Capitol Hill hearing draws from USA Today project investigated by faculty member, students

A September 25 hearing on Capitol Hill addressing reverse mortgages drew on findings of an investigative journalism piece that a Grand Valley faculty member co-authored.

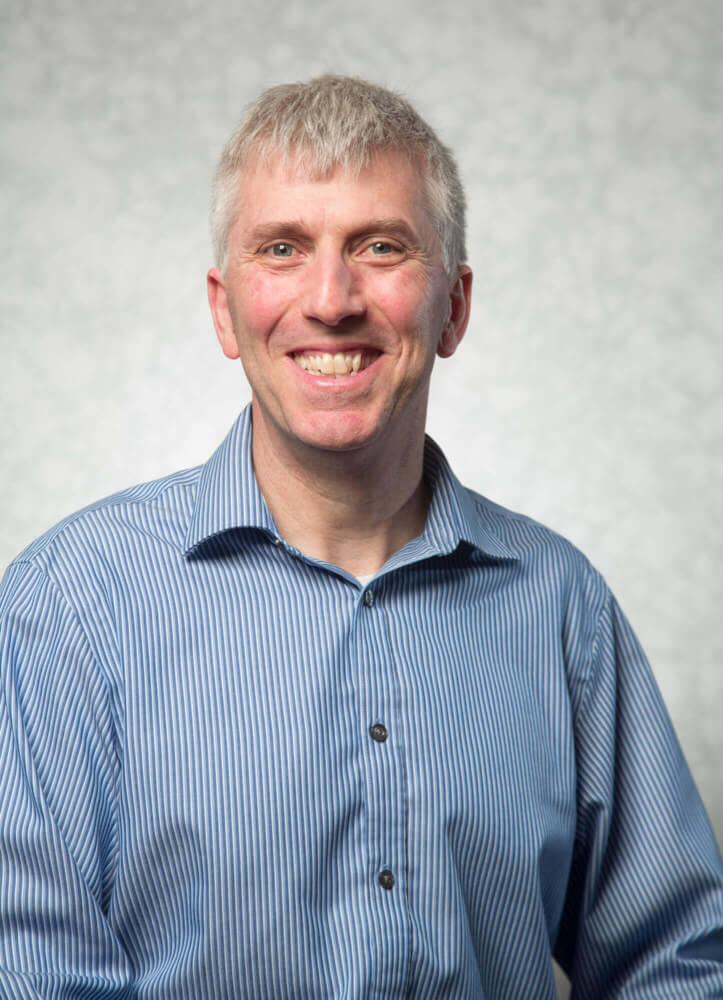

Jeff Kelly Lowenstein, assistant professor of multimedia journalism, shared the byline on a USA Today story detailing a reverse mortgage foreclosure crisis that has hit predominantly African-American neighborhoods at a rate that is six times higher than neighborhoods that are primarily white.

In addition, three Grand Valley students contributed to the report: Allison Donahue, Jamie Fleury and Shirley Keys.

The hearing by the U.S. House Financial Services Committee was conducted amid the unveiling of new legislation to protect seniors from foreclosures, according to a Sept. 25 USA Today report by Kelly Lowenstein and investigation co-author Nick Penzenstadler.

"It's always a wonderful experience when our work as journalists makes a difference for people who have been negatively impacted by a policy or law," Kelly Lowenstein said. "That this has happened on a project that I worked on with three students and our colleagues on USA Today's national investigative team only makes it more so."

Kelly Lowenstein added he is "optimistic" about the benefit of a Housing and Urban Development policy change that eased tight deadlines for spouses who are not on the home's title to secure documentation necessary to stay in the home after the borrower dies. The original USA Today investigation listed this protection as a suggested reform because surviving spouses who didn't meet such deadlines faced losing their homes.

Kelly Lowenstein helped spur the USA Today investigation after reporting in 2015 on the problems African American residents in some areas of Chicago were experiencing because of reverse mortgages. In 2017, he pulled data from the Department of Housing and Urban Development website that prompted him to reach out to the other co-author of the USA Today piece, suggesting they analyze the data at a national level.

USA Today signed on to the investigation in March 2018. In addition, members of the investigative team applied for and received a McGraw Center for Business Journalism fellowship, which helped provide the financial resources necessary to carry out a nationwide investigation.

Subscribe

Sign up and receive the latest Grand Valley headlines delivered to your email inbox each morning.