Tax Information & Sprintax

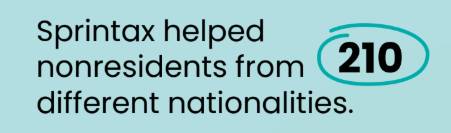

GVSU's International Student Services teams up with Sprintax to provide easy-to-use tax preparation software designed for non-resident students and scholars in the U.S. The ISS Team (and all other university staff) are not qualified nor allowed to provide individual tax advice.

The information on this page is for the 2025 tax year. In the US, we file taxes for the previous calendar year. So in 2026, we are filing for January 1 - December 31 of 2025.

How to File

Create a Sprintax Account

Enrolled International Students will receive an email from ISS providing you with a link to Sprintax to set up your account as well as your unique code to use on Sprintax. This unique code will cover the costs of the Federal tax return and 8843 at no cost for the first 250 students. Open your new Sprintax account by creating a UserID and password or if you have an existing account on Sprintax you can log in using your existing credentials.

After you login to Sprintax, it will ask you a series of questions about the time you have spent in the United States and in which immigration status, looking back over a period of years. Sprintax will then determine your tax status. If it determines that you are a "nonresident alien" (NRA) for federal tax purposes, you can continue and will respond to a series of guided questions. Sprintax will complete and generate the forms you need to print, sign, and mail to the IRS (Internal Revenue Service) for Federal and, depending on your situation, State filing. If it determines you are a resident alien for federal tax purposes, you won't be able to continue using the software.

Who must file tax forms for 2025 tax season?

If you were physically in the U.S. in F or J status anytime between January 1 - December 31, 2025 you're obligated to send one form, Form 8843, to the U.S. tax agency IRS (Internal Revenue Service), even if you had no income. For the 2025 tax season, if you earn over $0 of US source income, you may need to file a federal tax return with the IRS. Depending on your individual circumstances, you may also need to file a state and city tax return(s).

Click on the button to register for helpful, free, tax info sessions

- OR - watch a recorded webinar to hear "All You Need to Know About Nonresident Tax" from the Sprintax team

Sprintax recently published a new blog on this topic and the difficulties that many students face when applying for an ITIN while outside the US

J-1 Tax Webinars

Learn about your tax filing obligations as a J1 participant who was present in the USA. We will cover topics such as who must file, residency for tax purposes, FICA taxes, implications of not filing/filing incorrectly, an overview of using Sprintax and much more in this educational webinar. Register for helpful, free, J-1 tax info sessions.

No Income?

All individuals present in the U.S. on F-1, F-2, J-1, or J-2 visa status must file Form 8843 even if they received NO income during 2025. Form 8843 must be filed regardless of the individual’s age and even if the individual is not required to file a U.S. income tax return (Form 1040NR or Form 1040NR-EZ). If this is your situation, you can use the Sprintax to file the 8843.

Students Who Don't Have an SSN Need an ITIN to File Taxes

International students who do not work on campus and do not meet the Social Security Administration's evidence requirements for an SSN, may apply for an Individual Taxpayer Identification Numbers (ITIN) from the Internal Revenue Service if they have a valid tax reason for needing an ITIN, as explained in the Form W-7 instructions.

Read and understand ITIN here. Those who are not eligible for an SSN can apply for an ITIN here.

State & City Tax Returns

GVSU has agreed to cover the cost of the Federal 8843 filing documents for the first 250 GVSU International Students to use Sprintax's software. Sprintax's software can produce both the Federal and State filing documents. You can choose to purchase the State filing document in addition to the Federal document. However, City filing forms are not created using Sprintax's software. Please visit the Michigan Department of Treasury website for more information on State and City filing requirements and forms.

Beware of scams!

Please note- there are many "scams" about taxes, tax collecting, etc. The IRS will NEVER contact you by telephone. Details here.

Disclaimer

GVSU's ISS (International Student Services) and the school are NOT permitted to assist any student/scholar with any IRS tax form preparation or tax related questions. The information provided is intended for your benefit. Any questions or concerns should be directed to Sprintax, a certified tax preparer or a local IRS field office.

Need Sprintax Support?

If you need help while using Sprintax, please make use of the following:

- 24/7 Live Chat Help

- Refer to their FAQs

- Email at [email protected]

- Sprintax YouTube Videos

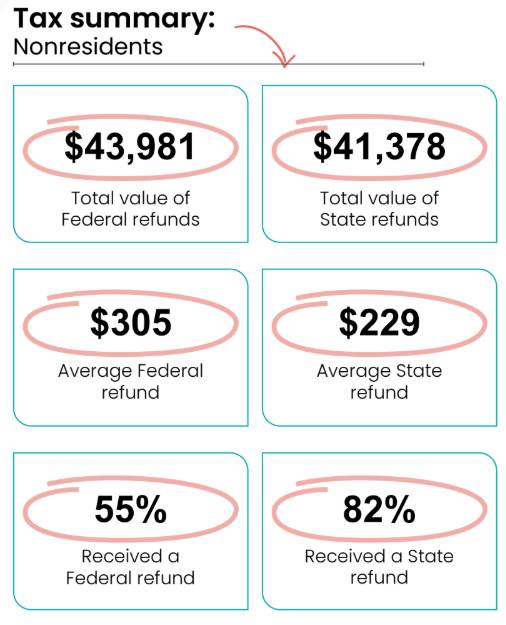

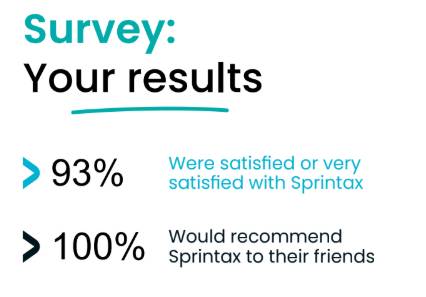

What was the benefit to GVSU iStudents during the 2024 tax year?