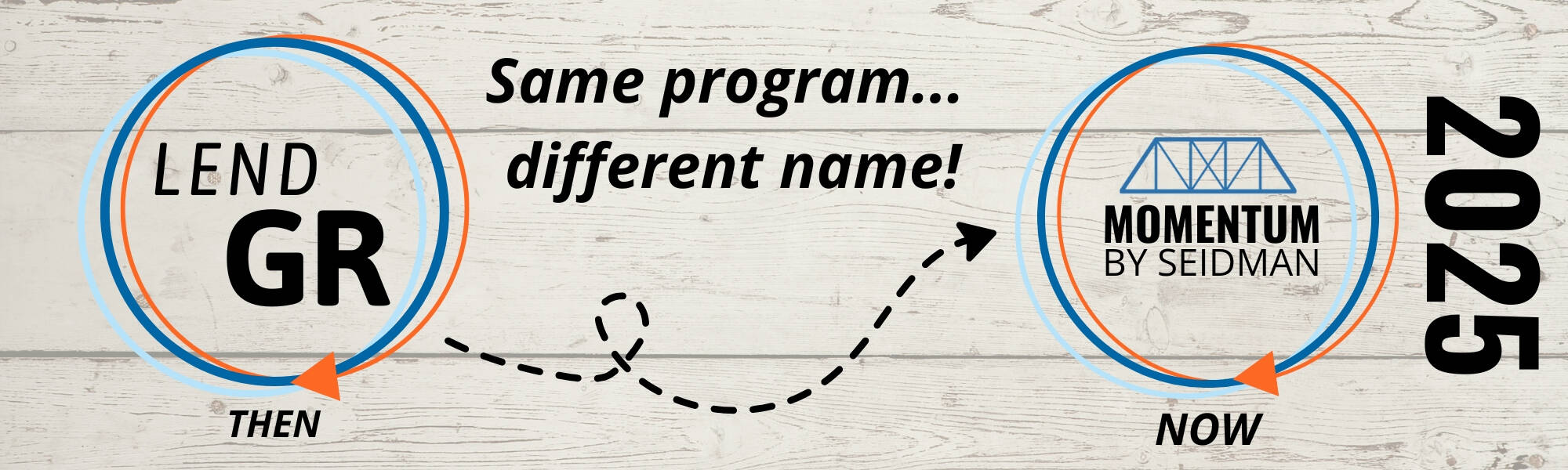

Momentum by Seidman

(Formerly known as LendGR)

Momentum by Seidman is a student-led consulting program that partners with growing businesses in the Grand Rapids area to provide free, high-quality support in areas like marketing, finance, and business strategy. Powered by the Richard M. and Helen DeVos Center for Entrepreneurship & Innovation, part of the Seidman College of Business at Grand Valley State University, the program connects passionate student consultants with local entrepreneurs who may not have the resources to hire professional services. Each business is paired with a student for 25 hours of dedicated work, resulting in tailored deliverables designed to meet their unique goals. Whether it's a branding refresh, financial plan, or strategic roadmap, Momentum helps businesses move forward with purpose. This initiative empowers students to apply their skills in real-world settings while giving back to the community. At its core, Momentum by Seidman is about progress, partnership, and possibility.

Driven by Students. Designed for Growth.

Momentum Client Testimonies

“I'm really happy with the help I received finding alternate sources of funding apart from just loans.”

Program is amazing, Tatiana did such an amazing job capturing the vibe that I was looking for.”

“Sophie was attentive, asked clarifying questions and exceeded my expectations. Her work boosted my confidence in my business and marketing. She provided me everything I asked for and more!”

“Kennedy was amazing. She did an awesome job and was very professional.”

“Jade was great and I'm so thankful for the help she was able to provide.”

Contact Us

Have questions about Momentum by Seidman? Send us a message!