top* 25 publicly-traded Michigan**firms and then one additional firm. Thus each subject rated four firms total. Using a 5 point Likert scale, subjects rated the firms on how familiar they were with the firm, how trustworthy that firm was and if the firm had integrity. Trust was then measured by taking the average of trustworthiness and integrity measures. We then measured demographic data.

Data was collected via a random intercept paper survey for approximately 10% of the sample population and then via an on-line survey utilizing a cross section of Michigan residents. Significance testing showed no differences between the two sample populations. The total sample population was 2099 individual subjects who provided 9745 ratings. Due to missing or invalid data, or subjects not being Michigan residents we removed 146 subjects for an effective sample of 1954, with 7669 individual firm ratings.

The sample population was a cross-section of Michigan residents with 12.06% being <24 years old, 39.73% 25-44, 35.18% 45-64 and 10.03% >65. The population was 48.38% male, 51.62% female; 56.78% had a college degree, while 1875% held a post-graduate degree. Political affiliation was an open-ended question with 25.74% clearly identifying as Democrat, 20.13% clearly identifying as Republican and 54.13% identifying as being part of another party, not being part of a party, undecided, or not clearly identifying as one of the two other parties. 84.47% identified as Caucasian, 7.21% Black or African American, 2.43% Hispanic or Latino, .96% as Native American, 2.75% as Asian or Pacific Islander, and 2.17% identifying as Other. Religion was another open-ended question with 5.57% clearly identifying as Agnostic, 21% as Catholic, 46.02% as Christian, but not Catholic, 22.5% as Atheist or not having a religion, and 4.91% as Other. Income levels ranged from 18.89% < 25,000; 25.32% 25-50K, 22.75% 50-75K, 14.69% 75-100K, 7.99% 100-125K and 10.36% > 125,000 per year. Sample population was across the state with 12.19% from the Bay area, 17.08% from the Grand Rapids area, 11.07% from the Kalamazoo region, 43.9% from the Metro region, 4.56% from the North region, 2.77 from the Upper Peninsula, and 8.43% from the University region.

Statistical Analysis of Covariance (ANCOVA) tests were run to determine the difference in levels of trust for each firm. We controlled for age, gender, education, political affiliation, ethnicity, religion, income, region and familiarity with familiarity being the strongest control and linked very closely to trust.

*based on revenue

**Businesses headquartered in Michigan