Spending Plan

Why should I create a spending plan?

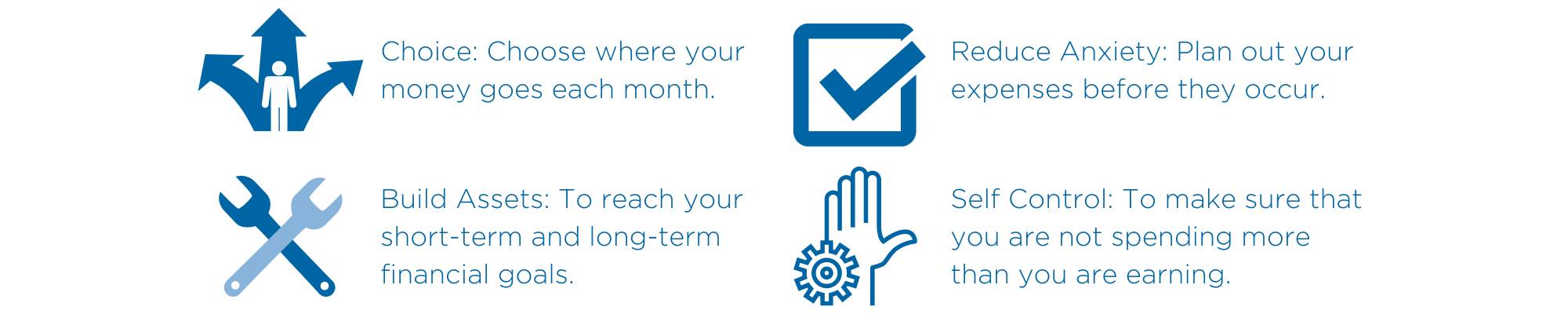

Creating a spending plan can give you a break down of the big picture on where your money is going. Creating a spending plan gives you the right tools to make choices that allow you to stop endlessly working for more money, and instead, make your money work for you.

Having a plan allows you to make informed choices on what to purchase or how much to save, helps to reduce money-related stresses and anxiety, and can also help you build your assets and reach your financial goals. So the real question here is, why shouldn’t I create a spending plan?

Stop by the MoneySmart Lakers office to discuss your own personalized spending plan today!

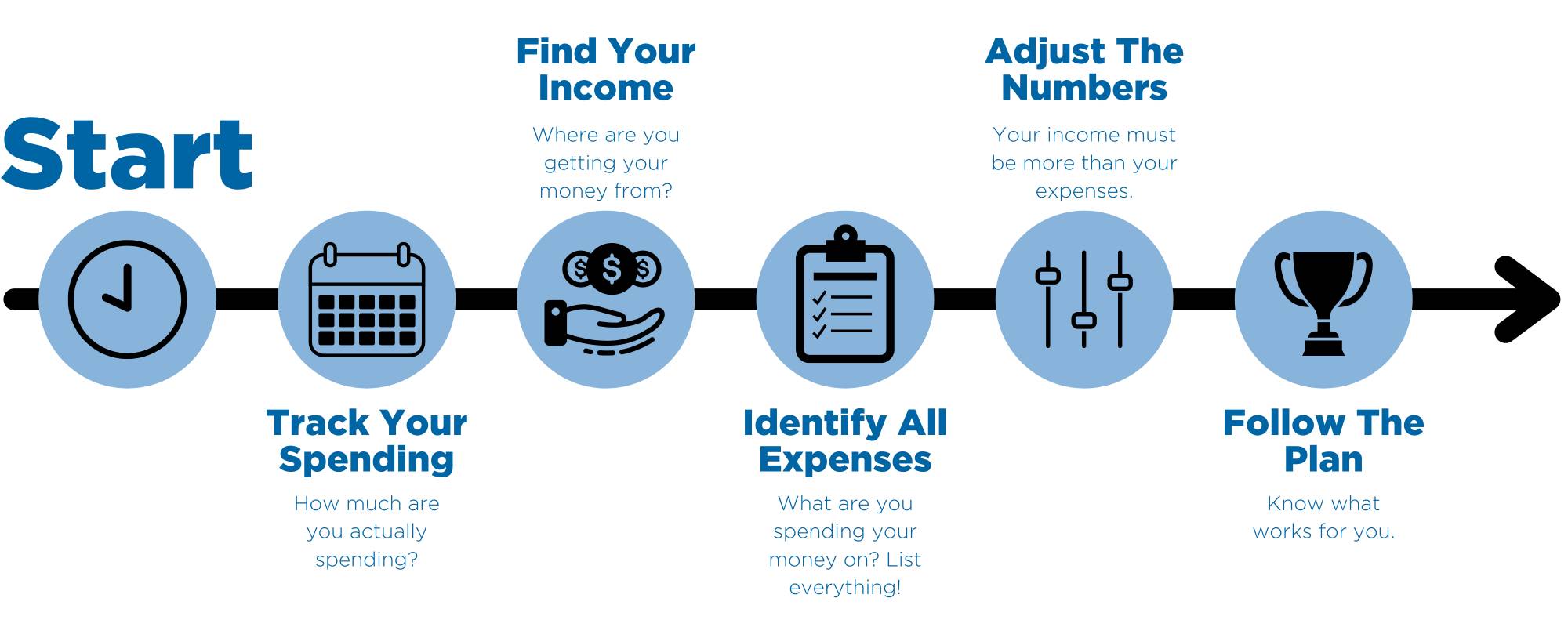

Learn about setting a budget and how to stick to it!

Some Useful Apps

There are many tools available to help you achieve your spending goals. Here are some tools you can use to know where your money is going.

MoneySmart Lakers does not endorse any specific financial resources (apps). This website is suggested for educational purposes only.