Credit Explained

What is Credit?

Using credit might seem easy. You buy a new pair of shoes, gas for a road trip, or pay for dinner by simply handing over a credit card and signing a receipt. Using credit allows you to pay for things you do not have enough cash to cover or it allows you to spread your payment over a couple of months. But you want to be sure the way you're using credit is better for you than it is for the credit provider. For a free annual copy of your credit report visit Annual Credit Report.

Credit Report and Credit Score

A credit report is your financial transcript. This focuses on who you are, how much debt you have, payment history, and any public records associated with your name.

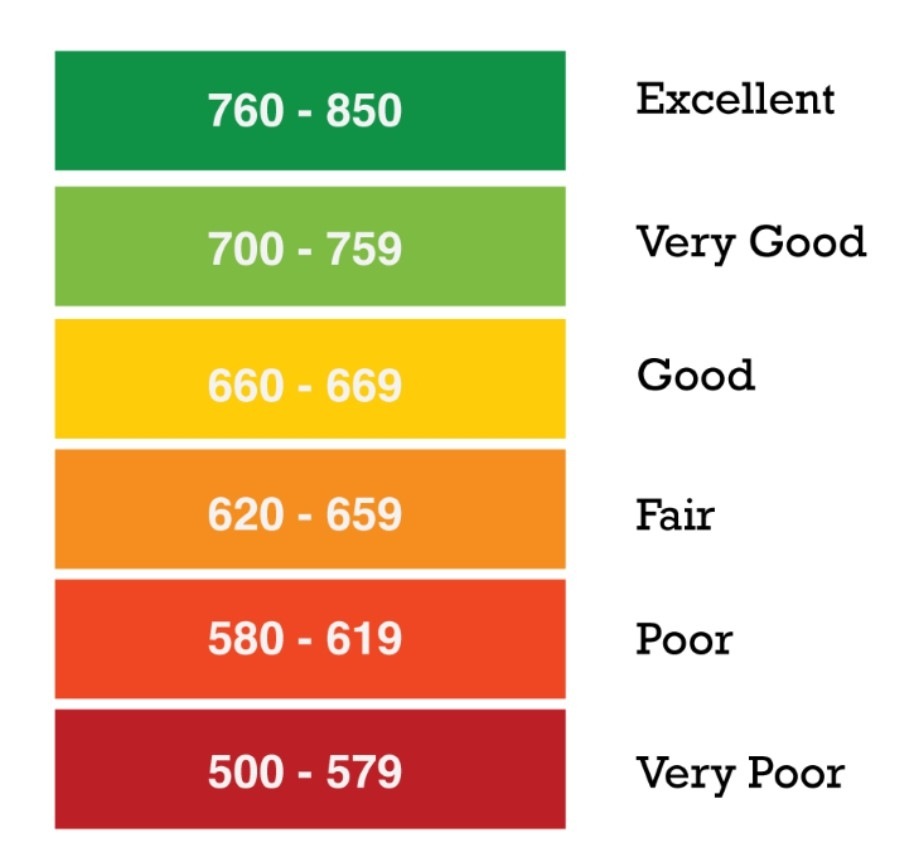

A credit score is your financial GPA. The score summarizes your credit history and lenders use your score to grant/deny you credit. It also is used to determine what terms you are offered and the rate you will pay on a loan. In a breakdown, it looks at your payment history, amounts owed, types of credit, length of history, and new credit.

Having a higher credit score allows you to get access to lower interest rates, pay less for borrowing money, and have better access to lenders. On the other hand, having a low credit score results in higher interest rates, paying more over the life of the loan, and getting denied lines of credit.